The Latest Tax Changes and How They Impact Your Bottom Line

Recent tax changes, including widened income tax brackets and increased standard deductions, can lead to modest savings by reducing taxable income and providing relief from inflationary pressures. Adjustments to retirement account contribution limits and revisions in tax credits offer opportunities to optimize retirement savings and leverage tax benefits, while changes in capital gains and dividends taxation may influence investment strategies. Staying informed and consulting with a tax professional can help you navigate these changes effectively, potentially saving money and enhancing your financial planning.

In the ever-evolving landscape of personal finance, staying abreast of tax changes can feel a bit like trying to catch the wind. Yet, understanding these changes is crucial, as they can significantly impact your financial health. Recent updates in tax legislation promise both challenges and opportunities, offering avenues for savings and strategic planning. From widened income tax brackets to enhanced retirement savings options, these adjustments are designed to provide some relief from inflationary pressures and optimize financial strategies. Let's dive into the details of these changes and see how they might affect your bottom line.

Whether you're a seasoned investor or just starting out on your financial journey, knowing how to adapt to tax changes can be a game-changer. Imagine sitting down with your favorite cup of coffee, calculator in hand, and realizing that with a few tweaks, you could save hundreds, if not thousands, on your tax bill. It's not just about saving money; it's about making your money work smarter for you. So, let's explore what these new tax provisions mean for you and how you can leverage them to enhance your financial well-being.

Widened Income Tax Brackets and Increased Standard Deductions

One of the headline changes in recent tax legislation is the widening of income tax brackets. This adjustment essentially means that more of your income may now be taxed at a lower rate, potentially reducing your overall tax liability. For instance, if you were teetering on the edge of a higher tax bracket last year, you might find yourself comfortably within a lower bracket this year, thanks to these shifts. As a result, you could see extra dollars staying in your pocket, which is always a welcome change.

In tandem with widened tax brackets, the standard deduction has also received a boost. This increase is particularly beneficial for taxpayers who do not itemize deductions, as it allows them to reduce their taxable income more substantially. For many, this adjustment can mean significant savings, effectively shielding more of your income from taxation. It's as if the tax system has thrown you a small but meaningful financial lifeline, helping to buffer the effects of inflation on your purchasing power.

These changes are not just about numbers on a paper; they reflect a broader understanding of the economic pressures many face today. According to a report by the IRS, these adjustments aim to keep up with inflation and provide taxpayers with more breathing room. It’s a strategic move that can make a noticeable difference when balancing your household budget.

Enhancements to Retirement Account Contribution Limits

Retirement savings have always been a cornerstone of financial planning, and the recent increase in contribution limits to retirement accounts like 401(k)s and IRAs is a boon for those looking to secure their future. By allowing you to stash away more money, these enhanced limits not only offer the potential for greater retirement savings but also immediate tax benefits, as contributions to these accounts are typically tax-deductible.

Consider this: if you’re able to max out your 401(k) or IRA contributions, you could significantly reduce your taxable income, lowering your tax bill in the process. It's like getting a two-for-one deal—your future self benefits from a larger nest egg, while your present self enjoys a reduced tax burden. This dual advantage is a compelling reason to reassess your current savings strategy and consider increasing your contributions if possible.

Financial advisor Jane Smith notes that these changes are particularly timely, as they come at a moment when many are concerned about the adequacy of their retirement savings. She advises clients to take full advantage of these new limits, emphasizing that even modest increases in contributions can lead to substantial growth over time thanks to the power of compound interest.

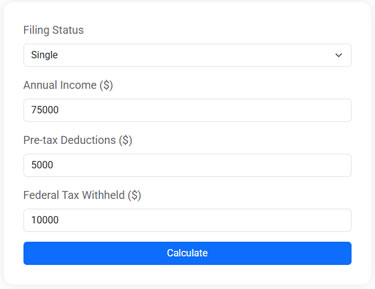

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Revisions in Tax Credits

Tax credits often fly under the radar, yet they hold the potential to dramatically decrease your tax liability. Recent revisions to several key tax credits are worth noting, as they can enhance your ability to save money. For example, the child tax credit and earned income tax credit have undergone changes that could mean more money back in your pocket when tax season rolls around.

These credits are designed to support individuals and families, making it easier to manage the costs associated with raising children or earning a lower income. By increasing the amount of these credits, the government aims to provide crucial financial support to those who need it most. It's a reminder that tax policy isn't just about numbers—it's about providing real-world relief to everyday people.

According to CNBC, these revisions are part of a broader effort to make the tax system more equitable and responsive to the needs of taxpayers. By staying informed about these changes, you can ensure that you're not leaving money on the table when filing your taxes. As always, consulting with a tax professional can provide personalized insights tailored to your unique financial situation.

Changes in Capital Gains and Dividends Taxation

For investors, understanding the nuances of capital gains and dividends taxation is crucial. Recent changes in this area may influence how you approach your investment strategy. While the base rates for capital gains and dividends taxation remain largely unchanged, there are adjustments in the income thresholds that determine which rate applies to you.

For instance, if you're an investor nearing the threshold between the 15% and 20% long-term capital gains tax rates, these adjustments could impact your tax planning. It might be worth revisiting your investment portfolio and considering the timing of any asset sales. Strategically planning when to realize gains can help manage your tax burden effectively.

As financial journalist Kyle Thompson points out, these changes underscore the importance of tax-efficient investing. By aligning your investment decisions with the latest tax provisions, you can optimize your returns and minimize your liabilities. It's a delicate dance, but one that can pay off handsomely with the right moves.

The Importance of Staying Informed and Seeking Professional Advice

With so many changes swirling around, it’s easy to feel overwhelmed. However, staying informed is your best defense against unnecessary tax expenses. Taking the time to understand the latest tax updates can empower you to make smarter financial decisions, potentially saving you money and enhancing your financial security.

It’s also wise to recognize the value of professional advice. A seasoned tax professional can offer insights that go beyond the surface, providing tailored strategies that align with your personal financial goals. Whether it’s optimizing your deductions, maximizing credits, or planning for retirement, a tax advisor can be an invaluable ally in navigating these complex waters.

Ultimately, while tax changes can seem daunting, they also present opportunities. By approaching them with a proactive mindset, you can take control of your financial future. After all, the goal is not just to save money, but to use those savings to build a more secure, prosperous life. So, grab that cup of coffee, dig into the details, and consider how these tax updates can work to your advantage.