Transform Your Finances: The Power of Strategic Financial Planning

To achieve financial stability and independence, strategic financial planning is essential, involving understanding your financial situation, setting SMART goals, budgeting, building an emergency fund, and investing for future growth. By thoroughly analyzing your assets, liabilities, income, and expenses, you can set realistic goals, prioritize them, and create a tailored financial plan. This approach empowers you to adapt to changes, navigate setbacks, and build wealth, ultimately bringing you closer to financial independence and stability.

To achieve true financial independence and stability, it's not enough to simply desire a better financial future. What's needed is a comprehensive, strategic financial plan. Think of it as your personal roadmap, one that guides you through the complexities of saving, spending, and investing, all while keeping your long-term goals in focus. This isn't just about crunching numbers—it's about transforming your relationship with money and empowering yourself to make informed decisions.

Imagine sitting down with a cup of coffee, a blank notebook, and a clear mind, ready to embark on a journey that could redefine your financial life. Strategic financial planning is about understanding where you stand today, setting realistic goals for tomorrow, and crafting a plan that can navigate the unpredictable twists and turns of life. It's about building a foundation that not only supports you through financial storms but also elevates you toward wealth and independence.

Understanding Your Current Financial Situation

Before setting off on any journey, you need to know where you are. This means taking a clear-eyed look at your current financial situation. Start by listing your assets—everything you own of value, like savings, investments, and property. Then, tally up your liabilities, including debts, mortgages, and loans. This gives you a snapshot of your net worth. Understanding these numbers is crucial because it shows you the gap between your current reality and your financial aspirations.

Next, examine your income and expenses. Track every dollar that comes in and goes out over a month to identify spending patterns. Are there areas where you could cut back? Perhaps those daily lattes are adding up more than you realized. According to a survey by the U.S. Bureau of Labor Statistics, the average American household spends over $3,000 annually on dining out. Being aware of such habits can help you make more intentional choices.

Setting SMART Financial Goals

Once you have a clear picture of your financial landscape, it's time to plot your course with SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of a vague aim like "save more money," a SMART goal would be "save $5,000 for an emergency fund by the end of next year." This specificity gives you a clear target to work toward and measure your progress against.

Financial advisor Jane Smith suggests breaking down larger goals into smaller, more manageable steps. If your ultimate aim is to retire comfortably, consider what milestones you need to hit along the way, such as maxing out your 401(k) contributions or paying off high-interest debt. By prioritizing these steps, you create a structured path that keeps you motivated and focused.

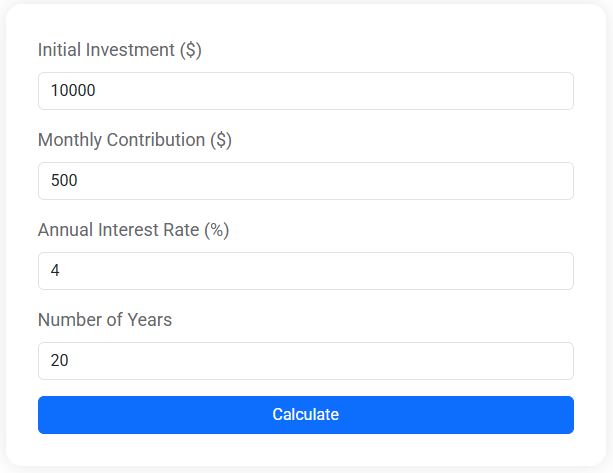

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Crafting a Budget That Works

With goals in place, the next step is crafting a budget that aligns with them. A budget isn't about restricting your freedom; it's about empowering you to make conscious choices. Begin by categorizing your expenses into needs (such as housing, utilities, and groceries) and wants (think entertainment, dining out, and vacations). This helps you identify areas where you can adjust spending to free up resources for your goals.

Consider adopting the 50/30/20 rule, popularized by Senator Elizabeth Warren. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This framework provides flexibility while ensuring you prioritize financial health. Remember, a budget is a living document—it should evolve with your circumstances. Regularly reviewing and adjusting it ensures it remains effective and relevant.

Building an Emergency Fund

One of the cornerstones of financial stability is having an emergency fund. This is your safety net, a buffer that shields you from unexpected expenses like medical bills or car repairs. Aim to save three to six months' worth of living expenses. While this might seem daunting, start small. Set aside a little each month, and watch your fund grow over time.

According to a report by Bankrate, nearly 25% of Americans have no emergency savings at all. Don't let this be you. Automating transfers to a dedicated savings account can simplify the process and ensure you stay on track. This fund not only provides financial security but also peace of mind, allowing you to pursue other financial goals with confidence.

Investing for Future Growth

Once your emergency fund is in place, it's time to think about growing your wealth through investing. While saving is crucial, investing is what allows your money to work for you. Start by exploring options like stocks, bonds, or mutual funds. Each comes with its own risk and reward profile, and understanding these can help you make informed choices.

Consider diversifying your investments to mitigate risk. As the old saying goes, "don't put all your eggs in one basket." Spreading your investments across different asset classes and sectors can protect your portfolio from market volatility. If the stock market feels intimidating, consulting a financial advisor can provide guidance tailored to your goals and risk tolerance.

Adapting to Life’s Changes

Life is unpredictable, and your financial plan should be flexible enough to adapt. Whether it's a job change, a new family member, or an unexpected windfall, revisiting your financial plan regularly ensures it reflects your current situation and priorities. According to a study by Fidelity, 35% of people experience significant life changes that impact their financial plans every year.

Stay proactive by scheduling regular check-ins with yourself or your financial advisor. This practice allows you to fine-tune your strategy and seize new opportunities as they arise. Remember, financial planning is not a one-time event but an ongoing process that evolves with you.

Navigating Setbacks and Building Resilience

Financial setbacks are inevitable, but a solid plan can help you weather the storm. Whether it's a market downturn or an unexpected expense, having a strategic plan in place means you won't be caught off guard. Building resilience involves learning from these experiences and adjusting your plan accordingly.

Consider setbacks as opportunities for growth. For instance, a job loss might prompt you to refine your budget or explore new career paths. Resilience is about more than just bouncing back; it's about emerging stronger and more prepared for future challenges. As financial expert Dave Ramsey says, "Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest."

Conclusion: Bringing It All Together

Transforming your finances through strategic planning is a journey, not a destination. By understanding your current financial situation, setting SMART goals, crafting a budget, building an emergency fund, and investing wisely, you're laying the groundwork for a stable and prosperous future. This approach empowers you to adapt to life's changes, navigate setbacks, and steadily build wealth.

Remember, you don't have to go it alone. Seek advice from trusted financial professionals, use available resources, and lean on your community for support. Ultimately, strategic financial planning is about creating a life where your money works for you, not the other way around. So, take that first step, and start your financial transformation today.