The Dos and Don'ts of Filing an Insurance Claim

To successfully file an insurance claim, first ensure you have a thorough understanding of your policy, including coverage, exclusions, deductibles, and deadlines, to set realistic expectations. Document the incident meticulously, notify your insurer promptly within the specified timeframe, and avoid admitting fault to protect your claim. Stay proactive by following up regularly, keeping records of communications, and seeking clarification to efficiently navigate the claims process.

Filing an insurance claim can feel like navigating a labyrinth with a blindfold on. You pay your premiums faithfully, hoping you'll never need to use your insurance, but when that fender bender happens or a pipe bursts in your basement, you find yourself needing to make sense of your policy's fine print. To make this process as smooth as possible, it’s crucial to know what steps to take—and which pitfalls to avoid.

Understanding the ins and outs of filing an insurance claim is like having a roadmap in your hand. It doesn’t just save time and stress; it can also make the difference between a denied claim and a successful payout. Whether you're dealing with auto, home, or health insurance, the principles remain largely the same. Here's a detailed guide on the dos and don'ts of filing an insurance claim, packed with practical advice and insights that can make a world of difference.

Do Understand Your Policy

Before you ever need to file a claim, make sure you thoroughly understand your insurance policy. This means knowing what is covered, what isn’t, and the deductible you’ll be responsible for. For instance, if you have a home insurance policy, familiarize yourself with the coverage limits for both dwelling and personal property. Often, people are surprised to learn that some natural disasters, like floods or earthquakes, require separate coverage.

To set realistic expectations, it’s also vital to grasp the exclusions in your policy. Many people assume that all damage is covered, but exclusions can specify otherwise. Taking the time to review your policy with your insurance agent can prevent unpleasant surprises later. As insurance expert John Doe from Insurance Today notes, "A significant part of claim disputes can be avoided if policyholders only knew what their policies actually cover."

Don't Delay in Notifying Your Insurer

Time is of the essence when it comes to filing an insurance claim. Most policies have specific timeframes within which you must notify your insurer about an incident. Delaying this step can jeopardize your claim. For instance, if your car is involved in an accident, report it as soon as possible. This promptness allows the insurance company to investigate the matter while details are still fresh.

Moreover, some policies have clauses that require immediate notification for certain types of claims. Waiting too long can give your insurer a reason to deny your claim based on non-compliance with policy terms. Keep contact information for your insurance company handy, and make the call as soon as you can safely do so.

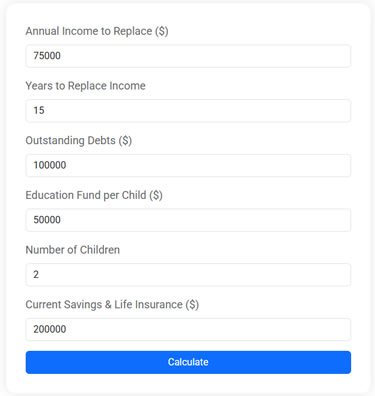

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Do Document Everything Meticulously

Documentation is your best friend when it comes to filing a claim. Take photos or videos of the damage from multiple angles. If you’re filing an auto insurance claim, make sure to capture the accident scene, including any traffic signals or signs that may have been involved. Collect contact information from witnesses and, if applicable, the other party involved.

For home insurance claims, document your belongings by keeping an updated inventory. This can be as simple as a spreadsheet or a dedicated home inventory app. Include receipts, warranties, and appraisals for more valuable items. In the unfortunate event of a loss, this documentation can help substantiate your claim and expedite the process.

Don't Admit Fault

In the aftermath of an accident or incident, you might feel an instinctive urge to apologize or accept blame. Resist this urge. Admitting fault can complicate the claims process and potentially lead to your claim being denied. This doesn’t mean you should be dishonest, but rather that you should allow the insurance adjusters to determine liability.

Even seemingly innocent statements can be misconstrued as admissions of fault. If you’re in an auto accident, stick to the facts when talking to the other driver and the police. Let your insurer handle the liability investigation. As attorney Jane Smith advises, "Your words can carry significant weight. It's best to keep the conversation factual and to involve your insurer at the earliest opportunity."

Do Keep All Communications

Throughout the claims process, keep a record of all communications with your insurer. This includes emails, letters, and notes from phone calls. Document the date and time of each interaction, the representative you spoke with, and the information exchanged.

This meticulous record-keeping can be vital if any disputes arise or if you need to reference past communications. In addition, having a paper trail can help you track the progress of your claim and ensure that it’s moving forward. In the words of insurance adjuster Mike Thompson, "Documenting every step can mean the difference between a smooth claim and a frustrating battle."

Don't Accept the First Settlement Offer

When your insurer presents a settlement offer, your first instinct might be to accept it and move on. However, this initial offer is often negotiable. Insurers, much like any business, aim to minimize costs, and the first offer may not fully cover your losses.

Before accepting any settlement, review the offer carefully and consider whether it adequately covers the damages or losses you’ve incurred. If you believe the offer is insufficient, you have the right to negotiate. Present any additional evidence you’ve gathered to support your case, and don’t hesitate to seek a second opinion if necessary.

Do Stay Proactive

The claims process can sometimes feel like a waiting game. However, staying proactive by regularly following up can prevent unnecessary delays. Check in with your insurer to ensure your claim is progressing and inquire about any additional information they might need from you.

If you're unsure about any part of the process, ask for clarification. Insurance policies can be dense and filled with jargon, so it's perfectly reasonable to seek explanations. This diligence can help you navigate the claims process more efficiently and ensure that you receive the compensation you're entitled to.

Conclusion

Navigating the world of insurance claims doesn’t have to be daunting. By understanding your policy, documenting meticulously, and maintaining proactive communication, you can maximize your chances of a successful claim. Remember, the goal is to work collaboratively with your insurer, armed with knowledge and an organized approach. This way, when life throws you a curveball, you’re prepared to knock it out of the park.