Insuring Your Future: Why Disability Insurance is Essential

Disability insurance is a crucial yet often overlooked aspect of financial planning, providing essential income support if you become unable to work due to illness or injury. This insurance can prevent financial strain by covering living expenses and medical costs without depleting your savings or retirement funds. Understanding the types and evaluating your needs can help you choose the right policy to secure your financial future and maintain peace of mind.

Disability insurance often flies under the radar when it comes to financial planning. We spend a lot of time thinking about health insurance, retirement savings, and even life insurance, but disability insurance? It tends to be the underdog in our insurance lineup. Yet, its role is incredibly important. Imagine a scenario where an unexpected injury or illness takes you out of work for an extended period. How would you pay your bills without your regular paycheck? This is where disability insurance steps in, offering a financial safety net when you need it most.

The reality is that no one is invincible. Accidents or health issues can happen to anyone, and the financial fallout can be significant. Disability insurance ensures that you have a steady income, even when you're unable to work. It’s not just about covering your immediate expenses; it's about safeguarding your financial future. Let's dive into why disability insurance is essential and how it can protect you and your loved ones from financial distress.

Understanding Disability Insurance

Disability insurance is designed to replace a portion of your income if you can't work due to injury or illness. There are two main types: short-term and long-term disability insurance. Short-term policies generally cover a portion of your salary for a few months to a year. In contrast, long-term disability insurance can extend benefits until you return to work or reach retirement age. According to the Social Security Administration, one in four 20-year-olds will experience a disability before they retire, highlighting the importance of having this coverage.

Many people mistakenly believe that their health insurance will cover everything if they become sick or injured. While health insurance covers medical expenses, it doesn't pay for your day-to-day living costs like rent, groceries, or utilities. Disability insurance fills this gap, ensuring that you have money to cover these essential expenses. When evaluating policies, it's crucial to understand the elimination period, which is the waiting time before benefits kick in after a disability occurs. A shorter elimination period usually means higher premiums, so it's important to balance your needs and budget.

The Financial Impact of a Disability

Imagine losing your income for several months or even years. The financial impact can be devastating, draining savings and putting retirement plans on hold. Many people mistakenly believe they can rely on savings alone. However, according to a Bankrate survey, nearly 60% of Americans don't have enough savings to cover even six months of expenses. Without disability insurance, the financial strain of an extended work absence can lead to increased debt or even bankruptcy.

For instance, consider a young professional, Alex, who suffers an unexpected back injury. Unable to work, Alex's savings quickly dwindle, forcing him to dip into his retirement account. This not only incurs penalties but also jeopardizes his future financial stability. Disability insurance could have provided Alex with the income needed to cover his expenses without depleting his savings or retirement funds. By providing a steady stream of income, disability insurance allows you to focus on recovery rather than financial stress.

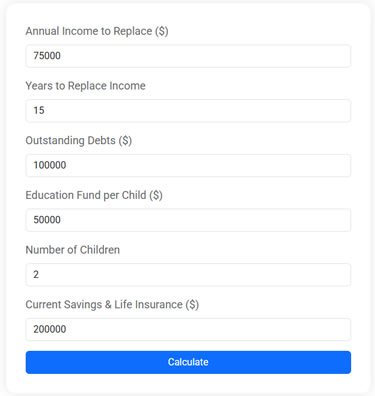

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Choosing the Right Policy

Selecting the right disability insurance policy involves several considerations. First, assess your current financial situation and determine how much of your income you need to replace. Some policies offer up to 60-70% income replacement, which can be sufficient to cover essential expenses. It's also important to consider the policy's duration and whether it aligns with your long-term financial goals. For many, a combination of short-term and long-term disability insurance provides comprehensive coverage.

Another key factor is whether to opt for an own-occupation or any-occupation policy. Own-occupation policies provide benefits if you're unable to perform your specific job, while any-occupation policies require you to be unable to work in any job reasonably suited to you. Own-occupation policies generally offer more comprehensive protection but can be more expensive. As financial advisor Jane Smith explains, "Understanding the differences between these policies is crucial to ensure you're adequately protected based on your personal and professional needs."

Employer-Provided vs. Individual Policies

Many employers offer group disability insurance as part of their benefits package. While this is a great starting point, it's important to understand the limitations. Employer-provided policies often cover only a portion of your salary and may not be portable if you change jobs. Additionally, benefits from employer-paid policies are typically taxable, reducing the actual amount you receive.

On the other hand, individual policies can be customized to better meet your needs and are typically non-taxable if you pay the premiums yourself. Although individual policies can be more expensive, the flexibility and additional coverage often justify the cost. For those self-employed or without employer coverage, an individual policy is essential. Researching and comparing policies from different providers can help you find the best coverage at a competitive price.

Maintaining Peace of Mind

Peace of mind is perhaps the most significant benefit of having disability insurance. Knowing that you're protected financially allows you to focus on recovery without the added stress of financial instability. It also provides reassurance to your family, who may otherwise feel the burden of supporting you during your time of need. As financial expert Suze Orman often says, "Insurance isn't for the odds, it's for the consequences." Preparing for the unexpected with disability insurance is a smart way to mitigate the financial impact of a disability.

Ultimately, disability insurance is an investment in your future. It ensures that even when life throws you a curveball, you have the resources to maintain your lifestyle and financial goals. By understanding your needs and carefully choosing the right policy, you can protect yourself and your loved ones from the financial uncertainties that can accompany a disability. Remember, it's not just about insuring your income; it's about insuring your peace of mind.