The Power of Budgeting: How to Create a Solid Financial Plan

Mastering budgeting is crucial for financial stability, aiding in managing expenses and achieving long-term goals. Start by assessing your financial situation, setting clear goals, and creating a budget plan using strategies like the 50/30/20 rule. Track your spending, make necessary adjustments, and build a savings cushion to prepare for unexpected expenses, ensuring financial control and independence over time.

Let’s face it: budgeting might not be the most glamorous part of personal finance, but it’s undeniably one of the most crucial. Think of budgeting like the foundation of a house. Without it, everything else—your savings, investments, and financial goals—might wobble precariously. A solid budget doesn’t just keep your finances in check; it empowers you to make informed decisions, manage your expenses effectively, and work towards sustaining financial stability. Whether you’re gearing up to buy your first home, planning for retirement, or simply trying to make it through the month without an overdraft, mastering the art of budgeting is key to financial peace of mind.

Creating a budget might sound daunting, but like any skill, it can be broken down into manageable steps. At its core, a budget is simply a plan for your money, a way to ensure that your spending aligns with your priorities and values. So how do you get started? In this article, we’ll walk through the process of building a solid financial plan, from assessing your current situation to setting goals and tracking your progress. We'll also explore some popular budgeting strategies, like the 50/30/20 rule, to help you create a system that works for you.

Assessing Your Financial Situation

Before diving into the nuts and bolts of budgeting, it's essential to get a clear picture of where you currently stand financially. Start by gathering all your financial documents—bank statements, credit card bills, loan statements, and any other records that provide insight into your income and expenses. This will give you a comprehensive view of your financial landscape.

Next, list all your sources of income. This could include your salary, any freelance work, rental income, or side hustles. Once you have a clear understanding of your income, turn your attention to your expenses. Detail everything from fixed costs like rent or mortgage payments to variable costs such as groceries and entertainment. Tracking these expenses helps identify patterns and areas where you might be overspending.

Understanding your cash flow—what comes in and what goes out—is crucial. As financial advisor Jane Smith explains, "Knowing your cash flow is like having a roadmap for your financial journey. It helps you navigate through life's financial ups and downs with confidence."

Setting Clear Financial Goals

With a clear understanding of your financial situation, the next step is to define your financial goals. What do you want to achieve in the short and long term? Perhaps you're saving for a vacation, building an emergency fund, or planning for retirement. Whatever your goals, it’s essential to make them specific, measurable, achievable, relevant, and time-bound (SMART).

For instance, instead of a vague goal like "save more money," aim for something specific like "save $5,000 for a vacation by next summer." This way, you have a clear target and a timeline, making it easier to track your progress and stay motivated.

Additionally, prioritizing your goals can be helpful. Determine which goals are most important to you and which ones can wait. This prioritization ensures that your budget aligns with what matters most to you, helping you allocate your resources effectively.

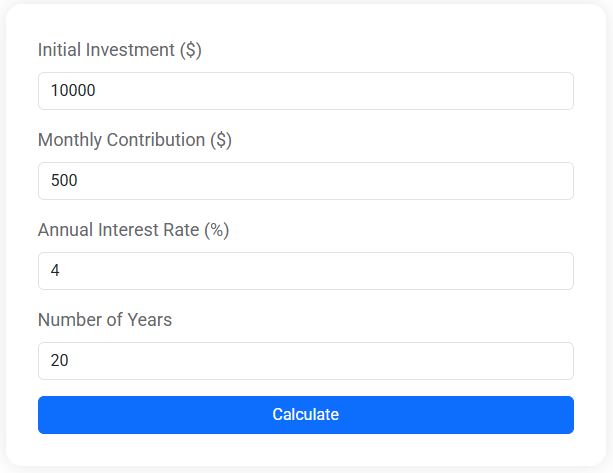

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Creating a Budget Plan

Once you have your goals in place, it’s time to create a budget plan. One popular method is the 50/30/20 rule, which suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This framework is flexible enough to adapt to various income levels and lifestyles, making it a great starting point for many people.

For instance, if your monthly income is $3,000, you’d allocate $1,500 to needs (like rent and groceries), $900 to wants (such as dining out and entertainment), and $600 to savings or debt. Adjust these percentages if your situation demands more savings or debt repayment.

Another strategy is zero-based budgeting, where every dollar you earn is assigned a specific purpose, ensuring nothing is left unaccounted for. This method requires more discipline but can be incredibly effective for those who want to maximize efficiency and control over their finances.

Tracking Spending and Making Adjustments

Creating a budget is only half the battle; the real challenge lies in sticking to it. Regularly tracking your spending is vital to ensure you’re adhering to your plan. Utilize budgeting apps like Mint or YNAB (You Need A Budget) to help you monitor your expenses in real-time and stay on track.

Review your budget weekly or monthly to identify areas where you might be overspending. Perhaps you’re dining out more than planned or your utility bills are higher than expected. Recognizing these patterns allows you to make necessary adjustments, ensuring your budget remains realistic and effective.

Remember, budgeting isn’t about depriving yourself; it’s about making conscious choices that reflect your values and priorities. As you track your spending, be flexible and willing to adjust your budget as your life or financial situation changes.

Building a Savings Cushion

A crucial component of any budget is building a savings cushion for unexpected expenses. Life is unpredictable, and having a financial buffer can prevent a minor setback from becoming a full-blown crisis. Aim to save three to six months’ worth of living expenses in an easily accessible account.

Start by setting aside a portion of your income each month specifically for your emergency fund. Even small contributions add up over time, and having this safety net provides peace of mind and financial security.

If you're overwhelmed by the prospect of building an emergency fund, remember that every little bit helps. As CNBC notes, many Americans face financial emergencies without savings, highlighting the importance of starting small and building gradually.

Achieving Financial Control and Independence

The ultimate goal of budgeting is to achieve financial control and, eventually, financial independence. By understanding your income and expenses, setting clear goals, and sticking to a budget, you’re taking control of your financial destiny.

Budgeting is not just about cutting costs; it’s about making informed decisions that align with your long-term objectives. Over time, this practice can lead to greater financial independence, allowing you to pursue opportunities and experiences without the constant worry of financial instability.

As you continue to refine your budgeting skills, you'll likely find greater freedom in your financial life. Embrace the process, and remember that budgeting is a journey, not a destination. With patience and perseverance, you can build a solid financial foundation that supports your dreams and aspirations.