How to Avoid Common Tax Mistakes and Save Money

Filing taxes can be intimidating, but avoiding common mistakes can help you keep more of your money. Key strategies include maintaining accurate records, understanding available deductions and credits, and timing your filing correctly. Additionally, double-checking personal information and considering professional help for complex situations can ensure a smoother tax filing process and potentially save you money.

Filing taxes might not be anyone's idea of a good time, but it's a crucial aspect of financial health. The process can feel like trying to solve a complex puzzle without all the pieces, and one wrong move can cost you. However, with a bit of know-how and some strategic planning, you can navigate the tax season smoothly, avoid common pitfalls, and potentially save yourself a nice chunk of change. This journey doesn't have to be a solo expedition; think of it as a guided tour through the maze of tax forms and regulations.

Let's dig into some practical strategies to help you avoid common tax mistakes and keep more of your hard-earned money in your pocket. Whether you're a seasoned filer or a first-timer, these tips are designed to clarify and simplify the process, making tax time less stressful and more fruitful.

Maintain Accurate and Organized Records

One of the simplest yet most effective ways to avoid tax filing mistakes is to keep meticulous records. This means more than just tossing receipts into a shoebox. Consider creating a digital or physical filing system where you can organize documents by category—such as income, expenses, and charitable donations. Not only does this make life easier when it's time to file, but it also provides a clear picture of your financial situation throughout the year.

Keeping track of these documents is crucial, especially if you're self-employed or have multiple income streams. According to the IRS, poor record-keeping is a frequent issue that can lead to errors and missed deductions. For instance, if you claim a home office deduction, you'll need to substantiate it with records showing your work-related use of the space. A well-organized system helps ensure that you're ready for any IRS inquiries and that you maximize your deductions without the headache of last-minute scrambling.

Understand Available Deductions and Credits

The tax code is packed with deductions and credits that can significantly reduce your tax bill, but they're easy to overlook if you don't know where to look. Deductions reduce your taxable income, while credits reduce your tax bill dollar-for-dollar. Understanding the difference between the two can help you strategize your filing.

Education-related expenses, for instance, can qualify for credits like the American Opportunity Credit or the Lifetime Learning Credit. If you've recently taken courses to enhance your skills or have student loans, these credits can provide substantial savings. As financial expert Suze Orman often emphasizes, “Education is the key to a better future,” and the tax system recognizes that through incentives.

Moreover, don't forget about deductions for retirement contributions, medical expenses, or home mortgage interest. By familiarizing yourself with these and other tax breaks, you can make informed decisions about your finances throughout the year, rather than scrambling to find savings when tax season hits.

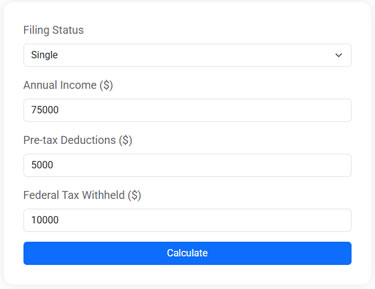

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Timing is Everything

When it comes to taxes, timing can be a decisive factor in how much you save or owe. Filing your taxes as early as possible is usually beneficial. Early filers not only get their refunds sooner but are also at a reduced risk of identity theft, since fraudsters won't have the opportunity to file in your name if you've already submitted your return.

Additionally, consider the timing of your income and expenses. For example, if you can defer income to the next tax year or accelerate deductions into the current year, you might lower your taxable income and reduce your tax liability. This strategy can be particularly useful for individuals who expect to be in a lower tax bracket in the following year. However, it's important to do this carefully and consult with a tax professional if you're unsure, as these decisions can have long-term implications.

Double-Check Personal Information

It might seem trivial, but the accuracy of your personal information is foundational to a smooth tax filing process. Small errors, like a misspelled name or incorrect Social Security number, can lead to unnecessary delays and complications. In fact, the IRS reports that simple mistakes are among the most common reasons for processing delays.

Ensure that all personal information, including your address, marital status, and bank details, is current and accurate. If you’ve had a significant life change—such as marriage, divorce, or the birth of a child—make sure these are reflected in your tax return. A quick review of these details before submitting your taxes can save you from headaches down the line and ensure your refund isn't held up due to preventable errors.

Consider Professional Help for Complex Situations

While DIY tax software has made it easier than ever to file taxes, there are times when enlisting professional help is the wiser choice. If you have a complex financial situation—such as owning multiple properties, running a business, or having international income—professional guidance can be invaluable. A tax professional can provide insights and strategies that software alone might not offer, potentially saving you more in the long run.

According to a study by the National Society of Accountants, taxpayers who used professional preparers reported higher satisfaction with their tax outcomes compared to those who filed on their own. Furthermore, professionals can help you stay abreast of changing tax laws and how they might impact your situation. If you're feeling overwhelmed, reaching out for professional assistance might be the best move for your financial health.

By taking these steps, you can make the tax filing process less daunting and more rewarding. The key is to stay informed, organized, and proactive, so you can avoid common pitfalls and keep more of your money where it belongs—in your wallet. Remember, taxes are a part of life, but with the right approach, they don't have to be a source of stress. So, grab a cup of coffee, take a deep breath, and tackle tax season with confidence.