Maximize Your Tax Refund with These Expert Tips

To maximize your tax refund, it's crucial to strategically leverage tax credits and deductions, contribute to retirement accounts, and maintain detailed records throughout the year. Carefully select your filing status and adjust your withholdings to optimize your refund, and consider using tax software or professional assistance to ensure accurate filing and uncover all eligible benefits. By following these expert tips, you can enhance your refund and use it to strengthen your financial future.

Maximizing your tax refund isn't just about luck or timing; it's about strategy, diligence, and understanding the tax code's many nuances. Imagine your tax refund as a puzzle where each piece is a potential savings opportunity, waiting to be unlocked. By leveraging tax credits and deductions, contributing smartly to retirement accounts, and keeping meticulous records, you can potentially transform what many consider a mundane task into a rewarding financial boost. Whether you're a seasoned tax filer or someone new to navigating this annual ritual, these expert tips will help you enhance your refund and set a solid foundation for your financial future.

Understand and Leverage Tax Credits and Deductions

The first step to maximizing your tax refund is to fully understand the tax credits and deductions available to you. Tax credits directly reduce the amount of tax you owe, which can significantly impact your refund. For instance, the Child Tax Credit or the American Opportunity Credit for education can provide substantial savings. Meanwhile, deductions lower your taxable income. Common deductions include those for mortgage interest, state and local taxes, or medical expenses. It's crucial to research and identify which credits and deductions align with your personal situation. According to the IRS, many taxpayers fail to claim all available credits and deductions simply because they're unaware of them.

Contribute to Retirement Accounts

One of the smartest moves you can make before the tax year ends is to contribute to retirement accounts like a 401(k) or an IRA. Not only do these contributions prepare you for the future, but they also offer immediate tax benefits. For example, traditional IRA contributions might be tax-deductible, depending on your income and whether you or your spouse have a retirement plan at work. A CNBC report highlights how increasing your 401(k) contributions not only lowers your taxable income but also builds your nest egg. It's a win-win scenario that benefits both your present and future self.

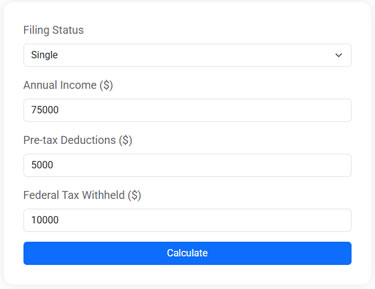

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Maintain Detailed Records Throughout the Year

Keeping accurate and detailed records throughout the year can save you significant time and stress during tax season. Meticulous record-keeping ensures you don't miss out on eligible deductions and credits because you've misplaced a receipt or forgotten an expense. Organize your documents in a way that makes sense for you, whether that's digitally or in a physical filing system. As financial advisor Jane Smith suggests, "Regularly updating your records is like brushing your teeth; it prevents issues from building up." By documenting your expenses, charitable contributions, and any other deductible items as they occur, you'll be in a stronger position to maximize your refund.

Choose the Right Filing Status

Selecting the correct filing status can have a significant impact on your tax refund. Your filing status determines your standard deduction, tax rates, and eligibility for specific credits and deductions. For example, the "head of household" status offers a higher standard deduction and better tax rates than "single" status for those who qualify. To determine the best status for your situation, consider factors like your marital status, dependents, and living arrangements. It's a small decision that can make a big difference in your tax outcome.

Adjust Your Withholdings

Adjusting your withholdings is a proactive approach to ensure you don't overpay or underpay taxes throughout the year. If you consistently receive a large refund, it might mean you're giving the government an interest-free loan with your money. Conversely, owing money could indicate insufficient withholdings. Use the IRS's Tax Withholding Estimator to assess your current situation and make necessary adjustments. By accurately aligning your withholdings with your tax liability, you can manage your cash flow more effectively throughout the year.

Consider Tax Software or Professional Assistance

Navigating the complexities of tax filing can be daunting, especially when new laws or regulations come into play. Tax software offers a user-friendly solution that guides you step-by-step through the filing process, often uncovering credits or deductions you might have missed. Alternatively, hiring a professional can be a wise investment, especially for those with complicated returns or significant changes in income. As tax professional John Doe notes, “An expert can provide insights and strategies that software alone might miss, ensuring you get the maximum refund possible.”

Use Your Refund to Strengthen Your Financial Future

Once you've maximized your tax refund, the next step is to use it wisely. Rather than splurging on short-term luxuries, consider allocating your refund toward long-term goals. This could mean paying down high-interest debt, bolstering your emergency fund, or investing in a retirement account. According to a survey by Bankrate, nearly 30% of Americans plan to use their tax refund to pay off debt, highlighting the importance of using this financial boost to improve overall financial health. By thoughtfully applying your refund, you can enhance your financial stability and work towards a more secure future.

Maximizing your tax refund is about more than just understanding the tax code; it's about implementing a comprehensive strategy that aligns with your financial goals. By leveraging available credits and deductions, maintaining accurate records, and making informed decisions about your filing status and withholdings, you can optimize your tax outcome. Whether navigating the process alone or with professional help, these expert tips are designed to empower you to take control and make the most of your tax refund.