10 Reasons Why You Need Life Insurance

Life insurance is a vital part of a comprehensive financial plan, offering peace of mind and financial security for your loved ones. It ensures that your family is protected from financial burdens like daily expenses, final costs, and outstanding debts if something happens to you. Additionally, life insurance can aid in estate planning, wealth transfer, and even provide supplemental income through policies with investment components.

Life insurance often finds itself at the bottom of our priority lists, overshadowed by more immediate financial concerns. It's not exactly the most thrilling topic to dive into over coffee, and it's certainly not something any of us wants to think about too often. However, understanding life insurance is crucial for anyone looking to build a solid financial foundation. Think of it as a protective cushion that ensures your loved ones are taken care of when you're no longer there to provide for them. It’s less about contemplating the inevitable and more about planning for peace of mind.

In essence, life insurance is a safeguard, a promise that your family won’t be left in financial turmoil if the unthinkable happens. It’s a way to secure the future for those who depend on you, covering everything from daily expenses to significant financial obligations. Let’s explore ten compelling reasons why life insurance should be a cornerstone of your financial plan.

1. Protect Your Loved Ones

The primary purpose of life insurance is to provide financial security to your dependents. Imagine leaving behind a partner, children, or aging parents who rely on your income. Life insurance steps in to replace lost earnings, ensuring that your family can maintain their current lifestyle. It covers basic needs such as housing, food, healthcare, and education. For example, if you're the primary breadwinner, a life insurance policy can ensure your children can still afford college tuition and your spouse doesn't face immediate financial distress.

2. Cover Final Expenses

Funeral costs can be surprisingly high, often reaching upwards of $10,000 when you factor in services, burial, and other associated fees. These expenses can be a heavy burden for your family during an already difficult time. Life insurance can provide the funds necessary to cover these costs, allowing your loved ones to focus on grieving and healing rather than worrying about money. As financial planner Sarah Thompson notes, "A comprehensive policy can lift the weight of final expenses off your family’s shoulders."

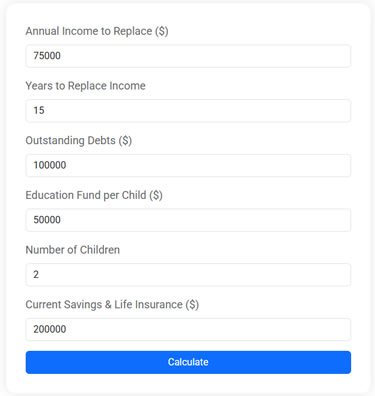

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

3. Pay Off Outstanding Debts

Your debts don't disappear after you pass away. Credit card balances, car loans, and even mortgage obligations can pass on to your estate or become the responsibility of your co-signers. Life insurance can be used to pay off these debts, ensuring they don’t become a financial burden for your family. Consider the story of a family who was able to keep their home after their primary earner passed, solely because a life insurance policy paid off the mortgage. It’s a safety net that prevents financial struggles during an already challenging time.

4. Ensure Business Continuity

If you’re a small business owner, life insurance can play a critical role in ensuring the continuity of your business. In the event of your passing, a policy can provide the funds necessary to keep the business running smoothly, cover operational costs, or buy out your share from business partners. According to a report by the U.S. Small Business Administration, having a life insurance policy linked to a buy-sell agreement can prevent disputes and ensure a smooth transition of ownership, safeguarding the livelihoods of your employees and partners.

5. Facilitate Wealth Transfer

Life insurance can be a powerful tool for estate planning and wealth transfer. It allows you to pass on wealth to your heirs more efficiently, often bypassing the lengthy and costly probate process. This is particularly important if your estate is large enough to incur estate taxes. Life insurance proceeds can be used to pay these taxes, ensuring your heirs receive their full inheritance. As estate planning attorney John Martinez explains, "Life insurance can preserve the value of an estate, ensuring that intended beneficiaries are not left with diminished assets."

6. Build Cash Value

Certain types of life insurance policies, like whole life or universal life, come with an investment component that builds cash value over time. This means a portion of your premium is set aside to grow at a guaranteed rate or based on market performance. This cash value can be borrowed against for emergencies, used to pay premiums, or even withdrawn for retirement income. It’s like having a financial Swiss Army knife that can adapt to your changing needs. Just remember, as with any investment, it’s crucial to understand the terms and potential impacts on your policy.

7. Supplement Retirement Income

Life insurance policies with a cash value component can serve as a supplemental source of retirement income. Once the cash value accumulates, you can tap into it for additional funds during retirement. This can be particularly beneficial if your retirement savings fall short or if unexpected expenses arise. Financial advisor Amy Lee suggests, "A well-structured life insurance policy can provide a financial buffer, giving retirees more flexibility and peace of mind." However, it’s important to manage withdrawals carefully to ensure the policy remains intact.

8. Provide Peace of Mind

Beyond the numbers and logistics, life insurance offers something invaluable: peace of mind. Knowing that your family will be financially secure, no matter what, relieves a significant burden. It allows you to live more fully, knowing you've taken steps to protect your loved ones' future. This peace of mind is often cited as one of the most appreciated benefits of having life insurance, giving individuals the confidence to pursue their goals without the constant worry of the "what ifs."

9. Support Charitable Giving

If philanthropy is close to your heart, life insurance can be used to support your favorite causes. By naming a charity as a beneficiary, you can ensure that your legacy includes contributions to organizations you care about. This can be an effective way to make a more significant impact than you might be able to during your lifetime. As philanthropy expert Linda Carter explains, "Life insurance allows individuals to leave a lasting legacy, supporting the missions that matter most to them."

10. Customize Coverage to Fit Your Needs

One of the great advantages of life insurance is its flexibility. Policies can be tailored to fit your specific needs and circumstances, from term life policies that cover you for a set period to permanent policies that last a lifetime. You can choose the coverage amount, the length of term, and even add riders for additional benefits. This customization ensures that you’re not paying for more than you need and that your policy aligns with your financial goals.

In the grand scheme of financial planning, life insurance might seem like just another box to check off. But in reality, it’s a multifaceted tool that provides protection, security, and opportunity. Whether you're just starting a family, building a business, or planning for retirement, life insurance can be a cornerstone of your financial strategy, offering benefits that extend well beyond the premiums you pay.