The Ultimate Guide to Choosing the Right Insurance Policy

Choosing the right insurance policy involves understanding your specific needs based on life stages and circumstances, comparing policies and providers, and thoroughly reading the fine print to ensure adequate coverage. Consider the balance between cost and coverage to avoid financial strain, and consult professionals if needed for personalized advice. By following these steps, you can make an informed decision that safeguards your financial well-being.

Choosing the right insurance policy can feel a bit like navigating a maze. With so many options, providers, and fine print to sift through, it's easy to feel overwhelmed. But here's the good news: with a bit of guidance, you can transform this potentially daunting task into a manageable and even empowering process. After all, insurance is meant to be a protective shield for life's uncertainties, not a source of confusion. By understanding your specific needs, comparing options, and considering expert advice, you can make informed decisions that safeguard your financial future.

Insurance isn't a one-size-fits-all deal. What works for your neighbor might not be the best choice for you. The secret lies in tailoring your coverage to fit your life circumstances and financial goals. Whether you're just starting out in your career, raising a family, or planning for retirement, each stage of life demands different considerations. So, let's dive into the ultimate guide to choosing the right insurance policy for your unique needs.

Understanding Your Needs: Life Stages and Circumstances

The first step in choosing the right insurance policy is to understand your specific needs. These needs will vary significantly depending on where you are in life. For instance, a young professional just entering the workforce might prioritize health insurance and disability coverage. In contrast, a middle-aged parent may be more focused on life insurance and homeowner’s insurance. As financial advisor Jane Smith explains, "Your insurance should evolve as your life changes. Regularly reassess your coverage to ensure it aligns with your current situation."

Consider a couple in their early thirties with a new home and a baby on the way. They might prioritize a term life insurance policy to provide financial security for their child in case of an unexpected tragedy. Meanwhile, a retiree might look into long-term care insurance to cover potential healthcare costs down the road. By understanding the specific risks and responsibilities you face at each stage, you can better tailor your insurance to meet those needs.

Additionally, consider any unique circumstances that might affect your insurance requirements. Do you have a side business? Are you caring for an elderly parent? These factors can influence the type and amount of coverage you need. Being aware of these nuances will help you make more informed decisions when selecting policies.

Comparing Policies and Providers

Once you have a clear understanding of your needs, the next step is to compare different policies and providers. This may sound tedious, but it's crucial for finding the best coverage at the most affordable price. Start by gathering quotes from multiple insurers. Many companies offer online tools that allow you to compare their policies side by side, which can save you time and effort.

Focus on more than just the premium cost. While it's tempting to go for the cheapest option, remember that the cheapest policy may not provide adequate coverage. Look into the details of what each policy offers. For instance, a health insurance plan with a low premium might come with high deductibles or limited coverage, which could cost you more in the long run. As a rule of thumb, balance cost with coverage to avoid financial strain later.

It's also worth considering the reputation of the insurance provider. According to a report by J.D. Power, customer satisfaction is a key indicator of an insurer's reliability and service quality. Check customer reviews, ratings, and any complaints filed against the company. A provider with a strong track record of customer service is likely to be more responsive and helpful when you need to file a claim.

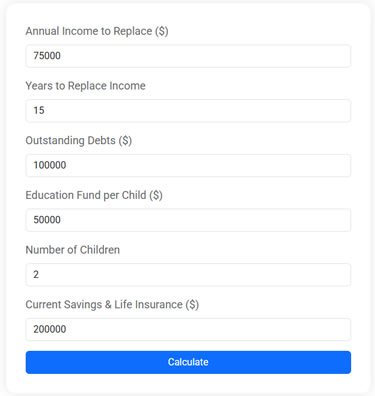

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Reading the Fine Print: Ensuring Adequate Coverage

We've all heard the saying, "The devil is in the details," and this couldn't be truer when it comes to insurance policies. Carefully reading the fine print is essential to ensure that you fully understand the terms, conditions, and exclusions of your policy. This step can prevent unpleasant surprises down the road.

For example, homeowner’s insurance policies often exclude certain natural disasters like floods or earthquakes unless you purchase additional coverage. Imagine the shock of discovering this exclusion only after a significant event occurs. To avoid such scenarios, scrutinize the policy documents and ask questions if anything is unclear. Insurance agents are there to help, so don't hesitate to seek clarification.

Pay particular attention to the exclusions and limitations sections. These outline the circumstances under which the insurer will not pay a claim. Understanding these clauses helps you gauge whether the policy truly meets your needs. If necessary, consider adding riders or endorsements to cover any gaps.

The Cost vs. Coverage Dilemma

Balancing cost with coverage is often one of the trickiest parts of choosing an insurance policy. While you don't want to overspend on unnecessary coverage, skimping on essential protection could leave you vulnerable. The key is to find a policy that offers adequate coverage without breaking the bank.

One strategy is to evaluate your risk tolerance. If you're comfortable shouldering more risk, you might opt for higher deductibles in exchange for lower premiums. This approach can save you money upfront, but ensure you have enough savings to cover the deductible if needed. On the other hand, if you prefer peace of mind, a policy with lower deductibles and more comprehensive coverage might be worth the extra cost.

Another tip is to bundle policies when possible. Many insurers offer discounts for customers who purchase multiple types of coverage from them, such as combining auto and home insurance. These savings can add up over time, making it easier to afford the coverage you need.

Consulting Professionals for Personalized Advice

When in doubt, consulting with a professional can provide valuable insights tailored to your situation. Insurance brokers and financial advisors have the expertise to help you navigate complex choices and find solutions that align with your goals. They can offer personalized advice that takes into account your entire financial picture, not just your insurance needs.

For instance, a financial planner might recommend a life insurance policy as part of a broader estate planning strategy, ensuring your loved ones are financially secure. Or they might advise on disability insurance to protect your income stream if you're unable to work. According to a study by the CFP Board, individuals who work with a financial advisor are more likely to feel confident about their financial decisions, including insurance.

Remember, the aim is to find a trustworthy professional who listens to your concerns and offers objective guidance. Don't be afraid to ask for credentials and check their experience before making a decision. A good advisor will prioritize your interests and help you navigate the complexities of insurance with clarity and confidence.

By following these steps, you can make an informed decision that safeguards your financial well-being. Whether you're just starting out or planning for the future, the right insurance policy can offer peace of mind and protect against life's uncertainties. So take the time to understand your needs, compare options, and seek expert advice when necessary. With a little effort and knowledge, you'll be well-equipped to choose the best insurance for your unique journey.