Navigating Personal Finance: The Basics of Financial Planning

Managing personal finances can be simplified by crafting a solid financial plan that acts as a guide towards achieving your financial goals. Begin by assessing your current financial situation, set SMART goals, create a budget using the 50/30/20 rule, build an emergency fund, and invest wisely for the future. This comprehensive approach will help you navigate financial challenges and work towards a secure financial future.

Navigating the world of personal finance can sometimes feel like trying to solve a Rubik's cube blindfolded. With so many pieces moving in different directions, it's easy to feel overwhelmed. But fear not! Crafting a solid financial plan is like having a map in this complex terrain, guiding you steadily towards your financial goals. Whether you're dreaming of buying a home, planning for retirement, or simply hoping to manage your day-to-day expenses more efficiently, a thoughtful plan can make these dreams achievable.

Let's dive into the essentials of financial planning. By assessing where you are financially, setting SMART goals, creating a budget, building an emergency fund, and investing wisely, you can embrace financial stability with confidence. This isn't about quick fixes or temporary solutions; it’s about laying down a foundation that supports your long-term financial health. Ready to get started? Here's a step-by-step guide to help you navigate your personal finance journey.

Assess Your Current Financial Situation

Before setting sail on any journey, it's crucial to know your starting point. Assessing your current financial situation is the first step in effective financial planning. Start by listing all your assets, such as your savings, investments, and any property you own. Next, tally up your liabilities, which include debts like student loans, credit card balances, and mortgages. This will help you understand your net worth.

Also, take a close look at your income and expenses over the past few months. Are there areas where you can cut back? Identifying spending patterns—like those daily lattes or spontaneous online shopping sprees—can be enlightening. As financial expert Dave Ramsey often says, "You must gain control over your money, or the lack of it will forever control you." Understanding your financial habits is key to taking control.

Set SMART Financial Goals

Goals are the compass that guide your financial journey. But not all goals are created equal. To maximize your chances of success, your goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of saying, "I want to save money," a SMART goal would be, "I want to save $5,000 for a vacation to Italy next summer."

Setting SMART goals provides clarity and focus. It transforms vague aspirations into actionable plans. For example, if paying off debt is a priority, decide on a specific amount to pay down each month. This not only makes the goal more tangible but also helps you track your progress and stay motivated.

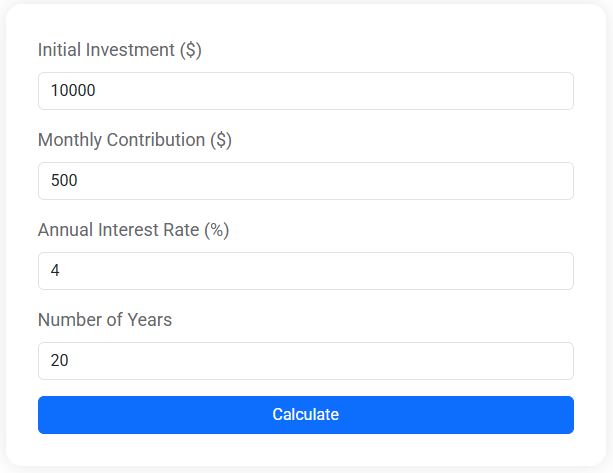

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Create a Budget Using the 50/30/20 Rule

Budgeting is the backbone of effective financial planning. One popular method is the 50/30/20 rule, which simplifies budgeting by allocating your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Needs include essentials like rent, groceries, and utilities. Wants are those extras that make life enjoyable, like dining out or Netflix subscriptions. The 20% category is crucial for building your financial future. According to a study by NerdWallet, people who systematically save and invest are far more likely to achieve their financial goals. Sticking to this budget can be challenging, but it's a powerful tool for financial discipline.

Build an Emergency Fund

Life is full of surprises, not all of them pleasant. That's where an emergency fund comes in. It's a financial buffer for the unexpected—like a job loss, medical emergency, or car repair. Ideally, your emergency fund should cover three to six months' worth of living expenses.

Start small if you need to. Open a separate savings account and automate a portion of your income to go directly into it each month. As finance guru Suze Orman advises, "The key to financial freedom is having the ability to take control of your finances." An emergency fund provides peace of mind and financial independence.

Invest Wisely for the Future

Once you have your emergency fund in place, it's time to think about investing. Investing is about making your money work for you, growing your wealth over time. Consider your risk tolerance, investment goals, and the time horizon for when you'll need the money.

Diversification is critical. Spread your investments across different asset classes—stocks, bonds, real estate—to reduce risk. As Warren Buffett famously said, "Do not put all your eggs in one basket." Additionally, consider tax-advantaged accounts like 401(k)s or IRAs for retirement savings. These accounts offer significant benefits that can enhance your long-term financial security.

Revisit and Revise Your Plan Regularly

Financial planning isn't a set-it-and-forget-it task. Life changes, and so should your financial plan. Review your plan at least annually, or more frequently if you experience major life events like marriage, a new job, or buying a home. Adjust your goals and strategies as needed to stay aligned with your evolving circumstances.

Stay informed about changes in the financial landscape. Whether it's new tax laws, interest rate shifts, or changes in the investment market, being informed helps you make sound financial decisions. As Benjamin Franklin once said, "An investment in knowledge pays the best interest."

Crafting a financial plan is an empowering step towards taking control of your financial destiny. By understanding your current situation, setting clear goals, budgeting wisely, safeguarding against the unexpected, and investing in your future, you're not just managing your money—you're actively shaping your future. Remember, every financial journey is unique, and there’s no one-size-fits-all approach. But with these fundamentals, you'll have the confidence and clarity to navigate whatever financial challenges come your way.