Insurance in Times of Crisis: How to Ensure You're Adequately Covered

In uncertain times, having adequate insurance coverage is crucial, yet many find themselves underinsured or confused about their policies. To ensure you're protected, thoroughly understand your current coverage, evaluate your risk profile, consider additional coverage options, and regularly update your policies to reflect life changes. Additionally, complementing your insurance with an emergency financial plan can provide immediate relief and streamline the recovery process during crises.

In the whirlwind of life’s unpredictability, having a solid insurance plan can feel like a warm blanket of security. Whether it’s the sudden onset of a health crisis, a natural disaster, or unexpected job loss, these moments remind us of the importance of being prepared. Yet, despite their significance, navigating the world of insurance can often feel like wandering through a dense fog. Many individuals find themselves underinsured or simply bewildered by the fine print of their policies. So, how do you ensure that you're adequately covered when a crisis hits? Let's dive into the essentials of understanding and optimizing your insurance coverage.

Understand Your Current Coverage

Before you can make any informed decisions about your insurance, it’s crucial to take stock of what you currently have. Start by gathering all your policy documents and create a summary of the coverage each one provides. It’s not uncommon for people to be surprised by the details—or lack thereof—in their policies. For instance, some homeowners discover too late that their policies don’t cover flood damage, a lesson often learned after the water starts rising.

Next, make it a point to read through your policies carefully. Yes, insurance documents are notorious for their jargon, but they’re worth the headache. Look for key terms and conditions that outline what is covered and, equally importantly, what isn’t. If something is unclear, don’t hesitate to reach out to your insurance agent for clarification. Remember, understanding your coverage is the first step in ensuring it meets your needs.

Evaluate Your Risk Profile

Your risk profile plays a significant role in determining what kind of insurance coverage is necessary. Risk can vary greatly depending on various factors, including your geographical location, lifestyle, and family situation. For example, if you live in a hurricane-prone area, your need for comprehensive home insurance is far greater than someone residing inland. Similarly, if you have dependents, life insurance becomes a critical component of your financial safety net.

To effectively evaluate your risk, consider both your immediate environment and your long-term plans. Are you planning to start a family? Are you nearing retirement? Each stage of life carries different risks and insurance needs. By assessing your risk profile, you can better tailor your coverage to address the specific challenges you might face.

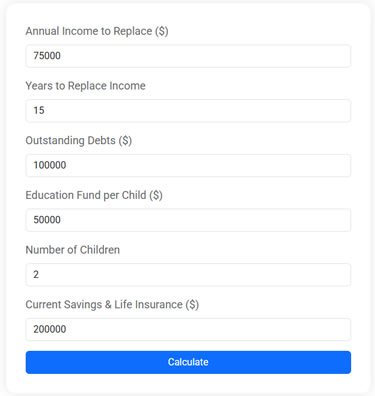

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Consider Additional Coverage Options

Once you have a clear understanding of your current coverage and risk profile, it’s time to explore additional coverage options. This doesn’t necessarily mean you should buy every insurance product available, but rather, look for gaps that need filling. For instance, umbrella insurance can be a smart move if you have significant assets that need protection beyond what your standard policies offer.

Another area to consider is health insurance. In times of crisis, medical expenses can quickly spiral out of control. As health care costs continue to rise, having a robust health insurance policy is more critical than ever. Make sure your policy covers essential treatments and consider supplemental plans if your current coverage falls short.

Regularly Update Your Policies

Life doesn’t stand still, and neither should your insurance policies. Major life events such as getting married, having children, or buying a home should prompt an immediate review of your insurance needs. Even without major changes, it’s wise to periodically review your policies to ensure they still align with your current situation and future goals.

For example, when your teenage child gets their driver’s license, your auto insurance policy may need to be updated to reflect the additional risk. Similarly, significant home renovations can affect your home insurance coverage. By keeping your policies up to date, you prevent unpleasant surprises when filing a claim.

Complement Your Insurance with an Emergency Financial Plan

Insurance is only one piece of the puzzle when it comes to financial preparedness. Complementing your insurance policies with a well-thought-out emergency financial plan can make a world of difference during a crisis. Start by building an emergency fund that can cover three to six months’ worth of living expenses—this provides a cushion for unexpected events, from job loss to medical emergencies.

Additionally, create a crisis budget that outlines essential expenses and identifies areas where you can cut back if necessary. Having a plan in place means you can act quickly, reducing stress and allowing you to focus on recovery. As financial advisor Jane Smith notes, “A solid emergency plan paired with adequate insurance coverage can significantly reduce the financial impact of unforeseen events.”

Stay Informed and Seek Professional Advice

The insurance landscape is constantly evolving, with new products and regulations emerging regularly. Staying informed about these changes is crucial. Subscribe to financial news outlets, attend workshops, or join online forums where insurance topics are discussed. Being proactive about your financial education helps you make informed decisions and avoid costly mistakes.

Moreover, don’t underestimate the value of professional advice. Insurance agents and financial advisors can provide personalized recommendations based on your unique circumstances. They can help you understand complex policy details and suggest adjustments to optimize your coverage. Remember, it’s their job to navigate this complex world on your behalf, so take advantage of their expertise.

In times of crisis, having the right insurance coverage can be the difference between financial devastation and resilience. By thoroughly understanding your current policies, evaluating your risk profile, considering additional coverage options, and maintaining an updated insurance plan, you can navigate uncertainties with confidence. Coupled with a comprehensive emergency financial plan, you’ll be well-equipped to face whatever life throws your way.