How to Protect Your Assets with the Right Insurance Coverage

In an unpredictable world, having the right insurance coverage is essential to protect your assets, whether they're personal or business-related. Understanding asset protection involves identifying your risks and choosing appropriate insurance types, such as homeowners, auto, health, and business insurance, tailored to your specific needs. Regularly reviewing and updating your coverage ensures it remains adequate, offering financial security and peace of mind against unforeseen events.

In an unpredictable world, protecting your assets with the right insurance coverage is a cornerstone of financial security. Whether you're safeguarding personal belongings or business investments, insurance acts as a safety net, ensuring you don't bear the brunt of unforeseen events alone. But navigating the landscape of insurance can be a daunting task. What types do you need? How much coverage is enough? Let's break it down, sip by sip, like a conversation over coffee, and explore how insurance can serve as a robust strategy for asset protection.

Insurance is often seen as a financial buffer, a way to transfer risk in exchange for a premium. It's like having an umbrella ready for when the weather turns, and given life's unpredictability, the right coverage can prevent a drizzle from turning into a deluge. From homeowners insurance to health coverage, each type serves its own purpose, protecting different facets of your life and work. Understanding your risks and tailoring your policies to cover them is key to ensuring you're not left vulnerable.

Understanding Your Risks

Before diving into the world of insurance, it's crucial to map out the terrain of your personal and financial risks. Are you a homeowner in a flood-prone area? Do you own a business that relies heavily on machinery or technology? Identifying these vulnerabilities is the first step in determining what types of insurance are necessary. For instance, if you live in an earthquake-prone region, basic homeowners insurance might not suffice—you'll need additional coverage tailored to seismic activity.

Take Jane, for example, who runs a small bakery. Her business thrives on her kitchen equipment. After a freak electrical storm, a power surge damaged her ovens. Fortunately, she had business interruption insurance and equipment breakdown coverage. This foresight allowed her to replace the damaged items without a crippling financial setback. Understanding the specific risks you face enables you to choose coverage that truly protects your assets.

Types of Insurance Coverage

Different types of insurance cater to different needs. Homeowners insurance, for example, protects against damages to your home and belongings from events like fires or theft. It's vital to read the fine print, though, as standard policies often exclude certain disasters like floods or earthquakes, which may require additional riders or separate policies.

Auto insurance is another common necessity. It covers damages from accidents, theft, or vandalism. Liability coverage within auto insurance is particularly crucial, as it protects you from financial responsibility if you're at fault in an accident. Health insurance, on the other hand, guards against the high costs of medical care. It's not just about covering hospital bills, but also ensuring access to routine checkups and preventive care.

For business owners, insurance needs can be more complex. Policies like general liability insurance, professional liability insurance, and workers' compensation are essential. They protect against lawsuits, claims of negligence, and employee injuries, respectively. Each type of coverage serves as a layer of defense, tailored to the unique risks of your industry.

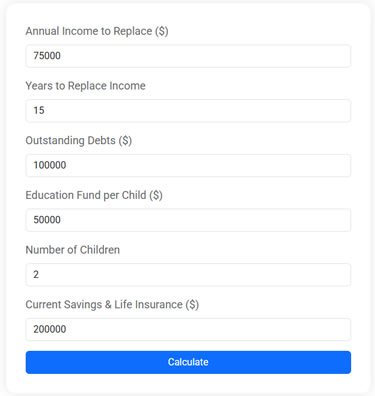

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Tailoring Insurance to Your Needs

Off-the-shelf insurance products might not always fit your specific needs. A tailored approach ensures that your policy limits and deductibles align with your financial situation and risk tolerance. For instance, if you own valuable artwork or jewelry, a standard homeowners policy might not provide adequate coverage for these high-value items. In this case, you'd need to add a personal articles floater, which provides additional coverage.

Consider Joe, who owns a tech startup. His business relies heavily on data. A standard business insurance policy might not cover cyber threats, which are a significant risk to his operations. By adding cyber liability insurance, Joe protects his company from potential data breaches and the associated financial fallout. Tailoring your insurance means scrutinizing your lifestyle and business operations to ensure every potential gap is addressed.

Regularly Reviewing Your Coverage

Insurance needs are not static—they evolve with changes in your life and business. Major life events like marriage, having children, or buying a new home can significantly impact your coverage needs. Similarly, as your business grows or pivots, its insurance requirements may also change. Regular review of your policies ensures that your coverage keeps pace with these changes.

Financial advisor Jane Smith suggests conducting an annual insurance review. This routine check-up helps identify any new risks or assets that need protection. For instance, if you've recently renovated your home, your homeowners insurance should reflect the increased value. Similarly, if you've downsized or sold significant assets, you might be over-insured, paying for coverage you no longer need.

Staying Informed and Proactive

Staying informed about your insurance options and remaining proactive in managing your policies can save you money and stress in the long run. Insurance is not a set-it-and-forget-it endeavor. It requires active engagement and a willingness to reassess your needs regularly. Engaging with a trusted insurance agent or financial advisor can provide valuable insights and help you navigate complex policy details.

As financial consultant Mark Thompson notes, "Insurance is about preparing for the worst while hoping for the best." This mindset encourages proactive planning and ongoing education about the risks you're facing. It's about striking a balance between adequate coverage and affordable premiums, ensuring peace of mind without breaking the bank.

Conclusion: Peace of Mind Through Preparedness

In the end, the right insurance coverage is about more than just protecting your assets—it's about achieving peace of mind. It's knowing that, come what may, you have a plan in place to handle life's curveballs. From personal belongings to business interests, insurance allows you to focus on what truly matters, without the constant worry of financial ruin lurking around the corner.

By understanding your risks, selecting appropriate coverage, tailoring policies to your needs, and regularly reviewing your options, you build a solid foundation for financial security. In doing so, you not only protect your assets but also your future, ensuring that you're prepared for whatever life throws your way.