Maximizing Your Insurance Benefits: What You Need to Know

Understanding your insurance policy thoroughly and regularly updating your coverage can lead to significant financial savings and peace of mind. By taking advantage of available discounts, bundling policies, and utilizing preventive services, you can optimize your insurance benefits. Additionally, being strategic about filing claims can help maintain lower premiums and protect your financial interests over time.

Insurance isn’t exactly a thrilling topic for a dinner party, but understanding how to maximize your insurance benefits can lead to significant savings and a lot more peace of mind. If you’ve ever felt overwhelmed by the jargon in your policy documents or confused about how to get the most out of your coverage, you’re not alone. Many of us purchase insurance—whether it’s for our car, home, health, or life—without fully grasping all the details. But by taking a proactive approach to reviewing your policies and leveraging available strategies, you can ensure your insurance works harder for you.

Whether you're a seasoned policyholder or new to the world of insurance, there are a few key strategies that can help you optimize your benefits. From understanding your policy terms and taking advantage of discounts, to bundling policies and knowing when to file a claim, there’s a lot you can do to make sure your insurance dollars are well spent.

Understanding Your Policy

The first step in maximizing your insurance benefits is understanding your policy thoroughly. It might sound obvious, but how many of us have actually read through our entire insurance documents? Your policy outlines not just what is covered but also the limits, exclusions, and your responsibilities as a policyholder.

Take, for instance, the difference between an actual cash value (ACV) policy and a replacement cost policy. An ACV policy will only pay out what your property was worth at the time of the loss, minus depreciation. On the other hand, a replacement cost policy covers the cost of replacing your property without deducting for depreciation. This distinction can make a huge difference in the event of a claim.

Don’t hesitate to reach out to your insurance agent for clarity on any confusing terms or conditions. As insurance expert Laura Adams suggests, "Agents are there to help you understand your coverage. A quick call can save you from costly misunderstandings later."

Regularly Update Your Coverage

Life changes—sometimes faster than we expect. Whether you’ve renovated your home, purchased a new car, or experienced a major life event like getting married or having a child, your insurance needs will change too. Regularly updating your coverage ensures that you are neither underinsured nor overpaying for unnecessary coverage.

For example, if you’ve recently paid off your car loan, you might not need as much collision coverage. Or, if you’ve installed a new home security system, you might qualify for a discount on your homeowner’s insurance. Keep your insurer informed about any significant changes, so they can adjust your coverage accordingly.

Financial advisors often recommend reviewing your policies annually. As personal finance columnist Ron Lieber notes in The New York Times, “An annual check-up on your insurance policies is just as important as a physical check-up for your health.”

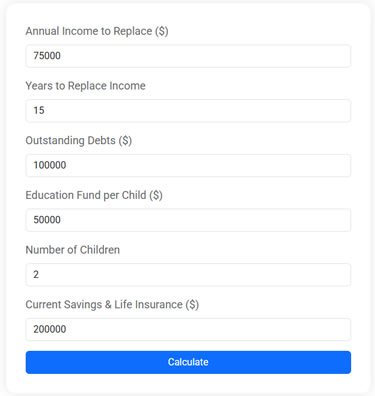

Life Insurance Needs Calculator

Use this free Life Insurance Needs Calculator to estimate how much life insurance you need to protect your family. Plan for income replacement, debt payoff, and education expenses with just a few simple inputs.

Take Advantage of Available Discounts

Insurance companies often offer a variety of discounts that can significantly reduce your premiums. These can include discounts for safe driving, installing safety devices in your home or car, being a long-term customer, or even belonging to certain professional organizations.

For instance, many auto insurers offer discounts if you have a clean driving record or if you complete a defensive driving course. Homeowners might receive a discount for installing smoke detectors or a home alarm system. Even bundling your insurance policies—like combining your home and auto insurance with the same provider—can result in substantial savings.

Don’t be shy about asking your insurer about available discounts. As insurance broker Michael Lewis advises, “The key is to ask the right questions and be proactive. Discounts are often not automatically applied, so it’s up to you to ensure you’re getting the best deal.”

Utilize Preventive Services

Many health insurance policies offer free or low-cost preventive services, such as annual check-ups, vaccinations, and screenings. Taking advantage of these services can not only help you maintain good health but also prevent more costly medical issues down the line.

According to the Centers for Disease Control and Prevention (CDC), routine preventive services can significantly reduce the risk of serious diseases and costly treatments. For example, regular screenings can detect diseases like cancer and diabetes early when they are more treatable and less expensive to manage.

Check your policy to see what preventive services are covered, and make it a priority to use them. As Dr. Samantha Harris, a healthcare consultant, points out, “Preventive care is one of the smartest investments you can make in your health and your wallet.”

Be Strategic About Filing Claims

Filing an insurance claim might seem like the obvious step after experiencing a loss, but it’s important to be strategic about it. Small claims can lead to higher premiums down the road, sometimes making it more cost-effective to cover minor losses out-of-pocket.

For example, if a minor accident results in a $500 repair and your deductible is $400, it might make more sense to pay the extra $100 yourself rather than filing a claim. Frequent claims can flag you as a higher risk to insurers, potentially raising your rates.

Insurance consultant David Thompson suggests, “Before filing a claim, consider the long-term impact on your premiums. Sometimes, keeping a clean claims record can save you more money in the long run.”

In conclusion, maximizing your insurance benefits requires a proactive and informed approach. By understanding your policy, regularly updating your coverage, taking advantage of discounts, utilizing preventive services, and being strategic about filing claims, you can optimize your coverage and ensure it serves your financial interests for the long haul. Remember, insurance is not just about protection; it’s also about smart financial management.