Mastering the Art of Financial Planning: A Comprehensive Guide

Mastering financial planning is essential for achieving financial stability at any life stage, whether you're just starting out or preparing for retirement. Key steps include setting clear financial goals, creating a flexible budget, building an emergency fund, and investing wisely for the future. Regularly reviewing and adjusting your financial plan ensures it remains effective in helping you reach your financial aspirations.

Mastering the art of financial planning is akin to learning how to navigate a complex journey. It requires a clear map, a sense of direction, and an ability to adapt to unexpected detours. This journey is essential for anyone seeking financial stability, whether you're just starting your career or savoring the twilight years of retirement. Financial planning isn't just about crunching numbers; it's about setting a course for your life.

In today's fast-paced world, financial stability is a cornerstone of personal freedom. Without it, even the simplest joys can become sources of stress. So, let's explore how you can master financial planning with strategies that are practical, adaptable, and, most importantly, tailored to your unique situation.

Setting Clear Financial Goals

Before embarking on any journey, knowing your destination is crucial. Financial goals act as this destination, providing both motivation and clarity. They can range from short-term objectives, like saving for a vacation, to long-term ambitions, such as building a retirement nest egg. By specifying what you want to achieve, you create a roadmap for your financial decisions.

According to a study by the Dominican University of California, people who write down their goals are 42% more likely to achieve them. So, take the time to articulate your financial aspirations clearly. Whether it's buying a home, starting a business, or ensuring a comfortable retirement, your goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Creating a Flexible Budget

A budget is the backbone of any financial plan. However, it's important to view it as a living document rather than a rigid set of rules. Life is unpredictable, and your budget should be flexible enough to accommodate changes. Start by tracking your income and expenses to understand where your money goes each month.

Consider using budgeting tools or apps like Mint or YNAB (You Need a Budget) to simplify this process. These tools can provide insights into your spending patterns and help you identify areas where you can cut back. For example, if you notice that dining out accounts for a significant portion of your expenses, you might decide to cook at home more often. Remember, the goal of a budget is to ensure your spending aligns with your financial goals, not to restrict your freedom.

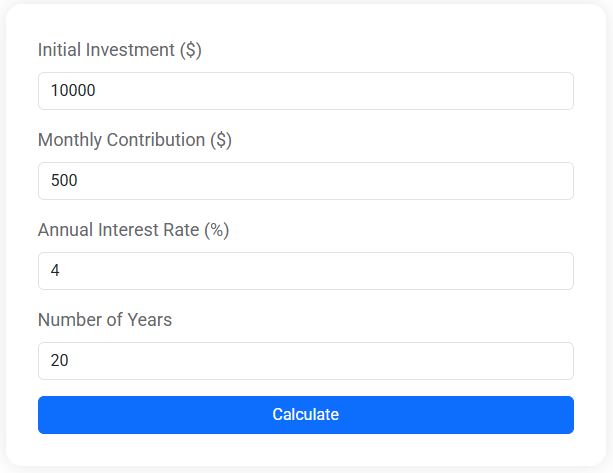

Compound Interest Calculator

Discover how your savings can grow with compound interest. Our free Compound Interest Calculator helps you estimate future investment value based on your initial deposit, monthly contributions, and expected interest rate. Whether you're saving for retirement, a house, or long-term goals, this tool gives you a clear view of your financial growth over time.

Building an Emergency Fund

Life is full of surprises, and not all of them are pleasant. An emergency fund acts as a financial safety net, protecting you from unforeseen expenses like medical emergencies, car repairs, or sudden job loss. Financial experts, like Dave Ramsey, recommend saving at least three to six months' worth of living expenses in an easily accessible account.

Building an emergency fund takes time and discipline. Start by setting aside a small, manageable amount each month. As you adjust your lifestyle and prioritize saving, your fund will grow. Having this cushion not only provides peace of mind but also prevents you from derailing your financial goals when unexpected expenses arise.

Investing Wisely for the Future

Investing is a powerful tool for building wealth over time. While it carries risks, a well-thought-out investment strategy can significantly enhance your financial future. Begin by assessing your risk tolerance, which varies based on your financial situation, age, and personal comfort level with market fluctuations.

Diversification is key. As the old saying goes, "Don't put all your eggs in one basket." Spread your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk. If you're new to investing, consider starting with low-cost index funds or exchange-traded funds (ETFs), which offer broad market exposure with minimal fees. As Warren Buffett advises, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Regularly Reviewing and Adjusting Your Financial Plan

A financial plan is not a set-it-and-forget-it endeavor. Regular reviews are essential to ensure your plan remains aligned with your life circumstances and goals. Changes in income, family dynamics, or the economy can all impact your financial strategy.

Make it a habit to review your financial plan at least once a year, or whenever you experience a significant life change. During these reviews, assess your progress towards your goals, adjust your budget as necessary, and reevaluate your investment strategy. As financial advisor Jane Smith explains, "Flexibility is the key to long-term financial success. Life changes, and your financial plan should change with it."

The Human Side of Financial Planning

It's easy to get lost in the numbers, but financial planning is ultimately about crafting the life you want to live. It involves making informed decisions that reflect your values and priorities. For instance, if travel is important to you, your financial plan should account for regular trips, even if it means delaying purchasing a new car.

Incorporate your personal values into your financial plan by asking yourself what brings you joy and fulfillment. Then, ensure your financial decisions support these priorities. This approach not only keeps you motivated but also ensures that your financial journey is personally meaningful.

Conclusion: Your Financial Journey, Your Rules

Mastering financial planning is a lifelong endeavor, akin to learning a new language. It requires patience, practice, and a willingness to adapt. By setting clear goals, creating a flexible budget, building an emergency fund, investing wisely, and regularly reviewing your plan, you're not just managing money—you're shaping your future.

Remember, financial planning is deeply personal. There's no one-size-fits-all solution. What works for someone else may not work for you, and that's okay. Trust yourself, seek advice when needed, and stay committed to your financial journey. With careful planning and a bit of resilience, you'll not only reach your financial aspirations but also enjoy the journey along the way.