Master Your Money: The Benefits of Professional Financial Planning

In today's complex financial landscape, the demand for professional financial planners is increasing as they provide clarity on financial goals, access to expert knowledge, and risk management. These professionals help craft personalized strategies to maximize wealth-building potential, offering peace of mind and long-term success. By engaging a financial planner, individuals can confidently navigate their financial journey and enhance their overall financial well-being.

In a world where financial headlines shift as frequently as the weather, keeping your financial house in order can feel like a Herculean task. It’s no wonder, then, that professional financial planners are becoming invaluable allies for those seeking clarity and confidence in their financial journey. These experts not only bring a wealth of knowledge to the table but also offer tailored strategies that can transform your financial outlook from chaotic to controlled. So, if you're pondering the value of bringing a financial planner into your life, you’re not alone. Let’s dive into the tangible benefits these professionals provide.

The role of a financial planner has evolved dramatically over the years. While they once focused on investment advice and retirement planning, today's planners are more like financial architects, helping to design and build a comprehensive strategy for long-term financial health. Whether it’s managing debt, planning for a child’s education, or ensuring a comfortable retirement, a good financial planner can make your financial goals feel less like dreams and more like achievable realities.

Clarity on Financial Goals

One of the most significant advantages of working with a financial planner is the clarity they bring to your financial goals. Many people know they need to save and invest but aren't sure where to start or what their end goals should look like. A financial planner can help you articulate these goals clearly. For instance, you might have a vague idea about wanting to retire "comfortably" someday. A planner will help define what "comfortably" means in concrete terms—how much money you'll need, where it might come from, and what steps you should take now.

Consider the experience of Sarah, a 35-year-old marketing manager who felt overwhelmed by her student loans, mortgage, and day-to-day expenses. When she sat down with her financial planner, they were able to prioritize her goals, establishing a plan to eliminate her high-interest debt while simultaneously setting aside savings for her children’s college fund. With a clear roadmap in place, Sarah found herself less stressed and more focused on her financial well-being.

Access to Expert Knowledge

Financial planners bring a treasure trove of knowledge and experience that most of us simply don’t have the time or resources to acquire. They stay updated on the latest regulations, market trends, and investment vehicles, allowing them to offer informed advice that's always current. According to a study by the Financial Planning Standards Board, individuals who engage with certified financial planners report higher levels of financial confidence and satisfaction.

For example, when new tax laws are enacted, a financial planner can quickly assess how these changes impact your personal situation and adjust your strategy accordingly. This expertise is particularly beneficial during tumultuous times, such as economic downturns, when making the right financial moves can have a substantial long-term impact. As financial advisor Jane Smith explains, "Navigating the financial waters without professional guidance is like sailing without a map—it’s possible, but not ideal."

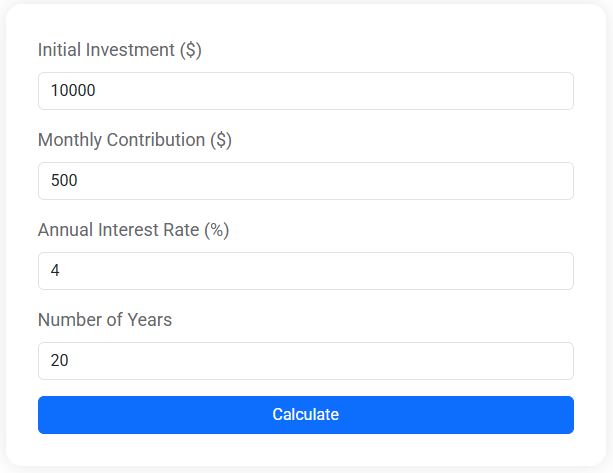

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Risk Management

Navigating risk is a crucial element of financial planning. While everyone’s risk tolerance is different, understanding how to manage it effectively can safeguard your financial future. Financial planners are adept at assessing your risk appetite and aligning your investments to match. They can diversify your portfolio to mitigate risks and ensure a balanced approach to growth and security.

Take John, a 50-year-old engineer who was heavily invested in tech stocks. His planner advised him to diversify, introducing bonds and international stocks into his portfolio, which provided a buffer when the tech market experienced volatility. This diversified approach not only protected John from significant losses but also positioned him for long-term gains.

Personalized Strategies for Wealth Building

No two financial situations are alike, which is why cookie-cutter advice often falls short. Professional financial planners take a personalized approach, considering your unique circumstances, goals, and preferences when crafting your financial plan. They can help identify opportunities you might not be aware of, such as tax-efficient investment options or lesser-known savings vehicles.

Let's consider a young couple, Alex and Jordan, who wanted to start investing but were unsure of how to proceed. Their financial planner evaluated their financial standing, discussed their risk tolerance, and developed a strategy that included both a Roth IRA and a diversified investment portfolio. This tailored approach gave Alex and Jordan peace of mind and a clear path toward building their future wealth.

Peace of Mind and Long-Term Success

Perhaps the most underrated benefit of professional financial planning is the peace of mind it provides. Knowing that you have a solid, well-thought-out plan in place can alleviate the anxiety that often accompanies financial decision-making. It’s not just about having a strategy; it’s about having a partner who’s there to guide you through the ups and downs of your financial journey.

Financial planners don't just set you on the right path—they're there for the long haul, adjusting your plan as life unfolds. Whether it’s a job change, a new addition to the family, or an unexpected expense, having a planner means you have someone to call when your life takes a turn. As the saying goes, "Life is what happens when you're busy making other plans," and a financial planner ensures that your financial health remains robust regardless of life's unpredictability.

Enhancing Overall Financial Well-Being

Ultimately, engaging a financial planner is about enhancing your overall financial well-being. It’s about feeling secure in your financial decisions and empowered to achieve your goals. Financial planners offer the tools, strategies, and support necessary to help you live the life you envision, not just someday, but starting now.

By working with a professional, you are investing in more than just your financial future—you're investing in a better quality of life. As you consider your financial options, remember that you don’t have to navigate this journey alone. With the right financial planner by your side, you can turn your financial aspirations into reality and embark on your future with confidence and clarity.