Tax Planning Strategies for a Stress-Free Filing Season

Tax season doesn't have to be stressful if you implement a few strategic moves, like understanding your tax bracket, maximizing retirement contributions, and keeping track of deductions and credits to minimize your tax liability. Strategies such as tax-loss harvesting and planning for estimated taxes are also crucial, especially if you're self-employed or have significant non-salary income. By organizing and planning ahead, you can navigate the filing season smoothly and enhance your overall financial health.

Tax season often feels like a looming deadline that many of us would rather avoid. It conjures up images of piles of paperwork, dizzying numbers, and the ever-present fear of making mistakes. However, with the right tax planning strategies, this annual task doesn't need to be a source of stress. Instead, it can be an opportunity to improve your financial health and potentially save money. In this article, we’ll explore several practical strategies to make the tax filing season a breeze and help you keep more of your hard-earned money.

Understanding your tax situation is the first step towards a stress-free filing season. Knowing your tax bracket, for instance, is crucial as it impacts how much tax you owe and can inform your decisions on income and deductions. But that's just the beginning. By strategically planning your tax approach throughout the year rather than scrambling at the last minute, you can ensure a smoother filing process and potentially minimize your tax liability.

Know Your Tax Bracket

Understanding your tax bracket is like having a map of your financial landscape. It tells you how much of your income will be taxed at various rates and can guide your financial decisions throughout the year. For example, if you're on the cusp of moving into a higher tax bracket, you might strategize to defer some income or accelerate deductions to stay in a lower bracket.

The IRS updates tax brackets annually, so it's wise to stay informed of any changes. For instance, if you're single and your taxable income is $90,000, you’ll fall into the 24% tax bracket in 2023. Knowing this helps you forecast your tax liability and plan accordingly. As financial planner Jane Smith notes, "Understanding your tax bracket can help you make informed decisions about your financial activities, such as timing your income and deductions."

Maximize Retirement Contributions

One of the most effective ways to reduce your taxable income is by maximizing contributions to your retirement accounts. Contributions to traditional IRAs and 401(k) plans are made with pre-tax dollars, which means they can lower your taxable income for the year. For 2023, the contribution limit for a 401(k) is $22,500, with an additional catch-up contribution of $7,500 if you're over 50.

Investing in your retirement not only helps you save on taxes today but also secures your financial future. By contributing the maximum amount, you’re effectively "paying yourself first" while reducing your current tax bill. As Forbes highlights, "Contributing to your retirement accounts is a win-win strategy: you save for the future and cut your present tax burden."

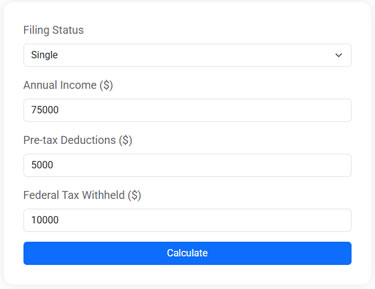

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Track Deductions and Credits

Keeping meticulous records of your deductions and credits can significantly impact your tax outcome. While deductions reduce your taxable income, credits directly reduce the amount of tax you owe. Common deductions include mortgage interest, student loan interest, and medical expenses, while credits might include the Child Tax Credit or the Earned Income Tax Credit.

To make tracking easier, consider using a dedicated app or software that categorizes your spending throughout the year. This proactive approach can save you the headache of scrambling for receipts come tax time. As the IRS emphasizes, "Organized record-keeping is key to a smooth tax filing experience."

Consider Tax-Loss Harvesting

If you have investments, tax-loss harvesting can be a smart strategy to offset gains and reduce your tax bill. This involves selling securities at a loss to offset a capital gains tax liability. For instance, if you made a $10,000 profit on one stock but lost $3,000 on another, you could sell the losing stock to offset some of your gains.

While this strategy can be beneficial, it requires careful planning to ensure that it aligns with your overall investment strategy. Some experts, like those at Investopedia, suggest reviewing your portfolio at least once a year to identify potential opportunities for tax-loss harvesting.

Plan for Estimated Taxes

For those who are self-employed or have substantial non-salary income, planning for estimated taxes is crucial. Unlike traditional employees, you're responsible for calculating and paying your taxes on a quarterly basis. Failure to do so can result in penalties, adding unnecessary stress to your tax season.

To avoid surprises, estimate your annual income and divide it into four equal payments due in April, June, September, and January. As self-employed entrepreneur Mark Johnson suggests, "Setting aside a portion of your income each month for estimated taxes can prevent a cash flow crunch when payments are due."

Organize Financial Documents Early

One of the simplest yet most effective ways to ensure a stress-free tax filing season is to organize your financial documents well in advance. Create a filing system for all your income statements, receipts, and tax forms. This will help you avoid the last-minute scramble and make the process of filing much more efficient.

Consider using digital tools to store and organize your documents. Applications like Evernote or Google Drive can help you maintain a digital archive that's easy to access and update throughout the year. "Being organized not only saves time but also reduces stress," says financial advisor Sarah Liu.

Consult a Tax Professional

While these strategies can help you manage your tax situation, consulting a tax professional can provide additional peace of mind. A seasoned CPA or tax advisor can offer personalized advice tailored to your unique financial situation and help you identify deductions or credits you might have overlooked.

Tax professionals can also assist with more complex issues, such as navigating the tax implications of a major life event like a marriage, divorce, or the purchase of a new home. As the saying goes, "You don't know what you don't know," and a professional's expertise can be invaluable.

Incorporating these strategic moves into your financial routine can transform the tax season from a dreaded task into a manageable, even beneficial, part of your year. By understanding your tax bracket, maximizing retirement contributions, keeping track of deductions and credits, and planning for estimated taxes, you'll not only ease the burden of filing but also enhance your overall financial health. Remember, the key to a stress-free tax season is planning and organization. With a little foresight and effort, you can navigate your taxes with confidence and ease.