The Importance of Reviewing Your Insurance Coverage Annually

Insurance is a crucial part of financial planning, providing protection against unforeseen events, but it requires regular reviews to ensure it meets your evolving needs. An annual review helps adapt to changes in personal circumstances and insurance products, identify cost-saving opportunities, and ensure coverage for emerging risks. By staying informed and updating your policies, you can optimize your financial protection and avoid unpleasant surprises.

Insurance might not be the most thrilling topic around, but it's an essential part of anyone's financial toolkit. Think of it as the sturdy umbrella you keep handy for life's unexpected downpours. While most of us are content to set our insurance policies and forget them, this hands-off approach can lead to gaps in coverage or missed opportunities for savings. Much like an annual health check-up, reviewing your insurance coverage each year is crucial. It ensures that your policies still align with your evolving needs and the ever-changing landscape of available products.

Over time, our personal and financial situations change, sometimes dramatically. As life progresses, so do the risks we face and the assets we need to protect. By regularly reassessing your insurance coverage, you can adapt to these changes, ensuring that you're neither underinsured nor overpaying for coverage you no longer need. Let's dive into why an annual insurance review is a smart move and how it can help you stay ahead of the curve.

Adapting to Life Changes

Life is full of milestones—some expected, others surprising. Whether it's getting married, having a child, buying a home, or starting a new job, these events can significantly impact your insurance needs. For instance, welcoming a new baby means more than just stocking up on diapers; it also means considering life insurance to ensure your child's financial security if something should happen to you.

Similarly, if you've landed a new job with a substantial pay bump, you might think about increasing your disability coverage to protect that higher income. Conversely, if you're nearing retirement, it might make sense to adjust your life insurance policy now that the mortgage is paid off and the kids are independent. By revisiting your policies annually, you can make sure they reflect your current life stage and financial responsibilities.

Keeping Up with Product Changes

The insurance market is not static. New products and features are introduced regularly, offering more tailored coverage options and competitive rates. For example, some home insurance policies now offer better coverage for home-based businesses, a nod to the growing number of remote workers. As these changes roll out, it's worth checking whether a newer policy could offer you better protection or savings.

Staying informed about these developments can also help you spot outdated or redundant coverage. Perhaps a new type of rider could enhance your existing policy at a minimal cost. By comparing your current coverage with what's available today, you can ensure you're getting the best value and protection without paying for unnecessary extras.

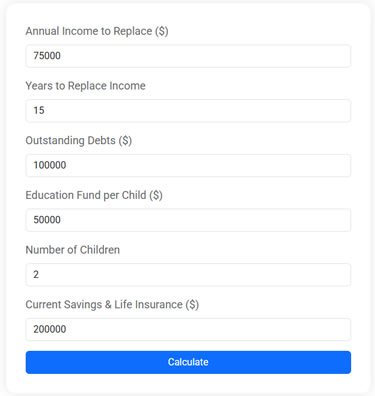

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Identifying Cost-Saving Opportunities

An annual insurance review isn't just about ensuring adequate coverage; it's also an opportunity to save money. Insurance companies frequently update their pricing models, which can lead to more competitive rates. By shopping around and comparing quotes each year, you might discover that switching providers could save you a tidy sum.

Bundling is another way to cut costs. Many insurers offer discounts if you combine different types of coverage, like home and auto. If your circumstances have changed—say, you've sold a vehicle or paid off a loan—your insurance needs may have shifted, opening the door to more savings. As financial advisor Jane Smith notes, "Even small adjustments can lead to significant savings over time, so it's worth taking a closer look."

Ensuring Coverage for Emerging Risks

As the world changes, so do the risks we face. Cyber threats, for example, have become a significant concern for both individuals and businesses. If you're working from home or running a business online, cyber insurance might be a wise addition to your policy portfolio. Similarly, climate change is affecting weather patterns, leading to more frequent and severe storms. Ensuring your home insurance covers these events is more important than ever.

By reviewing your insurance annually, you can assess whether you have adequate protection against these emerging risks. Don't wait until after a cyberattack or flood to discover you're not covered. Proactively updating your policies can help you manage potential threats before they become financial burdens.

Avoiding Unpleasant Surprises

One of the main benefits of an annual review is peace of mind. There's nothing worse than finding out, after the fact, that your insurance doesn't cover a particular loss. Imagine discovering that a flood isn't covered under your standard homeowner's policy only after your basement fills with water. Regularly checking your coverage helps prevent these unwelcome surprises and gives you confidence that you're prepared for whatever comes your way.

Moreover, insurance policies can be dense and filled with jargon. By going over them annually, you familiarize yourself with the terms and conditions, making it easier to understand what is and isn't covered. This understanding keeps you informed and empowered, so you can make educated decisions about your financial protection.

Conclusion

Reviewing your insurance coverage annually might not be at the top of your to-do list, but it's a crucial step toward maintaining a robust financial plan. Life is full of changes, both personal and in the broader world, and your insurance should evolve accordingly. By adapting to life changes, keeping pace with product innovations, identifying savings, and addressing emerging risks, you can optimize your coverage and ensure you're not caught off guard. So, set a reminder, grab your policy documents, and take an hour or two each year to review your insurance. Your future self will thank you.