The Impact of Your Credit Score on Insurance Premiums

Your credit score significantly impacts your insurance premiums, with lower scores often leading to higher costs due to a statistical correlation between credit scores and the likelihood of filing claims. While some states prohibit using credit scores for setting insurance rates, in many areas, maintaining a good credit score is crucial to keep insurance costs down. To potentially reduce premiums, improve your credit score, shop around for quotes, consider bundling policies, and explore available discounts.

Picture this: you're shopping around for car insurance, feeling pretty good about the quotes you've received, when suddenly you get a shockingly high premium from one company. You scratch your head and wonder, "What on earth caused that jump?" The answer might be lurking in the fine print of your credit report. Your credit score, that three-digit number that seems to shadow your financial life, can significantly impact your insurance premiums. It's not just about loans and credit cards anymore; insurers also use it to gauge your risk. While it might seem unfair, there's a method to this madness, and understanding how it works can help you manage your costs better.

Insurers have found a statistical correlation between credit scores and the likelihood of filing claims. In simple terms, individuals with lower credit scores are seen as riskier to insure, leading to higher premiums. And while some states have put their foot down, prohibiting the use of credit scores in setting rates, in many areas, your credit health still plays a crucial role. So, let's dive into why your credit score matters to insurers and what you can do to keep your premiums in check.

Why Insurers Care About Your Credit Score

Insurance companies are in the business of assessing risk, and your credit score serves as one of their tools. They use it to predict the likelihood that you'll file a claim. According to a study by the Federal Trade Commission, there’s a strong correlation between credit-based insurance scores and the cost of claims. This means that, statistically, individuals with lower scores tend to file more claims or have higher claim costs. As a result, insurers charge higher premiums to compensate for the perceived risk.

It's not just car insurance; your credit score can also affect home insurance, renters insurance, and even life insurance premiums. Consider this: if your credit score is in the "poor" range, you might pay significantly more than someone with an "excellent" score for the same coverage. For instance, a report from The Zebra, an insurance comparison site, found that drivers with poor credit pay over $1,500 more per year on average for car insurance than those with excellent credit.

While this practice is common, it's not without controversy. Critics argue that using credit scores for insurance pricing is unfair, as it doesn't directly relate to one's driving ability or likelihood of a home incident. However, insurers counter that the data supports their approach, claiming it enables them to offer fairer rates to those perceived as lower-risk.

States That Prohibit the Use of Credit Scores

Not all states allow insurers to use credit scores when setting premiums. States like California, Massachusetts, and Hawaii have gone on record to ban this practice, focusing instead on other risk factors. Their legislation reflects a belief that credit scores are not an equitable measure for insurance pricing. For instance, in California, insurers must rely on other metrics, such as your driving record or the type of car you drive, to determine your premiums.

These states argue that credit scores can be affected by various factors beyond a person's control, such as medical debt or unexpected job loss. They believe insurance premiums should be based on more relevant risk measures. However, outside these states, credit scores remain a significant factor, adding another layer of complexity for consumers trying to manage their insurance costs.

It's worth noting that even in states where credit scores aren't used directly, insurers might still examine financial responsibility through other means. Therefore, maintaining a good financial record can still benefit you, even if your state restricts credit score usage for insurance.

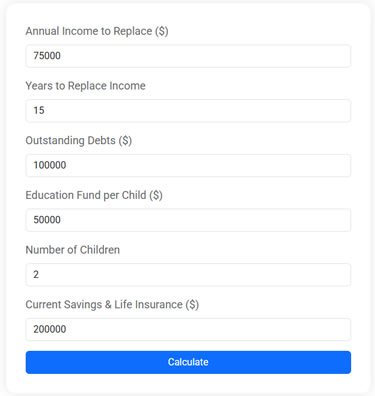

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

How to Improve Your Credit Score

Improving your credit score is a strategic move to potentially reduce your insurance premiums. Start by checking your credit report for errors. You can get a free copy annually from each of the three major credit bureaus—Experian, Equifax, and TransUnion—through AnnualCreditReport.com. If you spot inaccuracies, dispute them to ensure your score reflects accurate information.

Next, focus on paying your bills on time, which is one of the most significant factors in your credit score. Even a single missed payment can ding your score, so consider setting up automatic payments or reminders. Reducing your credit card balances also helps, as high utilization rates can negatively impact your score. Aim to keep your credit utilization below 30% of your total available credit.

Finally, avoid opening too many new accounts at once, as each application can temporarily lower your score. Instead, be strategic about when and why you apply for new credit. Over time, these efforts can lead to a healthier credit score, which might translate to lower insurance premiums.

Shopping Around and Exploring Discounts

Even with a so-so credit score, you can still find ways to save on insurance premiums. Start by shopping around and getting quotes from multiple insurers. Rates can vary significantly from one company to another, even for the same level of coverage. A 2020 article from Consumer Reports highlights that some insurers weigh credit scores more heavily than others, so it pays to compare.

Consider bundling policies, such as auto and home insurance, with the same company. Many insurers offer discounts for bundling, which can lead to substantial savings. Additionally, ask about other available discounts—such as safe driver, good student, or multi-car discounts—that might apply to your situation.

Some insurers also offer usage-based or telematics programs, where your premium is based on actual driving behavior rather than credit scores. These programs typically involve installing a device in your car or using an app that tracks driving habits. If you’re a safe driver, you could see significant savings with these options.

Conclusion: Taking Control of Your Insurance Costs

While it might feel disheartening to know your credit score can impact something as essential as insurance premiums, understanding the system gives you the power to navigate it wisely. By taking steps to improve your credit score, shopping around for the best rates, and exploring discounts, you can keep your insurance costs more manageable.

Remember, you’re not alone in this financial maze. Many consumers are in the same boat, working to balance their credit health with everyday expenses. By staying informed and proactive, you can not only control your insurance premiums but also enhance your overall financial well-being. After all, who wouldn’t appreciate a little extra cash in their pocket at the end of the day?