Weathering Financial Storms: The Importance of a Solid Plan

In the unpredictable realm of personal finance, having a solid financial plan is crucial for navigating life's unexpected financial challenges, such as job loss or medical emergencies. Key components of a comprehensive plan include establishing a financial safety net, crafting a flexible budget, investing for the future, and managing debt effectively. Seeking professional guidance from a financial advisor can further enhance your financial resilience, ensuring peace of mind and security for the future.

In the unpredictable world of personal finance, it often feels like we're sailing in choppy waters. One day, the sea is calm and the sun is shining, and the next, a storm hits without warning. These financial storms come in many forms—job loss, medical emergencies, or even an unexpected home repair. The key to navigating these challenges isn't just luck; it's having a solid financial plan. A well-crafted financial plan acts like a sturdy ship, designed to help you weather any storm that life throws your way.

You might be thinking, "But planning sounds boring, complicated, and maybe even a little restrictive." I get it. However, think of a financial plan not as a set of rigid rules, but as a roadmap that guides you toward your goals while allowing flexibility to adapt to life's changes. Here’s how you can build that roadmap, ensuring you’re prepared for whatever comes your way.

Building a Financial Safety Net

The cornerstone of any robust financial plan is a safety net, often referred to as an emergency fund. This is money set aside to cover unexpected expenses, like a sudden car repair or a medical bill. Financial experts typically recommend having three to six months’ worth of living expenses saved. This may sound daunting, but starting small is perfectly okay. Even setting aside $20 a week can grow into a substantial cushion over time.

For instance, consider the story of Tom and Lisa, a couple from Ohio. When Lisa unexpectedly lost her job, their emergency fund allowed them to maintain their lifestyle without immediately resorting to credit cards or loans. They had built up six months of expenses over several years, simply by consistently saving a small portion of their income. This fund provided them with peace of mind and time to find a new job that suited Lisa’s skills and passions.

Crafting a Flexible Budget

Budgeting often gets a bad rap, but think of it as giving your money a purpose. A flexible budget doesn’t mean cutting out all the fun stuff—it means planning for it. By tracking your income and expenses, you can identify areas where you might be overspending and reallocate those funds to more important areas, like savings or debt repayment.

Take Sarah, for example, a teacher who loved dining out. By closely analyzing her spending, she realized she could cut back on eating out just twice a month, freeing up an extra $100 to put toward her student loans. Her budget wasn’t about deprivation; it was about aligning her spending with her priorities. The key is to review your budget regularly and adjust as your life changes, such as when you get a raise or have a new expense.

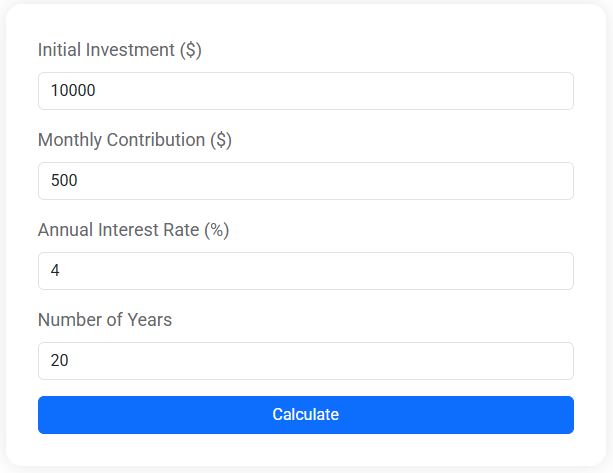

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Investing for the Future

While saving is crucial, investing is what helps your money grow over time. Albert Einstein reportedly called compound interest the "eighth wonder of the world," and for a good reason. Investing might seem intimidating, especially with its inherent risks, but it’s essential for building long-term wealth.

Take a cue from Maria, a nurse from Texas who started investing in her late twenties. By setting aside a modest amount each month into a diversified portfolio of stocks and bonds, she’s on track to retire comfortably by age sixty. The earlier you start, the more time your money has to grow. If investing feels overwhelming, consider consulting a financial advisor who can guide you based on your personal goals and risk tolerance.

Managing Debt Effectively

Debt is a reality for many of us, whether it’s from student loans, credit cards, or mortgages. The trick is not to let it overwhelm you. Prioritize paying off high-interest debt first, as it can quickly spiral out of control. Consider the debt snowball method, where you pay off smaller debts first to gain momentum, or the avalanche method, where you focus on the highest interest debt first.

Financial advisor Jane Smith suggests, "The best debt management strategy is the one you can stick with. Consistency over time beats short bursts of enthusiasm." For instance, Mark, a college graduate with $30,000 in student loans, used the snowball method. The psychological boost of paying off smaller debts first kept him motivated and on track.

Seeking Professional Guidance

Sometimes, the best way to enhance your financial resilience is to seek professional guidance. A financial advisor can offer personalized advice and strategies that align with your life goals. They can help you optimize your investments, create a tax-efficient plan, and ensure you’re on track to meet your retirement goals.

According to a report by CNBC, individuals who work with a financial advisor often feel more confident about their financial future. This doesn’t mean you’re handing over control; rather, you’re partnering with a professional who has your best interests in mind. It’s like having a seasoned sailor on board to help navigate the rough seas.

The Bottom Line

Financial storms are inevitable, but with a well-prepared plan, you can face them head-on. Building an emergency fund, crafting a flexible budget, investing wisely, managing debt, and seeking professional advice are all crucial components of a robust financial plan. Remember, the goal isn’t perfection, but progress. With each step you take, you’re strengthening your financial resilience, ensuring you can weather any storm with confidence and peace of mind. So grab your financial map and compass, and set sail toward a more secure and prosperous future.