The Hidden Costs of Being Underinsured

The article highlights the often overlooked financial risks of being underinsured, where insurance coverage is insufficient to cover potential losses, leading to significant financial strain. While lower premiums may seem appealing, the hidden costs of underinsurance can far exceed short-term savings, impacting long-term financial goals and stability. It emphasizes the importance of regularly reviewing insurance policies, assessing asset values, and consulting experts to ensure adequate coverage and protect against unexpected events.

When it comes to insurance, many of us are guilty of setting it and forgetting it. We pick a plan, pay our premiums, and hope we never need to file a claim. But what if the coverage you’ve been banking on falls short when you need it most? Being underinsured might save you money on premiums in the short term, but the long-term financial strain can be overwhelming. Underinsurance occurs when your policy doesn’t fully cover potential losses, leaving you to shoulder much of the burden. This can create a financial quagmire that derails your savings goals, retirement plans, or even your ability to maintain your lifestyle.

While it might be tempting to keep those monthly costs low, the hidden costs of insufficient coverage can easily outweigh those savings. As life changes, so do your insurance needs. Regularly reviewing your policies is crucial to ensure that you're adequately protected against the unexpected. It's a bit like wearing a seatbelt while driving—sure, you might never get into an accident, but when you do, you'll be glad it's there.

Understanding the Risks of Underinsurance

Underinsurance is a sneaky problem because it doesn’t show its true colors until disaster strikes. Imagine this: your home is valued at $300,000, but your homeowner's insurance only covers up to $200,000. If a fire or natural disaster were to occur, you’d be on the hook for the remaining $100,000. According to a report from the Insurance Information Institute, nearly two-thirds of American homes are underinsured, with the average homeowner lacking about 20% of necessary coverage.

Beyond property insurance, consider health coverage. If your health plan has high deductibles and low coverage limits, a serious illness or accident could lead to devastating medical bills. These hidden costs become apparent at the worst possible times, forcing people to dip into savings, take on debt, or make other sacrifices. This can set back financial plans for years or even decades.

The Temptation of Lower Premiums

It’s easy to see why someone might choose a policy with lower premiums. On the surface, it seems like a smart way to save money. However, these savings can be deceptive. Lower premiums often mean higher deductibles, less coverage, or both. It's like buying a cheap umbrella—fine in a light drizzle, but useless in a downpour.

For instance, auto insurance policies with lower premiums might have minimal liability coverage. In the event of an accident, you could be liable for repair costs and medical bills that far exceed your policy limits. This is particularly true if you're at fault. According to Consumer Reports, many drivers are underinsured in terms of liability, which can lead to legal and financial troubles down the line.

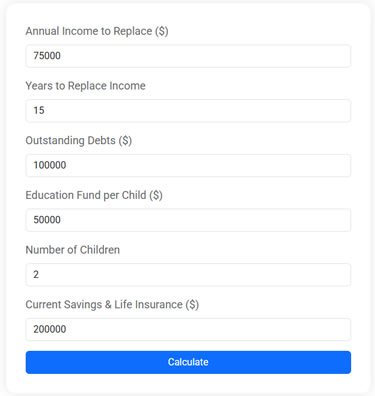

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

The Impact on Long-Term Financial Goals

Inadequate insurance can also disrupt your long-term financial goals. Imagine planning for retirement, only to have your savings wiped out by a catastrophic event that your insurance doesn’t fully cover. Rebuilding your financial safety net is not only challenging but also time-consuming, potentially delaying retirement or forcing lifestyle changes.

Let’s say you’re working toward paying off your mortgage early, but then you face unexpected medical expenses due to insufficient health coverage. Suddenly, the extra payments you were making toward your mortgage have to be redirected to cover these costs. As financial advisor Jane Smith points out, "Underinsurance might seem like a way to cut costs, but it often leads to borrowing against your future."

Regularly Reviewing Your Insurance Coverage

Given the stakes, it’s crucial to regularly review your insurance policies. Life events such as marriage, the birth of a child, buying a home, or even changes in the job market can affect your insurance needs. An annual review can help ensure that your coverage aligns with your current lifestyle and financial situation.

For example, if you’ve recently renovated your home or acquired valuable assets, it may be time to increase your homeowner’s insurance coverage. Similarly, if your income has risen, boosting your life insurance might be wise to provide better financial security for your family. As the National Association of Insurance Commissioners recommends, "An annual check-up with your insurance agent can help keep your coverage in line with your needs."

The Role of Professional Advice

When in doubt, consult with a professional. Insurance agents and financial planners are equipped to assess your needs and recommend appropriate coverage levels. They can help you navigate the complexities of different policies and find the balance between premium costs and adequate coverage.

Consider this scenario: You’re unsure if your life insurance is sufficient to support your family in the event of your untimely passing. A financial advisor can help you calculate how much coverage you need based on your income, debts, and family obligations. As financial planner Mark Reynolds notes, "Professional advice is invaluable in understanding the nuances of insurance policies and making informed decisions."

Conclusion: Protecting Against the Unexpected

Ultimately, insurance is about protecting against the unexpected. It’s the financial safety net that allows you to pursue life’s opportunities without fear of losing everything to a single unforeseen event. While lower premiums can be tempting, the peace of mind that comes from knowing you’re fully covered is worth so much more.

So the next time you’re tempted to skimp on coverage to save a few bucks, remember the potential hidden costs. Regularly review your policies, assess the value of your assets, and don’t hesitate to seek professional guidance. It’s an investment in your financial stability and peace of mind, safeguarding not just your present, but your future too.