The Best Ways to Organize Your Tax Documents for Filing

As tax season approaches, organizing your tax documents in advance can significantly ease the filing process and reduce stress. Key strategies include understanding necessary documents, creating a dedicated filing system (both physical and digital), regularly updating records, and leveraging tax software tools. For complex situations, consulting with a tax professional can help ensure your documents are well-organized and your tax benefits maximized.

Tax season is like a yearly marathon that even the most prepared among us approach with a mix of dread and anticipation. Whether you're waiting on a hefty refund or just trying to avoid penalties, one thing is for sure: organizing your tax documents ahead of time can transform this annual chore into a manageable task. By setting up a solid system now, you can save yourself a world of stress and confusion come filing time.

Think of your tax documents as puzzle pieces. Each one is a critical part of the whole picture that tells your financial story for the year. Without a clear grasp on what you need and where to find it, you'll be left scrambling. So, grab a cup of coffee, and let's dive into the best ways to organize your tax documents for filing.

Understanding Necessary Documents

Before you can start organizing, it's essential to know what documents you'll need. The usual suspects include W-2s if you're an employee, 1099s for any freelance work, and 1098s for mortgage interest if you're a homeowner. Don't forget about your bank statements and any receipts for deductible expenses. According to the IRS, keeping track of these documents is crucial for verifying your income, expenses, and any tax credits you might claim.

Remember to also gather documentation for any significant life changes over the past year, like a marriage, divorce, or the birth of a child. Each of these can impact your filing status and potentially your refund. For example, if you've had a baby, you might qualify for the Child Tax Credit, so having your child's Social Security number handy is vital.

If you’re unsure about what applies to you, check out resources like the IRS website, which offers a comprehensive checklist. This can help ensure you’re not missing anything critical. Alternatively, you can consult a tax professional to walk you through what documents are applicable to your specific situation.

Creating a Dedicated Filing System

Once you've gathered your documents, it's time to set up a filing system. This can be physical, digital, or a combination of both. A physical filing system might involve labeled folders for different categories like income, deductions, and investments. Keep these in a safe, easily accessible place. As CNBC suggests, using color-coded folders can add an extra layer of organization, making it easy to spot what you need at a glance.

For those who prefer going digital, consider scanning physical documents and saving them on your computer. Set up a dedicated folder on your desktop or in the cloud, with subfolders for each category. Make sure to back up these files to avoid losing them due to a technical glitch. Tools like Google Drive or Dropbox can provide secure storage solutions.

If you're tech-savvy, there are also specialized apps designed to help you manage your tax documents efficiently. Apps like Evernote or Expensify allow you to snap photos of receipts and categorize them instantly. These digital solutions not only save space but also make it easy to access your documents from anywhere, which is especially handy if you're working with a tax preparer remotely.

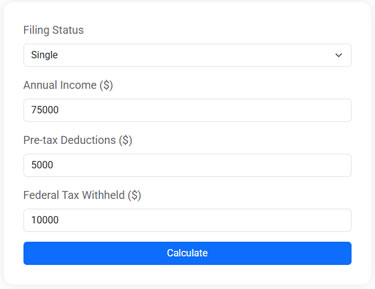

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Regularly Updating Records

Organizing your tax documents isn't a one-time task; it's something that requires regular maintenance. Make it a habit to update your records monthly. This way, when tax season rolls around, everything is up-to-date, and you’re not starting from scratch. For example, each time you receive a pay stub or a transaction receipt for business expenses, file it immediately in the appropriate folder.

Keeping your records current is especially crucial if you have complex finances. If you own rental properties, keep track of all expenses and income related to them. The same goes for investments; update your records with any dividends or capital gains throughout the year.

Regular updates also help you catch any errors early. Imagine discovering a mistake on your W-2 a week before the tax deadline—that’s a headache no one wants. By regularly checking your documents, you can address discrepancies promptly and avoid last-minute panic.

Leveraging Tax Software Tools

Incorporating tax software into your organizational strategy can be a game-changer. Platforms like TurboTax or H&R Block offer more than just filing services; they help you organize your documents throughout the year. These tools can import your W-2 forms directly from your employer and track any changes in tax laws that might affect your filing.

Many programs also offer a deduction finder feature, which scans your documents to ensure you’re claiming all possible deductions. This is particularly useful for freelancers and small business owners, who often overlook deductions they’re eligible for. As tax expert Jane Smith points out, "The right software can do the heavy lifting, allowing you to focus on running your business instead of crunching numbers."

Don't forget about the wealth of educational resources these platforms provide. From video tutorials to live support from tax professionals, these tools can transform a daunting task into an achievable one.

Consulting with a Tax Professional

While many people can handle their taxes independently, complex financial situations might necessitate professional help. If you're dealing with a major life event, multiple income streams, or international income, consider consulting a tax professional. They can offer personalized advice and ensure your documents are in order.

A tax advisor can also help you strategize for the future, potentially saving you money down the line. As tax regulations change, having a professional guide can be invaluable. According to a study by the National Society of Accountants, individuals who use tax professionals often see a higher refund than those who file themselves.

When selecting a tax professional, do your homework. Look for certified public accountants (CPAs) or enrolled agents (EAs) who have a good track record and positive reviews. The right professional can make the tax process smoother and more efficient, freeing you up to focus on what you do best.

Organizing your tax documents doesn’t have to be a dreaded task. By understanding what you need, setting up a reliable system, and using the right tools, you can make the process practically painless. With a little preparation and the right strategy, tax season can become just another item on your to-do list, rather than a source of stress. So, start organizing today and make your future self grateful.