Tax Tips for Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals enjoy the freedom of being their own bosses but must manage the complexities of taxes, including income and self-employment taxes. To navigate this, it's essential to understand tax obligations, maintain detailed financial records, maximize available deductions, make quarterly estimated tax payments, and consider consulting a tax professional. These strategies can simplify tax management, reduce liabilities, and enhance financial health.

Freelancers and self-employed individuals often cherish the freedom of being their own bosses, setting their schedules, and pursuing projects they're passionate about. However, with that freedom comes the responsibility of managing their own taxes—a task that can feel daunting, especially when you're juggling multiple clients or projects. Unlike traditional employees, freelancers and self-employed folks don't have the luxury of having taxes automatically withheld from their paychecks. This means they need to be proactive in understanding and fulfilling their tax obligations.

Navigating the complexities of taxes can seem overwhelming, but with the right strategies in place, it can become a manageable part of your business routine. From maintaining meticulous financial records to maximizing deductions and making quarterly estimated tax payments, there are several ways to simplify tax management and enhance your financial health. Here's a comprehensive guide to help you tackle your taxes with confidence and ease.

Understanding Your Tax Obligations

First things first, it's crucial to understand the types of taxes you're responsible for as a freelancer or self-employed individual. The primary taxes you'll deal with are income tax and self-employment tax. The latter includes both Social Security and Medicare taxes, which are typically split between an employer and employee. However, as your own boss, you’re responsible for the full amount, which is currently 15.3% of your net earnings.

Income tax rates vary depending on your total income and filing status. It's important to note that you must report all your earnings, even those from side gigs or part-time work. An oversight here could lead to penalties. According to the IRS, if you earn $400 or more in a year from self-employment, you're required to file a tax return. Understanding these basics can help you plan and avoid surprises come tax season.

Maintaining Detailed Financial Records

Keeping detailed financial records is not just good practice; it's a necessity. Accurate and organized records make it easier to track your income and expenses, prepare your tax return, and substantiate your deductions in the event of an audit. Consider using accounting software like QuickBooks or FreshBooks, which can automate many aspects of your bookkeeping. These tools can track invoices, monitor payments, and even categorize expenses for you.

In addition to software, maintaining a separate bank account for your business can help keep your personal and business finances distinct. This separation streamlines record-keeping and makes it easier to identify deductible expenses. As financial advisor Jane Smith explains, "Having a dedicated business account not only simplifies your bookkeeping but also provides a clear financial picture of your business." Remember to save receipts and document all transactions—every little bit helps when calculating your deductions.

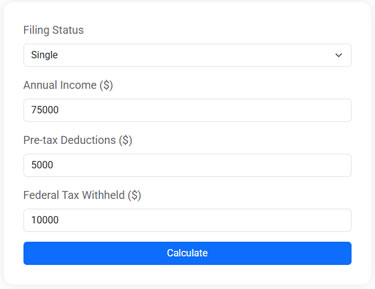

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Maximizing Available Deductions

One of the perks of being self-employed is the ability to deduct business-related expenses from your taxable income, thereby reducing your tax liability. Common deductions include home office expenses, travel, equipment, and even a portion of your phone and internet bills. However, it’s crucial that these expenses are ordinary and necessary for your business.

Take the home office deduction, for example. To qualify, the space must be used exclusively and regularly for your business. If you meet the criteria, you can deduct expenses related to the portion of your home used for business, such as rent, utilities, and insurance. Don't overlook the mileage deduction if you use your car for business purposes—keeping a detailed log can really pay off. As CNBC notes, "Every business mile driven could mean more money in your pocket at tax time."

Making Quarterly Estimated Tax Payments

Since taxes aren't withheld from your paychecks, you're responsible for making estimated tax payments throughout the year. The IRS requires these payments if you expect to owe $1,000 or more in taxes when you file your return. These payments cover income tax as well as self-employment tax.

To avoid penalties, it's essential to calculate and pay these taxes quarterly. The IRS provides Form 1040-ES, which includes a worksheet to help you estimate your tax liability. It's a good idea to set aside a percentage of each payment you receive to cover these taxes—many freelancers use a 25-30% rule of thumb to ensure they have enough to cover their estimated payments. Missing these payments can lead to underpayment penalties, so staying on top of them is crucial.

Consulting a Tax Professional

While some freelancers prefer the DIY approach to taxes, others find peace of mind in consulting a tax professional. An accountant or tax advisor can offer personalized advice, help you understand complex tax laws, and ensure you're taking full advantage of available deductions. They can also assist with strategic planning to minimize your tax burden.

For instance, a tax professional might recommend setting up a retirement account such as a SEP-IRA or a Solo 401(k), which not only helps you save for the future but also provides immediate tax benefits. According to personal finance expert Susan Lyons, "Working with a tax professional can turn a potentially stressful situation into a strategic opportunity to enhance your financial health."

Embracing Tax Season as a Freelancer

Ultimately, managing taxes as a freelancer or self-employed individual doesn't have to be a source of dread. By understanding your obligations, keeping detailed records, maximizing deductions, making timely estimated payments, and seeking professional advice when needed, you can simplify the process and focus more on what you love—your work.

Embrace tax season as an opportunity to review your business's financial health and make informed decisions that support your long-term success. With preparation and the right strategies, you can turn tax time from a stress-inducing task into a manageable part of your freelance journey.