Top 10 Tips for Saving Money on Your Insurance Premiums

Reducing insurance premiums can be manageable with strategic planning, such as shopping around for quotes, bundling policies, and increasing deductibles. Maintaining a good credit score and taking advantage of available discounts can also significantly lower costs. By actively seeking these opportunities, you can free up funds for other financial goals while ensuring adequate coverage.

Reducing insurance premiums might sound like a daunting task, but with a little strategic planning, it’s entirely possible to cut costs without compromising your coverage. As someone who’s spent years navigating the insurance landscape, I can tell you that it's often a matter of knowing where to look and what questions to ask. Whether it’s the house you live in, the car you drive, or even your health, there’s a policy for almost everything these days. The good news? There are just as many ways to save money on these premiums.

From shopping around for competitive quotes to maintaining a rock-solid credit score, there are numerous strategies you can use to reduce your insurance costs. After all, these savings can be redirected towards other important financial goals, like building an emergency fund or investing for your future. So, let’s dive into some practical tips that can help you take control of your insurance expenses.

Shop Around for Quotes

One of the most effective ways to save on insurance is to shop around for quotes. Many people stick with the same insurance provider year after year, but this loyalty doesn’t always pay off. By comparing rates from different companies, you might find a better deal elsewhere. Take car insurance, for example; according to a 2022 study by J.D. Power, customers who switched insurers saved an average of $388 annually on their premiums.

When shopping for quotes, don’t just focus on price. It’s also important to consider the coverage options and customer service reputation of each provider. Websites like NerdWallet and The Zebra can be handy tools for comparing multiple insurers at once. Remember, the cheapest option isn’t necessarily the best if it doesn’t offer the coverage you need.

Consider Bundling Your Policies

Bundling your policies can be another savvy way to save. Insurance companies often offer discounts to customers who purchase multiple types of coverage, such as home and auto insurance, from them. In fact, some providers offer discounts of up to 25% for bundling. This not only reduces your premiums but also simplifies your life by consolidating your policies under one roof.

Not every company offers the same bundling benefits, though, so it’s worth doing a bit of homework. Check what specific discounts your current provider offers and compare them with other companies. Sometimes, separating them can still be cheaper, depending on the individual policies and rates offered by different insurers.

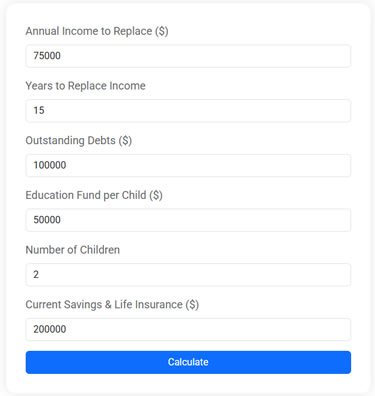

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Increase Your Deductibles

Raising your deductible is another straightforward way to lower your insurance premiums. A deductible is the amount you pay out-of-pocket before your insurance kicks in. By agreeing to pay a higher deductible, you can often secure a lower monthly premium. For instance, increasing your car insurance deductible from $500 to $1,000 could reduce your premium by as much as 15% to 30%.

However, it’s crucial to ensure that you can afford the higher deductible in the event of a claim. It might be wise to set aside some savings specifically for this purpose, so you’re not caught off guard if you need to file a claim.

Maintain a Good Credit Score

Your credit score might not seem directly related to your insurance premiums, but it plays a surprisingly significant role. Many insurers use credit-based insurance scores to help determine the risk of insuring you. A higher credit score often indicates a lower risk, which can lead to lower premiums. According to the Insurance Information Institute, maintaining a good credit history can save you hundreds of dollars annually on your insurance.

To improve your credit score, make sure to pay your bills on time, reduce outstanding debt, and avoid opening unnecessary credit accounts. Regularly checking your credit report can also help you spot and dispute any errors that might be affecting your score.

Take Advantage of Available Discounts

Insurance companies offer a variety of discounts that can reduce your premiums, and it’s worth taking the time to discover which ones apply to you. For example, many auto insurers offer discounts for safe drivers, students with good grades, or vehicles equipped with anti-theft devices. Home insurance providers might offer savings for having a security system or for being a loyal customer.

Don’t be shy about asking your insurer about potential discounts. You might be surprised at the number of savings opportunities available. A quick phone call or email could end up saving you a decent chunk of change.

Evaluate Your Coverage Needs Regularly

Life changes, and so do your insurance needs. Whether it’s a new job, a move, or changes in your family, these life events can impact the amount and type of coverage you require. Regularly evaluating your insurance needs ensures you’re not over-insured or paying for coverage you no longer need.

For instance, if your car’s value has significantly depreciated, it might not make sense to maintain comprehensive coverage. Similarly, if you’ve paid off your mortgage, you might be able to adjust your homeowner’s insurance. Periodic reviews can help keep your premiums aligned with your current situation.

Install Safety Features

Many insurers offer discounts for safety features that reduce the risk of accidents or theft. For example, installing smoke detectors and burglar alarms can lower your home insurance premiums. In the case of auto insurance, equipping your vehicle with anti-lock brakes, airbags, and anti-theft devices can also result in discounts.

Not only do these features make your home or car safer, but they also provide peace of mind. The initial investment in safety features can pay off through reduced premiums and improved protection.

Opt for Usage-Based Insurance

Usage-based insurance (UBI) programs are gaining popularity, especially among drivers who don’t rack up many miles. These programs use telematics technology to monitor your driving habits, such as speed, braking, and mileage. If you’re a safe driver, you could qualify for significant discounts on your auto insurance.

According to a report by the National Association of Insurance Commissioners, UBI can reduce premiums by 10% to 20% for low-mileage drivers. It’s an excellent option for those who work from home or have a short commute.

Review Your Policy Annually

An annual review of your insurance policy is a proactive way to ensure you’re still getting the best deal. Insurance rates can fluctuate based on various factors, including changes in the market or your personal circumstances. By reviewing your policy each year, you can catch opportunities to adjust your coverage or switch providers if better rates become available.

During this review, check for any changes in coverage terms, premium increases, or new discounts you might qualify for. Staying informed helps you make decisions that could save you money in the long run.

Consider a Higher Deductible Health Plan

When it comes to health insurance, choosing a higher deductible plan can reduce your premium costs. While it means paying more out-of-pocket before insurance kicks in, these plans typically have lower monthly premiums. They can be a good fit for those who are generally healthy and don’t anticipate needing frequent medical care.

Additionally, pairing a high deductible health plan with a Health Savings Account (HSA) can offer tax advantages. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free, providing another way to manage healthcare costs effectively.

By taking these steps, you can take control of your insurance premiums and keep more money in your pocket. Remember, the key is to stay informed and proactive about your insurance needs. With a bit of effort and research, you can ensure you’re getting the coverage you need at a price you can afford.