Insurance Coverage for Homeowners: What You Need to Know

Owning a home brings significant responsibility, including the need for homeowners insurance to protect your investment from unforeseen events. Understanding the different types of coverage, factors affecting premiums, and how to file a claim can help you make informed decisions and ensure you're adequately covered. Regularly reviewing and updating your policy ensures it continues to meet your needs and provides peace of mind.

Owning a home is a milestone that brings a sense of accomplishment and stability. But with that brick-and-mortar dream comes the responsibility of protecting it against the unpredictable twists life can throw your way. Enter homeowners insurance—a safety net that cushions the blow when disaster strikes. Yet, navigating the world of insurance can be as daunting as it is essential. The key lies in understanding what you're buying, how it works, and ensuring it keeps pace with your changing needs.

Homeowners insurance isn't just a box to tick off your to-do list; it's a critical component of safeguarding your largest investment. Whether you're securing a mortgage or simply shoring up peace of mind, knowing the ins and outs of your policy can make all the difference when it matters most. Let's break down the essentials of homeowners insurance, so you’re equipped to make savvy, informed choices.

Types of Homeowners Insurance Coverage

When it comes to homeowners insurance, one size does not fit all. Policies typically include several types of coverage, each serving a distinct purpose. Firstly, there's dwelling coverage, which protects the structure of your home from perils like fire or hail. This is the backbone of most policies and ensures you can rebuild if the worst happens.

Then there's personal property coverage, which extends to the contents of your home—think furniture, electronics, and clothing. If your belongings are stolen or damaged, this part of your policy can help replace them. For instance, if a water leak ruins your couch and TV, personal property coverage steps in to cover the cost.

Liability coverage is another crucial component. Suppose a visitor trips over your garden hose and sustains an injury; liability coverage helps with legal fees and medical expenses. Lastly, loss of use coverage can provide for temporary living expenses if your home becomes uninhabitable due to a covered event. Understanding these components ensures you’re not caught off guard when filing a claim.

Factors Affecting Premiums

Several factors influence how much you'll pay for homeowners insurance. The location of your home plays a significant role—living in an area prone to natural disasters, like hurricanes or earthquakes, typically results in higher premiums. Insurers assess risk based on historical data, so if you're in a flood zone, expect a heftier bill.

The age and condition of your home also impact your rates. Older homes may have outdated electrical systems or plumbing that pose higher risks, leading insurers to charge more. Conversely, modern homes with updated safety features like smoke detectors and security systems might earn you a discount.

Your credit score can also affect premiums. While it might seem unrelated, insurers often view a strong credit history as a sign of responsibility, potentially leading to lower rates. Finally, the amount of coverage and deductible you choose will influence your premium. Opting for a higher deductible can lower your monthly payments but means more out-of-pocket expenses when filing a claim.

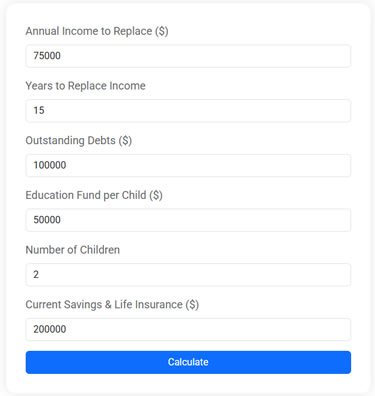

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

How to File a Claim

Filing a homeowners insurance claim doesn’t have to be a headache if you’re prepared. Start by documenting the damage with photos and notes. This helps provide a clear record of the incident, which is invaluable when dealing with adjusters. Contact your insurer as soon as possible to report the claim; many have convenient apps or online portals to streamline the process.

Next, understand your policy inside and out. Knowing what’s covered and what isn’t can save time and frustration. For example, if a tree falls on your house, dwelling and personal property coverage might apply, but if it falls without causing damage, you might be on your own for removal costs.

Once you've reported the claim, your insurer will assign an adjuster to assess the situation. Be prepared to provide documentation and answer questions. Keep copies of all correspondence and track expenses related to the claim. With patience and organization, you can successfully navigate the claims process.

The Importance of Regular Policy Reviews

Life changes, and so should your insurance policy. Regularly reviewing your coverage ensures it remains aligned with your current needs. Have you renovated your kitchen or added a home office? These improvements can increase your home's value and the cost to rebuild, so your coverage should reflect that.

Moreover, as your circumstances evolve, so too might the risks you face. If you've recently adopted a dog, for example, you may need to adjust your liability limits. Or, if you’ve paid off your mortgage, you might consider increasing your deductible to lower premiums now that the lender requirements no longer dictate terms.

According to financial advisor Jane Smith, "Policy reviews should be an annual affair, much like a health check-up for your finances." This proactive approach not only protects your investment but also ensures that you're not overpaying for coverage you no longer need.

Common Mistakes to Avoid

Even savvy homeowners can fall into common pitfalls when it comes to insurance. One major mistake is underinsuring your home, often due to trying to cut costs. While saving a few dollars on premiums might seem appealing, it can leave you vulnerable to significant financial loss in the event of a disaster.

Another misstep is neglecting to understand exclusions in your policy. Standard policies might not cover events like floods or earthquakes, requiring additional coverage. Failing to recognize these gaps can lead to costly surprises down the road.

Lastly, don't overlook the small print regarding personal property limits. High-value items such as jewelry or art often have specific caps unless you purchase additional endorsements. As CNBC highlights, "Many homeowners find out too late that their most prized possessions aren't fully covered—until they need to make a claim."

Conclusion

Navigating the complexities of homeowners insurance can feel like a tall order, but with the right knowledge, it becomes manageable. Understanding the different types of coverage, the factors that influence your premiums, and the steps to file a claim empowers you to make informed decisions. Regularly reviewing and updating your policy ensures it continues to meet your needs, providing the peace of mind that comes from knowing your home—and your investment—are protected. So, grab a cup of coffee, sit down with your policy, and take the steps necessary to secure your home’s future.