Insurance Riders: Enhancing Your Coverage for Specific Needs

Insurance riders are optional add-ons to standard insurance policies that allow for customization, addressing specific needs that may not be covered by the base policy. These riders can provide enhanced protection for various scenarios, such as high-value items, critical illnesses, or income loss due to disability, and are often more cost-effective than purchasing separate policies. To maximize their value, it’s essential to regularly review your coverage, consider life changes, and consult with an insurance advisor to ensure your policy remains aligned with your evolving needs.

Insurance is one of those things we buy hoping never to use, yet when the need arises, it can be a financial lifesaver. But if you've ever felt like your standard insurance policy isn't quite tailored to your unique lifestyle or needs, you're not alone. Enter insurance riders—those customizable add-ons that can enhance your coverage for specific needs. These riders can be a game-changer, offering peace of mind without the hefty price tag of standalone policies.

Imagine you finally bought that dream camera for your photography side hustle, or you've been diagnosed with a condition that requires long-term care. Your basic insurance policy might not cover these scenarios, but a rider could. In this article, we’ll delve into how insurance riders work, the various types available, and how to determine if they’re right for you.

Understanding Insurance Riders

Insurance riders are essentially customizations to a standard insurance policy. Think of them as the toppings on your pizza—optional, but they can make your meal (or in this case, your coverage) exactly what you need. These riders allow policyholders to address specific risks that aren’t covered under the basic policy. For instance, a standard homeowner’s insurance might not cover high-value items like a diamond ring or an antique vase, but a personal property rider could.

One of the appealing aspects of insurance riders is their flexibility. They can be added at the time you purchase your policy or later, as your needs evolve. This adaptability is particularly beneficial in a world where personal and financial circumstances can change rapidly. According to a survey by the Insurance Information Institute, more than half of policyholders have added at least one rider to their insurance policies, underscoring their importance in comprehensive risk management.

Types of Insurance Riders

There are several types of insurance riders, each serving different needs. For instance, in the realm of life insurance, a critical illness rider can provide a lump sum payment if you're diagnosed with a covered illness, such as cancer or heart disease. This financial cushion can be invaluable in covering medical costs or supplementing lost income during recovery.

For homeowners, a valuable personal property rider ensures that high-ticket items, like jewelry or art collections, are covered beyond the limits of a standard policy. If you own a business, a business interruption rider can offer protection by compensating for lost income if your operations are suspended due to a covered event, like a fire or natural disaster.

Disability income riders in life insurance policies are also popular, especially among those who are self-employed or have occupations with higher injury risks. These riders provide a steady stream of income should you become unable to work due to a disability. As financial advisor Jane Smith explains, "Disability income riders can mean the difference between maintaining your lifestyle and facing significant financial hardship."

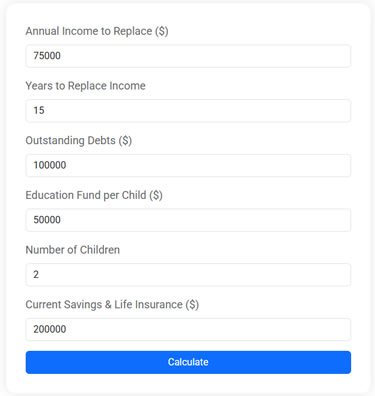

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Cost-Effectiveness of Riders

One of the most compelling reasons to consider riders is their cost-effectiveness. Adding a rider to an existing policy is often cheaper than purchasing a new, separate policy. For example, if you’re concerned about covering potential long-term care costs, a long-term care rider on your life insurance might be more affordable than buying a standalone long-term care insurance policy.

The savings can be significant. According to a report by Consumer Reports, policyholders who opted for life insurance riders instead of separate policies saved up to 30% annually on their premiums. This cost advantage makes riders an attractive option for those looking to enhance their coverage without overspending.

Reviewing and Updating Your Coverage

Just as you wouldn’t wear the same clothes from 10 years ago (at least not every day), your insurance coverage shouldn’t remain static over time. Life changes—getting married, having children, or even changing jobs—can all impact your insurance needs. Regularly reviewing your policy and any attached riders is crucial to ensure they still align with your current situation.

Consulting with an insurance advisor can provide valuable insights. Advisors can help identify gaps in your coverage and suggest appropriate riders. As your circumstances evolve, so too should your insurance strategy. This proactive approach not only ensures adequate protection but can also optimize your financial resources.

Real-Life Examples

Consider the case of Sarah, a freelance graphic designer who added a business interruption rider to her business insurance. When a flood damaged her home office, the rider kicked in, covering lost income during the repair period. Without it, Sarah might have faced financial strain, highlighting the practical benefits of riders.

Or take Mark, a father of two who added a child term rider to his life insurance policy. This rider ensures that if anything happens to his children, the family will have financial support to cover funeral expenses or medical bills. It’s a small addition, but one that offers significant peace of mind.

Making Informed Decisions

Choosing the right insurance riders requires a balance of personal needs and financial capacity. Start by assessing your current policy, identifying potential coverage gaps, and considering your future plans. Are there specific risks you’re worried about? What are your priorities in terms of protection?

Once you have a clearer picture, consult with an insurance professional to explore your options. They can provide tailored advice and help you navigate the complexities of policy language and terms. Remember, the goal of insurance—and its riders—is to provide security and peace of mind, so take the time to make informed decisions that align with your life’s journey.

In a world rife with uncertainties, insurance riders offer a personalized touch to your coverage, ensuring you're prepared for life's twists and turns. By understanding their benefits and incorporating them wisely, you can enhance your financial resilience and gain the confidence that comes with knowing you're comprehensively protected.