Insurance Fraud: How to Protect Yourself from Scams

Insurance fraud is a widespread problem that increases premiums for honest policyholders and costs the U.S. economy over $80 billion annually. Being informed about common fraud tactics, recognizing red flags, verifying agents, and protecting your personal information are key steps in safeguarding yourself from scams. Promptly reporting any suspected fraud to your insurance provider and relevant authorities helps protect both you and the broader community from these deceitful schemes.

Insurance fraud might sound like something that happens only in movies, but it's a very real and costly issue impacting many honest policyholders and the economy at large. Picture this: you're diligently paying your insurance premiums, thinking you're covered in case of an emergency, only to find out that a scam has inflated your costs or, worse, left you vulnerable. In the U.S., insurance fraud racks up an eye-watering $80 billion annually, according to the FBI. This isn't just a distant problem; it's one that affects your pocketbook directly.

With premiums rising and scams becoming more sophisticated, it's crucial to arm yourself with knowledge. Understanding common fraud tactics and learning how to protect yourself are vital steps in ensuring you don't fall victim to these deceitful schemes. Let's explore practical ways to safeguard yourself from insurance fraud and contribute to a more honest and transparent insurance industry.

Understanding Insurance Fraud

Insurance fraud isn't a one-size-fits-all crime; it comes in many forms and sizes. From faking accidents to inflating claims, fraudsters are continually devising new ways to cheat the system. For instance, consider the case of staged car accidents, where scammers intentionally cause accidents to claim insurance money. This not only affects the insurance company but also increases premiums for everyone. According to the Coalition Against Insurance Fraud, such scams can add up to 20% to your auto premiums.

Moreover, there are also "phantom" insurance plans. These involve fraudsters posing as legitimate insurance providers, offering non-existent policies to unsuspecting customers. Imagine paying for a policy that doesn't even exist — it's a nightmare scenario that leaves you unprotected. Understanding these tactics is the first step in recognizing and avoiding them.

Recognizing Red Flags

Spotting the signs of insurance fraud can save you a lot of trouble. A common red flag is when you're pressured to make quick decisions or payments. Scammers often create a false sense of urgency to prevent you from thinking things through. If an agent is pushing you to sign on the dotted line without giving you time to review the policy, consider it a warning signal.

Another red flag is a lack of proper documentation. Legitimate insurance transactions involve a lot of paperwork. If someone offers a deal without the standard documentation, it's time to dig deeper. Check for inconsistencies in the policy details and always verify the credentials of the agent and the company.

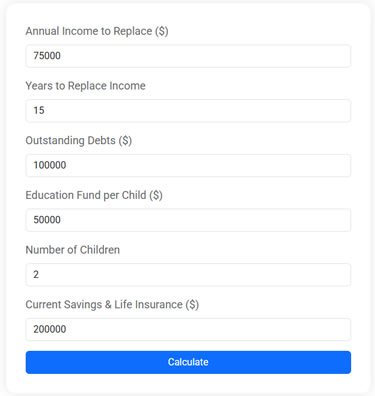

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Verifying Agents and Companies

Before you engage with any insurance agent or company, it's crucial to verify their legitimacy. Start by checking if the insurance company is licensed in your state. The National Association of Insurance Commissioners (NAIC) offers a comprehensive database where you can verify company licenses and complaints.

For individual agents, ask for their license number and cross-check it with your state's insurance department. It's a simple step that can prevent a lot of potential headaches. Additionally, reading online reviews and seeking recommendations from trusted friends or family can provide insights into the agent's reputation and reliability.

Protecting Your Personal Information

Your personal information is like gold to scammers, so safeguarding it should be a top priority. Be cautious about sharing personal details, especially over the phone or online. Scammers often impersonate insurance agents or companies to harvest your data. Always initiate contact with your insurer through official channels and verify any requests for sensitive information.

Consider using a credit monitoring service to keep an eye on any unusual activity. These services can alert you to potential identity theft, allowing you to act swiftly. Remember, if something feels off, trust your instincts and verify before proceeding.

Reporting Suspected Fraud

If you suspect insurance fraud, don't keep it to yourself. Reporting it promptly can protect you and others from becoming victims. Contact your insurance provider immediately to express your concerns. Most companies have dedicated fraud investigation teams ready to handle such cases.

Additionally, report the suspected fraud to your state's insurance department. They have the resources to investigate and take action against fraudulent activities. According to the Insurance Information Institute, reporting fraud not only helps combat the issue but can also lead to improvements in industry regulations and practices.

Educating Yourself and Others

Knowledge is your best defense against insurance fraud. Stay informed about the latest scams by subscribing to alerts from consumer protection agencies and insurance watchdogs. The Federal Trade Commission (FTC) regularly publishes updates on emerging scams and how to avoid them.

Sharing what you learn with friends and family can create a ripple effect, equipping more people with the tools to protect themselves. Consider organizing community talks or online webinars to raise awareness about insurance fraud. The more people know, the harder it becomes for fraudsters to succeed.

Staying Vigilant

Insurance fraud is a persistent threat, but with vigilance and informed actions, you can shield yourself from its impacts. Always read the fine print of any policy, ask questions, and ensure you understand what you're purchasing. It's better to spend a little extra time upfront than to deal with the aftermath of a fraud.

Keep a record of all communications and transactions with your insurance company. This paper trail can be invaluable if you ever need to dispute a claim or report fraud. Remember, staying vigilant isn't just about protecting your own interests; it's about safeguarding the integrity of the entire insurance system.

By taking these steps, you contribute to a culture of transparency and trust in the insurance industry. Protect yourself, your community, and your finances by staying informed and proactive against the ever-evolving threat of insurance fraud.