The Evolution of Insurance: From Ancient Times to Modern Policies

Insurance, a financial safety net, has evolved from ancient risk-sharing practices in Babylon and ancient Greece to modern, sophisticated policies. Throughout history, it has adapted to societal and economic changes, with significant developments during the Middle Ages, the Industrial Revolution, and the 20th century, leading to today's digital transformation. The modern insurance industry leverages technology like telematics and AI to offer personalized coverage, reflecting society's ongoing quest to mitigate risk and ensure financial stability.

Insurance might seem like a modern invention, a sophisticated system of contracts, premiums, and policies. However, its roots stretch back to ancient civilizations, where the concept of risk-sharing emerged as a way to navigate the uncertainties of life. From the bustling marketplaces of Babylon to the maritime prowess of ancient Greece, societies have long sought ways to protect themselves from financial ruin. Over the centuries, insurance has evolved, adapting to the changing needs and dynamics of the world, ultimately becoming the complex yet indispensable industry we know today.

In our journey through history, we'll explore how insurance has transformed and how it continues to innovate in an increasingly digital world. By examining the past, we gain insight into the enduring human desire to manage risk and ensure stability—a desire that remains as relevant as ever.

The Ancient Roots of Risk-Sharing

The earliest known form of insurance dates back to ancient Babylon around 1750 BC, with the Code of Hammurabi. This set of laws included provisions for what we might now recognize as a form of marine insurance. Merchants would pay lenders an additional sum to guarantee the cancellation of a loan should their shipment be lost at sea. This early attempt at managing risk highlights a fundamental human need: safeguarding against the unpredictable forces of nature and commerce.

In ancient Greece, maritime loans also served as a precursor to modern insurance. Shipowners would secure loans with the understanding that repayment was contingent upon the successful completion of a voyage. If the ship was lost, the lender absorbed the financial loss. These practices illustrate how insurance was intrinsically linked to trade and exploration, vital components of ancient economies.

Medieval Guilds and the Development of Mutual Aid

As we move forward to the Middle Ages, the concept of mutual aid societies began to take shape. Guilds, which were associations of artisans and merchants, provided a form of communal insurance for their members. These organizations pooled resources to support members in times of need, such as illness, death, or economic hardship. Guilds laid the groundwork for the mutual insurance model, which emphasizes shared risk and collective support.

The medieval period also saw the emergence of the first known insurance contract, signed in Genoa in 1347. This marine insurance policy marked a significant step towards the formalization of insurance practices, providing a legal framework for the transfer of risk. The contract stipulated specific terms and conditions, reflecting a growing sophistication in how people approached risk management.

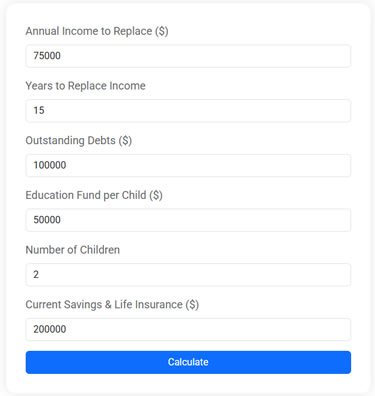

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

The Rise of Modern Insurance in the Industrial Age

The Industrial Revolution brought profound changes to society, and with it, the insurance industry underwent significant transformation. The rise of factories and urbanization created new risks and challenges, necessitating the development of various types of insurance. Fire insurance, for instance, became crucial in densely populated cities where fires could devastate entire neighborhoods.

Life insurance also gained popularity during this period, as people sought to protect their families from financial instability in the event of untimely death. The establishment of companies like the Equitable Life Assurance Society in 1762 marked the beginning of modern life insurance. These companies introduced actuarial science to calculate risks and premiums more accurately, a practice that remains foundational to the industry today.

The 20th Century: Regulation and Expansion

The 20th century was a time of significant growth and regulation for the insurance industry. Governments recognized the importance of protecting consumers and ensuring the solvency of insurance companies, leading to the establishment of regulatory frameworks. For instance, the U.S. passed the McCarran-Ferguson Act in 1945, allowing states to regulate insurance and ensuring that companies operated within safe and ethical boundaries.

This period also saw the diversification of insurance products, with the introduction of health insurance, automobile insurance, and liability insurance. The expansion of insurance types reflected the increasing complexity of modern life and the need for protection against a wider array of risks. As societal needs evolved, so too did the insurance industry, continually adapting to offer relevant coverage options.

The Digital Transformation of Insurance

Today, the insurance industry is in the midst of a digital revolution. Technology is reshaping how companies assess risk, interact with customers, and deliver services. Telematics, for example, allows insurers to gather real-time data on driving behavior to offer personalized auto insurance policies. This technology not only incentivizes safe driving but also provides more accurate pricing models.

Artificial intelligence (AI) is another game-changer, enabling insurers to process claims faster and more efficiently. AI-powered chatbots and virtual assistants enhance customer service, providing instant support and streamlining communication. These advancements demonstrate how technology is making insurance more accessible and responsive to consumer needs.

Looking Ahead: The Future of Insurance

As we look to the future, the insurance industry is poised for further innovation. The integration of blockchain technology promises to increase transparency and security in policy administration and claims processing. Additionally, the rise of the gig economy and remote work is prompting insurers to develop new products that cater to these evolving lifestyles.

Climate change also presents significant challenges and opportunities for the insurance sector. Companies are increasingly focused on developing strategies to mitigate environmental risks and support sustainability efforts. As Allianz CEO Oliver Bäte noted, "We need to find ways to make the planet more resilient, and insurance has a crucial role to play in that."

In conclusion, the evolution of insurance is a testament to humanity's enduring quest to manage uncertainty and protect against life's unpredictabilities. From ancient practices to modern innovations, insurance continues to evolve, reflecting society's changing needs and priorities. As we navigate the complexities of the 21st century, the industry's ability to adapt and innovate will be vital in ensuring financial stability and peace of mind for generations to come.