How to Lower Your Car Insurance Rates

Car insurance is essential, but you don't have to overpay if you shop around for the best rates, consider increasing your deductible, and take advantage of available discounts. Maintaining a clean driving record and a good credit score can also help lower your premiums. Additionally, reviewing your policy for unnecessary coverage can further reduce costs, allowing you to manage your car insurance expenses effectively.

Car insurance is one of those necessary expenses that can feel like a financial thorn in the side. We all need it to hit the road legally and safely, but that doesn't mean we should resign ourselves to sky-high premiums. Whether you're a seasoned driver or a newbie behind the wheel, there's a good chance you're overpaying for car insurance. But don’t worry—there are plenty of ways to trim that bill down to size without sacrificing the coverage you need.

Let's dive into some effective strategies for lowering your car insurance rates. From adjusting your deductible to taking advantage of often-overlooked discounts, these tips can help you manage your car insurance expenses more effectively. Plus, we’ll explore why maintaining a clean driving record and a healthy credit score can make a big difference in how much you pay.

Shop Around for the Best Rates

One of the simplest and most effective ways to lower your car insurance rates is to shop around. Insurers base their rates on a variety of factors, and what one company considers high-risk, another might view as perfectly acceptable. According to a study by NerdWallet, drivers can save an average of $859 per year by comparing quotes from different insurers. It’s like shopping for a new pair of shoes—don’t settle until you find a perfect fit.

When comparing rates, make sure you’re looking at apples-to-apples coverage. Each policy should offer the same level of protection, so you’re comparing the cost of equivalent products. Don’t hesitate to use online comparison tools to streamline the process. They can quickly give you a sense of what’s out there, but remember, sometimes a call to a local agent can uncover discounts not listed online.

Consider Increasing Your Deductible

Your deductible is the amount you pay out of pocket before your insurance kicks in after an accident. Opting for a higher deductible can significantly lower your monthly premium. For instance, raising your deductible from $500 to $1,000 might reduce your premium by 10% to 20%. However, this strategy comes with a caveat: ensure you have enough savings to cover the higher deductible if you need to make a claim.

Think of it as a balancing act. If you’re a safe driver with a cushion of savings, a higher deductible can be a smart move. On the other hand, if you frequently find yourself in fender benders or don’t have much in rainy-day funds, a lower deductible might be worth the slightly higher monthly cost.

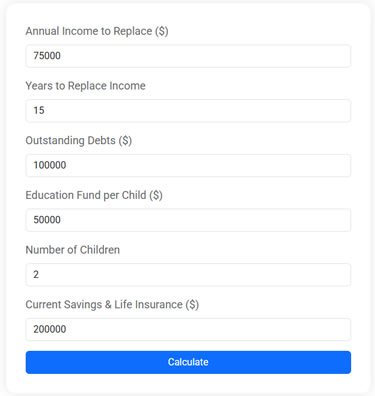

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Take Advantage of Discounts

Insurance companies offer a treasure trove of discounts, but they don’t always advertise them. Bundling your home and auto insurance is one of the most common discounts, potentially saving you up to 25% on both policies. If you don’t own a home, consider bundling your renter's insurance instead.

Good student discounts are another way to save. Many insurers offer lower rates for students who maintain a B average or better. There’s also the low mileage discount for drivers who don’t rack up many miles annually. And let’s not forget about safety features; if your car boasts anti-lock brakes, airbags, or an anti-theft system, you might be eligible for additional savings.

Maintain a Clean Driving Record

Your driving record is one of the most significant factors in determining your car insurance rates. A history free of accidents and traffic violations signals to insurers that you’re a responsible driver, potentially earning you a lower premium. According to the Insurance Information Institute, premiums can increase by 20% to 50% after a single at-fault accident.

If your record isn’t spotless, consider taking a defensive driving course. Many insurers offer discounts for completing these courses, and they can help remove points from your driving record. It's a proactive step that shows you’re serious about becoming a safer driver, which insurers tend to reward.

Review Your Policy for Unnecessary Coverage

It’s easy to set your policy and forget it, but regular reviews can uncover unnecessary coverage that costs you money. For instance, if you drive an older car, you might not need comprehensive or collision coverage. These types of insurance pay out based on the value of your car, so if your vehicle is worth less than the cost of the coverage, it might be time to drop it.

Additionally, check for add-ons you might have agreed to without realizing, like roadside assistance or rental car reimbursement. If you already have AAA or another form of coverage for these services, removing them from your policy could put money back in your pocket.

Keep Your Credit Score in Check

Not everyone realizes that their credit score can have a direct impact on their car insurance rates. Insurers use credit scores as a factor in determining risk; a better score can mean lower premiums. According to a report from Consumer Reports, drivers with poor credit might pay over $500 more annually than those with excellent credit.

Improving your credit score takes time, but it’s worth the effort. Pay your bills on time, reduce your credit card balances, and avoid opening too many new accounts at once. As your credit score rises, contact your insurer to see if you qualify for a lower rate. It’s proof that being financially responsible can pay off in more ways than one.

Explore Pay-Per-Mile Insurance

If you’re someone who doesn’t drive much, pay-per-mile insurance could be a game-changer. This type of coverage charges you based on the actual miles you drive, rather than a flat rate. It’s perfect for those who work from home or primarily use public transportation.

Companies like Metromile specialize in usage-based insurance and often offer competitive rates for low-mileage drivers. Just be sure to read the fine print—some policies come with a daily base rate in addition to the per-mile charge, so you'll want to ensure it’s a good fit for your driving habits.

By taking the time to understand your policy and exploring the various ways to save, you can effectively lower your car insurance rates. Remember, it’s about finding that sweet spot where you’re adequately covered without overpaying. So, next time your renewal notice arrives, don’t just file it away. Take it as an opportunity to reassess and potentially save big.