Tips for Maximizing Your Tax Refund and Minimizing Liabilities

As tax season approaches, it's crucial to maximize your refund and minimize liabilities by leveraging tax deductions and credits, contributing to retirement accounts, and selecting the right filing status. Keeping detailed records and receipts is essential for claiming all eligible deductions, and seeking professional advice can help navigate complex tax laws. By following these strategies, you can enhance your financial security while optimizing your tax return.

As tax season looms on the horizon, the prospect of sorting through financial paperwork can feel daunting. But here's the silver lining: with some strategic planning, you can maximize your tax refund and minimize your liabilities. Whether you're a seasoned taxpayer or a newbie navigating this annual ritual, understanding the nuances of the tax system can lead to significant savings. Think of it as an opportunity to enhance your financial health, rather than merely a bureaucratic chore.

Taxes aren't just about handing over a chunk of your hard-earned money to the government. They're also about leveraging the tools available to ensure you're not overpaying. This involves a mix of art and science—art in the way you organize and present your financial life, and science in understanding the tax code's intricacies. So, let’s dive into some practical tips that could have you looking forward to filing, rather than dreading it.

Understand and Leverage Tax Deductions and Credits

Tax deductions and credits are your best friends when it comes to maximizing your refund. Deductions reduce your taxable income, while credits reduce the tax you owe. For instance, if you qualify for the Earned Income Tax Credit (EITC), you could see a substantial decrease in your tax bill. According to the IRS, as of 2023, the EITC can be worth up to $6,935 for a family with three or more children.

Don’t overlook deductions for things like student loan interest, which can deduct up to $2,500 from your taxable income, or educator expenses, allowing teachers to deduct up to $300. These can seem small in isolation, but they add up. It's worth the effort to sift through your finances and identify every possible deduction and credit.

Consider the Child Tax Credit, which was expanded in recent years. In 2023, it offers up to $2,000 per qualifying child, with up to $1,500 of that being refundable. Refundable credits mean you can get money back even if you owe no tax, a key distinction that can significantly impact your refund.

Contribute to Retirement Accounts

Contributing to retirement accounts not only secures your future but also provides immediate tax benefits. Traditional IRAs and 401(k)s allow you to make contributions that reduce your taxable income. For 2023, you can contribute up to $6,500 to an IRA or $22,500 to a 401(k) if you're under 50. Those over 50 can make additional catch-up contributions.

Imagine this: by contributing the maximum $6,500 to an IRA, you could potentially lower your taxable income by that amount, thus reducing your overall tax liability. This is a savvy move for those in higher tax brackets, where every dollar deferred can make a significant difference.

Additionally, if your employer offers a match on your 401(k) contributions, it's like free money. Not taking advantage of it is akin to leaving cash on the table. As financial advisor Jane Smith notes, "Maximizing your retirement contributions isn't just about future security; it's a powerful tool for reducing today's tax burden."

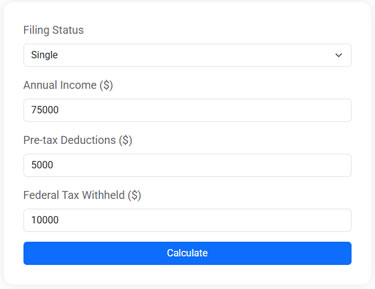

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Select the Right Filing Status

Choosing the correct filing status is crucial, yet many taxpayers overlook its impact. Your filing status determines your standard deduction, tax brackets, and eligibility for certain credits. The options generally include single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

For instance, if you're single but supporting a dependent, you might qualify for head of household status, which offers a higher standard deduction and more favorable tax brackets than filing as single. This could result in significant tax savings, so it’s worth exploring if you fit the criteria.

Married couples often debate between filing jointly or separately. While filing jointly typically offers more benefits, there are scenarios where filing separately may be advantageous, such as when one spouse has significant medical expenses. It’s a balancing act, and sometimes consulting with a tax professional can help clarify the best choice for your circumstances.

Keep Detailed Records and Receipts

Good record-keeping is the backbone of effective tax filing. Maintaining detailed records and receipts is essential for claiming all eligible deductions. This means keeping track of everything from charitable donations to medical expenses and business-related costs.

Consider using a digital tool or app to organize your documents. These tools can help you track expenses throughout the year, so you’re not scrambling come tax time. In fact, IRS audits are less daunting when you have well-organized documentation to back up your claims.

Take the example of John, a freelance graphic designer. By meticulously tracking his business expenses, including software subscriptions and office supplies, he was able to claim all applicable deductions. This attention to detail saved him several thousand dollars in taxes, money he was able to reinvest into his growing business.

Seek Professional Advice

Navigating the tax code can be complex, and sometimes it pays to seek professional advice. A tax professional can provide insights that might not be immediately obvious, especially if you have a unique financial situation. They can help you uncover deductions and credits you might have missed, ensure compliance, and even represent you if the IRS comes calling.

According to CNBC, many people find that the cost of hiring a tax professional is offset by the additional savings and peace of mind it provides. It’s like having a financial safety net, ensuring you’re not leaving money on the table or making costly errors.

Remember, tax professionals are up-to-date on the latest tax laws and can provide personalized advice tailored to your situation. This can be particularly beneficial if you have significant life changes during the year, such as marriage, a new child, or a change in employment.

By following these strategies, you can not only enhance your financial security but also make tax season a little less stressful. The key is to approach your taxes proactively and thoughtfully, treating them as an opportunity to better understand and improve your financial well-being. And who knows, with a little planning, you might even find yourself looking forward to next year's tax season.