Planning for Tomorrow: How Financial Planning Shapes Your Future

Financial planning is essential for achieving a stable and prosperous future, encompassing more than just budgeting or saving—it's a comprehensive approach to managing finances to meet life goals. This guide emphasizes the importance of setting clear financial goals, creating and adhering to a budget, investing wisely, and preparing for retirement to ensure financial security and independence. By actively engaging in financial planning, individuals can mitigate risks, make informed decisions, and adapt to life's uncertainties, ultimately transforming their financial landscape.

Planning for tomorrow isn't just about dreaming big or hoping for the best. It's about laying down a well-thought-out financial plan that not only supports your aspirations but also prepares you for life's unpredictabilities. While many of us might equate financial planning with simply saving or budgeting, it's a much broader concept. It's a road map that guides you through the peaks and valleys of your financial journey, ensuring that you make informed decisions every step of the way.

The essence of financial planning lies in its holistic approach. It's not just about accumulating wealth but about managing it wisely to meet both current needs and future goals. Whether you're eyeing a comfortable retirement, looking to invest in your child's education, or dreaming of that long-desired vacation home, financial planning is your compass.

Setting Clear Financial Goals

The cornerstone of any solid financial plan is clear, achievable goals. It's crucial to know what you're aiming for—whether it's buying a house, starting a business, or ensuring your children graduate college debt-free. Having well-defined goals gives you direction and purpose. For instance, rather than vaguely deciding to "save more," specify how much you want to save and by when. This specificity transforms an abstract desire into a concrete plan.

To illustrate, consider Sarah, a teacher who decided she wanted to travel to Europe in five years. By setting the goal of saving $10,000 for her trip, she was able to break down her savings into manageable monthly amounts. This clarity not only kept her motivated but also made the whole process less daunting. As personal finance expert Dave Ramsey puts it, "A goal without a plan is just a wish."

Creating and Sticking to a Budget

Creating a budget is like building the foundation of a house. It's essential for supporting everything else in your financial life. A budget helps you track your income and expenses, ensuring that you're making the most out of every dollar. What's more, it reveals spending patterns and highlights areas where you can cut back.

Sticking to a budget, however, is where many stumble. It's easy to create a budget, but following it requires discipline and commitment. Take the classic example of the latte factor, a term coined by author David Bach, which refers to how small, daily expenses can add up over time. By identifying these small expenses in your budget, you can redirect funds toward more meaningful goals.

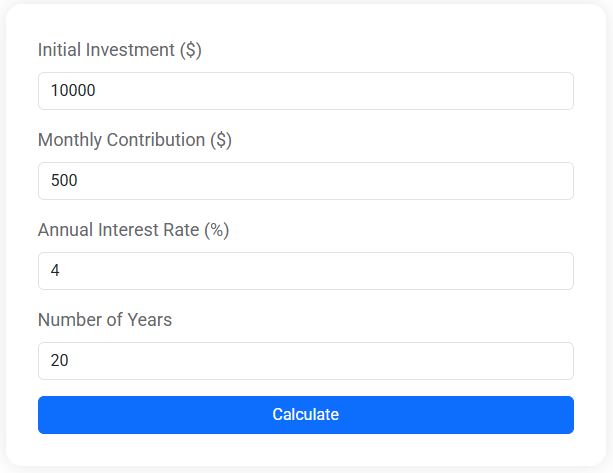

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Investing Wisely

Once you've set your goals and established a budget, the next step is to make your money work for you—through investing. Investing isn't just for the wealthy; it's a critical component of financial planning for anyone looking to grow their wealth over time. The key is to start early and be consistent.

Consider the power of compound interest, which Albert Einstein reportedly called the "eighth wonder of the world." It allows your investments to grow exponentially as your returns start earning returns themselves. For example, if you invest $1,000 at an annual return of 7%, it will grow to $7,612 in 30 years. Imagine the potential if you invested more and diversified your portfolio.

However, investing doesn't come without risks. It's important to educate yourself and perhaps consult with a financial advisor to create a diversified portfolio that aligns with your risk tolerance and time horizon.

Preparing for Retirement

Retirement might seem like a distant horizon, especially if you're early in your career, but it's never too early to start planning for it. The sooner you begin, the more you'll benefit from compound interest and the less you'll need to save each month to reach your goals.

Consider setting up a retirement account, such as a 401(k) or an IRA, and contribute regularly. Many employers offer matching contributions, which is essentially free money. By not taking advantage of this, you're leaving money on the table. As financial advisor Suze Orman often emphasizes, "Never pass up free money."

Think about John, a 30-year-old engineer who began contributing 10% of his salary to his 401(k). By the time he retires at 65, he could potentially have a nest egg of over a million dollars, thanks to compound interest and employer contributions.

Mitigating Risks and Adapting to Uncertainties

Life is full of surprises—some delightful, others less so. Financial planning helps you prepare for both. By incorporating risk management strategies like insurance and emergency funds into your plan, you can safeguard against unforeseen events.

An emergency fund acts as a financial cushion, covering three to six months of living expenses in case of job loss, medical emergencies, or unexpected repairs. Insurance, on the other hand, protects you from liabilities that could otherwise derail your financial plans.

According to a study by the National Bureau of Economic Research, households with at least $2,000 in emergency savings are significantly less likely to face financial hardship. These safety nets allow you to weather storms without derailing your long-term goals.

Transforming Your Financial Landscape

Engaging actively in financial planning transforms your financial landscape, turning what could be a chaotic and uncertain future into a structured and secure one. By setting goals, budgeting, investing, and preparing for retirement, you're not just reacting to financial situations as they arise—you're proactively shaping your future.

Take the time to revisit and adjust your financial plan regularly. Life changes—jobs, family, economic conditions—all require us to adapt our strategies. By doing so, you'll maintain control over your financial destiny, ensuring that your dreams don't just remain dreams, but become achievable realities.