Insurance 101: A Beginner's Guide to Different Types of Insurance

Insurance is a vital aspect of personal finance that offers financial protection against unexpected events, yet it often remains overlooked until urgently needed. This guide simplifies the complexities of various insurance types, including health, auto, homeowners, renters, life, and disability insurance, each serving a specific role in safeguarding your financial health. By understanding these insurance forms and aligning them with your individual needs, you can create a robust financial strategy that ensures peace of mind.

Have you ever found yourself in a debate over why you need insurance or what types are essential? You're not alone. Insurance is like that mysterious safety net we all know is crucial but often don't fully understand until we're in freefall. The good news is that grasping the basics of insurance isn't as daunting as it sounds. Think of it as a financial superhero, swooping in to save the day when unexpected events try to wreak havoc on your finances. By the end of this guide, you'll have a clearer picture of the insurance landscape, making it easier to protect your future self.

Whether it’s safeguarding your health, your car, or even your income, insurance serves a unique purpose in your financial toolkit. It’s not just about paying premiums and hoping for the best; it’s about strategic planning. As financial advisor Jane Smith puts it, "Insurance is not just a purchase; it's a plan." So, let’s dive into the different types of insurance and see how each piece fits into your overall financial puzzle.

Health Insurance

Health insurance is often the first type of insurance people think about, and for good reason. Medical bills can pile up faster than you can say “deductible,” and without coverage, even minor medical events can become financially crippling. Most health insurance plans cover a range of services, from preventative care like vaccinations and screenings to more substantial needs like surgery or emergency care. For example, if you have a plan through your employer, it might cover a significant portion of your hospital stay after an unexpected appendix removal. According to a 2022 report by the Kaiser Family Foundation, about 49% of the U.S. population is covered by employer-provided health insurance.

For those not covered by an employer plan, the marketplace offers various options, often confusing. Still, taking the time to understand the terms can save you money and stress in the long run. Consider factors like premiums, deductibles, and out-of-pocket maximums when choosing a plan. As health insurance expert Dr. Emily Carter suggests, "Don't just look at the monthly premium. Consider what you'll actually pay if you need to use the insurance." Tailoring your health insurance to your needs ensures that you’re not overpaying for unnecessary coverage or underinsured when you need it most.

Auto Insurance

If you drive, auto insurance is not just a smart choice; it's usually a legal requirement. It’s designed to protect you financially in the event of a car accident, which, let’s face it, can happen to the best of us. Auto insurance generally covers damages to your vehicle, damages to other vehicles, medical expenses for you and others involved, and even legal fees if necessary. According to the Insurance Information Institute, the average annual cost for auto insurance in the U.S. was approximately $1,070 in 2022, but this can vary widely depending on factors like your location, driving history, and the type of car you drive.

Imagine you're driving home after a long day and someone rear-ends you at a stoplight. Without insurance, you’d be stuck covering the repair costs, which could easily run into thousands of dollars, and that’s before considering any medical expenses if you’re injured. When selecting auto insurance, think about the level of coverage you need. Liability coverage is often mandatory, but comprehensive and collision coverage might be worth considering if your car is newer or financed. And don't forget about those discounts—safe driver, good student, or even bundling with other insurance types can lower your premiums significantly.

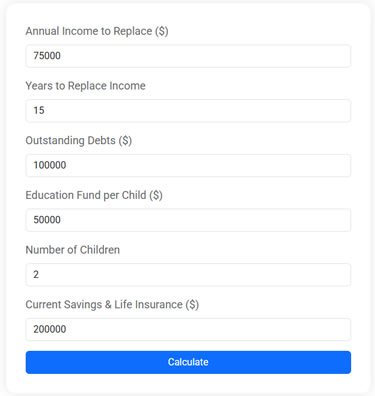

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Homeowners Insurance

For homeowners, this type of insurance is almost as vital as the roof over your head. Homeowners insurance covers damages to your home and personal property due to events like fires, storms, or theft. It also provides liability coverage if someone is injured on your property. Picture this: a winter storm knocks a tree onto your roof, causing significant damage. With homeowners insurance, the repair costs are covered, saving you from a potentially devastating financial blow.

When evaluating homeowners insurance, consider the replacement cost of your home and belongings—not just their current market value. You want to ensure your policy covers the full cost of rebuilding your home from the ground up if necessary. As real estate expert Laura Green advises, "Don’t skimp on coverage just to save a few dollars on premiums; the cost of being underinsured can be much higher." Different policies offer varying levels of coverage, so read the fine print and understand what’s included and what’s not, such as flood or earthquake damage, which are often separate policies.

Renters Insurance

If you’re renting, renters insurance might not be on your radar, but it should be. While your landlord’s insurance covers the building itself, renters insurance protects your personal belongings inside. Whether it’s a kitchen fire or a break-in, renters insurance ensures that you can replace your possessions and get back on your feet. For example, if a thief makes off with your laptop and other electronics, renters insurance can help cover the cost of replacing them.

According to a survey by the Insurance Information Institute, only 37% of renters have renters insurance, despite its affordability. Policies can cost as little as $15 a month, offering peace of mind at a low price. Additionally, renters insurance often includes liability coverage. So if a guest is injured in your apartment and decides to sue, your policy can help cover legal fees and any settlements. It’s a small price to pay for significant protection.

Life Insurance

Life insurance is a financial safety net for your loved ones in the event of your passing. It’s not the cheeriest topic, but it’s crucial for those who have dependents or significant financial obligations. Life insurance proceeds can help cover funeral costs, pay off debts, or provide ongoing income for your family. There are two primary types of life insurance: term life, which covers you for a specific period, and whole life, which provides lifelong coverage and can build cash value over time.

Consider the story of Mark, a young father who opted out of life insurance because he felt invincible. Tragically, he passed away unexpectedly, leaving his wife and kids struggling to cover their mortgage and daily expenses. As financial planner Susan Lee notes, "Life insurance isn't for you; it's for those you leave behind." When choosing a policy, think about your financial situation, dependents, and long-term goals to determine the appropriate coverage amount.

Disability Insurance

Disability insurance is like a backup plan for your income. It kicks in if an illness or injury prevents you from working and earning a paycheck. While many people consider their health insurance needs, few think about what would happen if they couldn't work for an extended period. According to the Social Security Administration, more than one in four 20-year-olds will become disabled before reaching retirement age, highlighting the importance of this often-overlooked coverage.

There are two main types of disability insurance: short-term, which covers a portion of your income for a few months, and long-term, which can last for several years or until retirement. Imagine you're a graphic designer who suffers a hand injury that prevents you from working for six months. Without disability insurance, you might struggle to cover everyday expenses. When selecting a policy, consider how long you can afford to be without income and choose coverage that aligns with your financial needs.

In the grand scheme of personal finance, insurance serves as both a buffer and a bridge, offering financial stability when life throws curveballs. By understanding the different types of insurance and how they fit into your life, you’re better equipped to make informed decisions that align with your financial goals. Remember, it’s not just about buying a policy; it’s about crafting a strategic plan that gives you and your loved ones peace of mind.