5 Common Insurance Myths Debunked

Navigating insurance can be complex, but it's crucial to debunk common myths for informed decision-making. Contrary to popular belief, car color doesn't affect insurance rates, older drivers often benefit from discounts, and health insurance doesn't cover all medical expenses. Additionally, standard home insurance policies exclude certain damages, and life insurance holds value beyond just breadwinners. Understanding these myths helps ensure you have the right coverage to protect your financial future.

Navigating the world of insurance can feel a bit like trying to solve a complex puzzle. With so many different policies, terms, and conditions, it's easy to get tangled up in misconceptions that might lead you astray. Making informed decisions about insurance is essential to safeguarding your financial health, but that requires separating fact from fiction. Today, we're diving into some of the most stubborn insurance myths that persist despite being more fiction than fact.

These myths aren't just harmless misunderstandings; they can lead to poor decisions and inadequate coverage. From the idea that a red car will send your insurance premiums skyrocketing to the misconception that life insurance is only for those who bring home the bacon, it's time to set the record straight. Let's explore these common myths and reveal the truth behind them, ensuring you're equipped with the knowledge you need to protect yourself and your loved ones.

Myth 1: The Color of Your Car Affects Your Insurance Rates

One of the most pervasive myths out there is the belief that the color of your car impacts your insurance rates. Many people are convinced that owning a flashy red car will cost them more in premiums. However, the truth is, insurers don't care whether your car is red, blue, or polka-dotted. What matters more are factors like the make, model, age, and even the safety features of your vehicle.

Insurance companies focus on data-backed risk assessments. For example, a sports car known for high speeds might attract higher premiums, not because of its color but due to its potential for accidents. As Nationwide Insurance clarifies, "The color of the car is not a factor used in calculating your insurance rate." So, if you've been holding back from buying that vibrant red convertible, rest easy knowing it won't cost you more just because of its hue.

Myth 2: Older Drivers Always Have Higher Insurance Rates

It's a common assumption that as drivers age, their insurance premiums will inevitably skyrocket. While it's true that very young and very old drivers are often considered higher risk, many insurance companies actually offer discounts to older drivers with a good driving record. This is because experienced drivers tend to be more cautious and have a wealth of driving knowledge.

Additionally, many states offer programs that provide discounts to senior drivers who complete defensive driving courses. According to the AARP, members who take an approved driving course can often see a reduction in their premiums. So, if you're over 55, it might be worth looking into these programs to see if you can lower your insurance costs. Just remember, maintaining a clean driving record is key to taking advantage of these benefits.

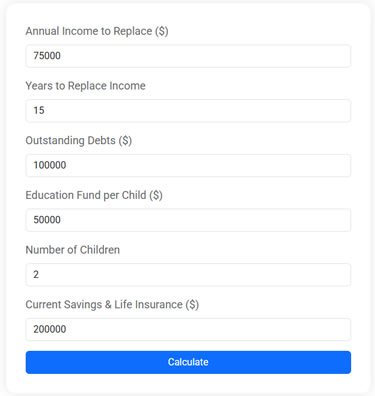

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Myth 3: Health Insurance Covers All Medical Expenses

Many people mistakenly believe that health insurance is a catch-all solution for medical expenses. However, even the best health insurance plans have limitations and exclusions. While insurance can significantly reduce the cost of medical care, it's essential to understand that not every expense will be covered.

For instance, elective procedures, some alternative therapies, and even certain prescription drugs might not be included in your plan. As CNBC highlights, "Insurance plans can have complex rules about what's covered and what's not," and it's crucial to read the fine print. Moreover, out-of-pocket expenses like deductibles, copayments, and coinsurance can add up quickly. Being aware of these potential costs can help you budget more effectively and avoid surprise bills.

Myth 4: Standard Home Insurance Covers All Types of Damage

Home insurance is designed to protect your most valuable asset, but many homeowners are unaware that standard policies don't cover everything. A common misconception is that all types of damage are included, leading to unpleasant surprises when disaster strikes. For instance, most standard policies exclude damage caused by floods or earthquakes.

If you live in an area prone to these natural disasters, it's wise to consider additional coverage. According to the Insurance Information Institute, "Flood insurance is available from the federal government’s National Flood Insurance Program (NFIP) and from a few private insurers." Similarly, earthquake insurance is a separate policy that can protect you in the event of a quake. Understanding what your policy covers—and what it doesn't—is crucial to ensuring you have comprehensive protection for your home.

Myth 5: Life Insurance Is Only for Breadwinners

Life insurance is often thought of as a safeguarding measure for families reliant on a single income. However, this narrow view overlooks the many ways life insurance can benefit a broader range of people. Non-working spouses, stay-at-home parents, and even children can all have policies that provide financial security and peace of mind.

Consider the valuable, albeit unpaid, contributions of a stay-at-home parent. If something were to happen to them, the cost of replacing their services—such as childcare, cooking, and housekeeping—could be substantial. Financial advisor Jane Smith points out, "Life insurance for a non-working spouse can ease the financial burden during a difficult time." Additionally, policies for children can serve as a financial tool, building cash value over time that can be accessed for future needs like education or starting a business.

In conclusion, understanding these common insurance myths is more than an academic exercise—it's a practical step toward making informed decisions that protect your financial future. By debunking these myths, you've armed yourself with the knowledge to navigate the complex world of insurance with confidence. Whether it's choosing the right car, planning for medical expenses, safeguarding your home, or considering life insurance options, the truth is your best ally.