Top 5 Insurance Companies for Excellent Customer Service

When selecting an insurance provider, prioritizing customer service alongside cost is crucial, as it significantly impacts the claims process and policy understanding. Top insurers renowned for stellar customer service include State Farm, USAA, Amica Mutual, The Hartford, and Progressive, each offering unique strengths such as personalized support, innovative tools, and comprehensive educational resources. These companies excel in providing peace of mind and a seamless experience, ensuring policyholders receive the assistance they need.

When it comes to choosing an insurance provider, it’s tempting to focus solely on cost. After all, who doesn’t want to save a little money? But if you’ve ever had to file a claim or needed guidance on your policy, you know that customer service can make or break your experience. An insurer's ability to communicate clearly, resolve issues promptly, and provide ongoing support is invaluable. The peace of mind knowing you can reach a helpful human when you need it most is worth its weight in gold—or at least a few dollars more in premiums.

Several top insurers stand out for their exemplary customer service, transforming what can often be a dreaded interaction into a reassuring experience. These companies not only offer competitive rates but also excel in making their policyholders feel valued and supported. Let's dive into five insurance powerhouses known for their outstanding customer service: State Farm, USAA, Amica Mutual, The Hartford, and Progressive.

State Farm: Personal Touch and Local Presence

State Farm has long been a household name in insurance, and for good reason. Their customer service is often praised for its personal touch, largely due to their vast network of local agents. This means you’re not just dealing with a faceless corporation; you have a local representative who knows your community and can offer tailored advice.

A recent survey by J.D. Power ranked State Farm highly in customer satisfaction, highlighting their ability to provide clear and concise information during the claims process. One policyholder recounts how, after a minor car accident, her agent walked her through every step, ensuring she understood her coverage and what to expect next. This kind of personalized service can be a game-changer when you’re navigating the often-confusing world of insurance claims.

Moreover, State Farm invests heavily in technology to enhance their customer service. Their mobile app and website are user-friendly, allowing customers to manage their policies, file claims, and even get quotes with ease. This combination of local, personalized support and digital tools ensures that State Farm customers are well taken care of, no matter how they prefer to interact.

USAA: Military Families' Trusted Ally

USAA is a unique player in the insurance market, primarily serving military members and their families. This specialization allows USAA to offer services and benefits specifically tailored to the unique needs of military life, such as deployment and frequent relocations. Their customer service is consistently rated as top-notch, often described as empathetic and understanding.

According to a report by Insure.com, USAA customers frequently highlight the company’s dedicated service representatives who genuinely understand military life and its challenges. One veteran shared how during his deployment, USAA made it incredibly easy to adjust his car insurance to reflect his new circumstances, saving him time and money.

USAA's commitment to customer service extends beyond the typical 9-to-5. They offer 24/7 customer support, ensuring that help is always available, whether you’re on base or abroad. Their website and mobile app are also equipped with a plethora of educational resources, helping policyholders make informed decisions about their insurance needs.

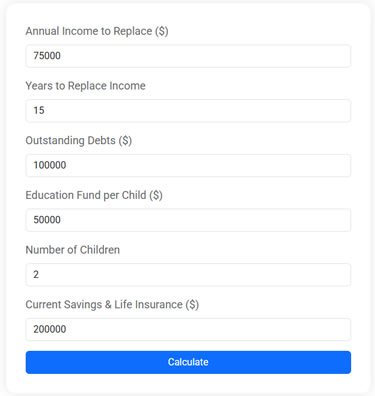

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Amica Mutual: A Tradition of Excellence

Amica Mutual is renowned for its no-frills, customer-first approach. As a mutual company, Amica is owned by its policyholders, which often translates into better customer service and satisfaction. This structure allows them to focus on the needs of their customers rather than shareholders, resulting in a service model that’s both responsive and proactive.

Amica consistently ranks at the top of customer satisfaction surveys. In fact, according to Consumer Reports, Amica has been a leader in home insurance satisfaction for several years running. Customers praise their straightforward claims process and the way representatives handle issues with empathy and efficiency.

One standout feature of Amica’s service is their “Platinum Choice Auto” package, which includes extras like full glass coverage and rental reimbursement. This package, alongside their attentive service, reflects Amica's commitment to going above and beyond for their policyholders.

The Hartford: Dedicated Support for AARP Members

The Hartford has carved out a niche in providing insurance solutions for AARP members, offering tailored auto and home insurance packages to meet the needs of older adults. Their focus on this demographic allows The Hartford to provide specialized customer service that addresses the unique concerns of senior policyholders.

AARP members often praise The Hartford for their patience and clarity when explaining policy options and changes. As one customer noted in a review, the representative took the time to walk her through each aspect of her coverage, ensuring she felt confident and informed. This level of detail is especially crucial for older adults who may have specific coverage needs or concerns about navigating digital platforms.

The Hartford also excels in offering innovative tools to simplify the insurance process. Their mobile app provides easy access to policy details, claims filing, and even vehicle maintenance tips. This tech-savvy approach complements their personalized customer service, making them a top choice for those seeking both convenience and care.

Progressive: Innovating with Empathy

Progressive has long been known for its catchy commercials and competitive rates, but its customer service is just as impressive. With a strong focus on innovation, Progressive continually updates its offerings to better serve its customers. Their “Name Your Price” tool, for instance, allows potential policyholders to customize their coverage to fit their budget, a feature that has won them many fans.

What sets Progressive apart is their commitment to transparency and education. They offer a wealth of resources on their website, including detailed guides on understanding insurance terms and coverage options. As Forbes notes, Progressive’s representatives are trained to help customers navigate these resources, ensuring they make informed decisions.

Progressive also places a high value on customer feedback, using it to refine their services continuously. One policyholder shared how after experiencing a minor claim hiccup, Progressive not only resolved the issue promptly but also followed up to ensure satisfaction, illustrating their commitment to continuous improvement.

Choosing an insurance provider involves more than just comparing premiums. It's about finding a company that will support and guide you when you need it most. The top contenders—State Farm, USAA, Amica Mutual, The Hartford, and Progressive—offer exceptional customer service that makes navigating the complex world of insurance a little clearer and a lot more reassuring. With their unique strengths, these companies ensure that policyholders are not just another number, but valued members of a supportive insurance community.