The Psychology of Insurance: Why We Need Protection and Peace of Mind

Insurance is more than just a financial safety net; it offers peace of mind by mitigating the fear of the unknown and providing emotional comfort in an unpredictable world. While the perceived value of insurance might not always align with its actual use, its potential to prevent catastrophic financial loss makes it indispensable. Trust in insurers and the strategic inclusion of insurance in financial planning are crucial for long-term stability and personal well-being.

Insurance is one of those things we often take for granted until we need it. It's a bit like a safety net at the circus — you hope you'll never fall, but knowing it's there allows you to swing higher and try tricks you might otherwise avoid. In essence, insurance provides more than just a financial fallback; it offers psychological comfort, cushioning us against the unpredictable nature of life. While many people grumble about paying premiums for something they might never use, the peace of mind that insurance provides is invaluable.

In a world where uncertainties are the only certainties, understanding the psychology behind insurance can help us appreciate its role in our lives. Let's dive deeper into why we need insurance and how it contributes to our overall well-being.

The Fear of the Unknown

Life is full of uncertainties. From natural disasters to health crises, the unpredictability of life can be downright daunting. This fear of the unknown is a fundamental human experience, prompting us to seek security in various forms. Insurance acts as a buffer against this fear, offering a sense of control when life throws curveballs. It's not just about covering costs; it's about having a plan when the unexpected happens.

Consider a homeowner living in a hurricane-prone area. Without insurance, each storm season could be a source of significant anxiety. However, having a comprehensive insurance policy can alleviate this stress, knowing that even if the worst happens, there’s a way to recover financially. This psychological comfort can be a powerful motivator for taking out insurance, often outweighing the actual likelihood of filing a claim.

The Emotional Comfort of Coverage

Insurance also provides emotional comfort by reducing stress and anxiety. When people know they are covered, they tend to worry less about events beyond their control. This reduction in stress can have tangible benefits, such as improved mental health and even physical well-being. In fact, a study published in the Journal of Health Economics found that individuals with health insurance experience better mental health outcomes than those without coverage.

Imagine a parent who wants to protect their family’s future. By securing life insurance, they ensure that their loved ones are financially protected should anything happen to them. This foresight and preparation can bring immense peace of mind, allowing the parent to focus on living in the moment rather than fearing the "what-ifs" of tomorrow.

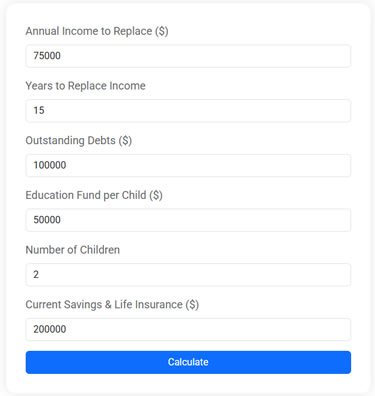

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Perceived Value vs. Actual Use

One of the intriguing aspects of insurance is the disconnect between its perceived value and its actual use. Many people pay for insurance for years without ever needing to file a claim. This can lead to a sense of frustration or even skepticism about the necessity of insurance. However, the true value of insurance lies not in its frequent use but in its potential to prevent catastrophic financial loss.

Take, for example, auto insurance. Most drivers will never be involved in a severe accident, yet the cost of not having insurance in such an event could be financially devastating. Insurance is about readiness for the unexpected, not the frequency of claims. As personal finance expert Suze Orman often says, "Insurance is a necessary expense to protect the things you can't afford to lose."

The Role of Trust in Insurance

Trust is a cornerstone of the insurance industry. Without it, people would be hesitant to pay premiums or rely on insurers to fulfill their promises. The relationship between policyholders and insurers is built on the expectation that claims will be honored and support provided when needed. This trust can be shaken by experiences of denied claims or poor customer service, underscoring the importance of choosing reputable insurers.

According to a survey by J.D. Power, customer satisfaction with insurers is heavily influenced by the claims process. Insurers that communicate clearly and settle claims efficiently tend to maintain higher levels of trust and loyalty among their customers. Thus, when selecting insurance, it’s crucial to consider not just the cost of premiums but the reputation and reliability of the provider.

Strategic Planning for Long-term Stability

Incorporating insurance into a broader financial strategy is key to achieving long-term stability. Smart financial planning considers potential risks and incorporates measures to mitigate them, with insurance playing a critical role. For instance, retirement planning often includes long-term care insurance to protect against the high costs of elder care, ensuring that savings are not depleted by unforeseen health expenses.

Financial advisor Jane Smith explains, "Insurance should be seen as a foundational element of any comprehensive financial plan. It protects your assets and future income, allowing you to pursue other financial goals with confidence." By strategically including insurance in financial planning, individuals can create a safety net that supports their journey toward financial independence and security.

Conclusion: Embracing Insurance for Peace of Mind

In the end, insurance is about more than just financial protection; it's about peace of mind. By understanding the psychology behind insurance, we can better appreciate its value in our lives. It allows us to navigate life's uncertainties with confidence, knowing that we're cushioned against potential setbacks. Whether it's safeguarding our homes, health, or loved ones, insurance provides the reassurance that we're prepared for whatever life throws our way. So, next time you pay your insurance premium, consider it an investment in your peace of mind — an investment that might just be priceless.