The Ultimate Tax Filing Checklist for a Stress-Free Season

Tax season doesn't have to be stressful if you're well-prepared. By organizing your personal information, income documents, deductions, and investment accounts, you can simplify the process and maximize your return. Whether you file your taxes yourself or hire a professional, understanding your financial situation and using a comprehensive checklist can help you approach tax season with confidence and clarity.

Tax season often conjures up images of towering paperwork, cryptic forms, and the ticking clock of the looming deadline. But what if this annual rite of passage didn’t have to be synonymous with stress? With a bit of preparation and the right approach, filing your taxes can be a straightforward, if not downright enlightening, experience. Whether you're a DIY tax filer or prefer to hand over your financials to a pro, having a comprehensive checklist can transform tax season from a dreaded task into a manageable part of your financial routine.

Before you dive into the checklist, it’s essential to take a moment to understand your financial picture. Knowing what documents you need, the deductions available to you, and any changes in tax law can help you file accurately and efficiently. Plus, it ensures you’re maximizing your potential return. So, grab a cup of coffee, settle in, and let’s tackle tax season together.

Gather Your Personal Information

The first step in preparing for tax season is to round up all relevant personal information. This might seem like a no-brainer, but ensuring you have the correct details can save you from headaches down the line. Start with the basics: your Social Security number, and if applicable, your spouse’s and dependents’ Social Security numbers as well. It’s also wise to have last year’s tax return handy, as it can serve as a helpful reference point.

Don’t forget about any changes that may have occurred over the past year. For instance, if you moved, got married, or had a child, you'll need to update your personal information accordingly. According to the IRS, these life changes can significantly impact your filing status and the credits or deductions you may qualify for. Ensuring your personal details are current is a simple but vital step in streamlining the tax filing process.

Organize Your Income Documents

Next up, it’s time to gather all documents related to your income. This includes W-2 forms from your employer, 1099 forms for any freelance or contract work, as well as documentation for any unemployment benefits, rental income, or dividends and interest earned from investments. Each form provides crucial information regarding the income you received over the tax year and ensures you accurately report your earnings.

If you’re self-employed, this step becomes even more critical. Keeping detailed records of all invoices, receipts, and bank statements can help avoid discrepancies. As financial advisor Jane Smith emphasizes, "Maintaining organized records not only reduces stress during tax season but also protects you in the event of an audit." A shoebox full of crumpled receipts might have worked in the past, but going digital with apps like QuickBooks or Expensify can make tracking income and expenses much more manageable.

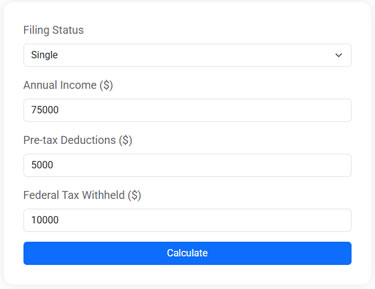

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Identify Potential Deductions and Credits

Deductions and credits can significantly reduce your tax liability, so they deserve special attention. Common deductions include mortgage interest, student loan interest, and medical expenses. If you’re a homeowner, make sure to gather all relevant mortgage documents, while students or parents of students should look for forms related to tuition and education expenses.

Credits, like the Earned Income Tax Credit or the Child Tax Credit, can directly reduce the amount of tax you owe, sometimes even resulting in a refund. As noted by Kiplinger, keeping an eye out for lesser-known credits can sometimes yield unexpected savings. For instance, if you’ve made energy-efficient improvements to your home, you might be eligible for a tax credit that could help offset the costs.

Review Your Investment Accounts

Investment accounts require careful attention during tax season. Whether you have stocks, bonds, mutual funds, or retirement accounts, each can impact your tax return. You’ll need 1099 forms detailing dividends, interest, and capital gains or losses. If you sold any investments, you’ll also need the purchase and sale price to determine your capital gains or losses.

Don’t overlook retirement contributions. Contributions to traditional IRAs, for example, may be deductible, which can lower your taxable income. But remember, not all retirement contributions are created equal. Roth IRA contributions, for instance, are made with after-tax dollars and hence don’t offer a deduction. According to CNBC, understanding the nuances of your investment accounts can prevent costly mistakes and ensure you’re taking full advantage of tax benefits.

Decide Between Standard and Itemized Deductions

Choosing between taking the standard deduction or itemizing your deductions is a decision that can significantly affect your tax outcome. The standard deduction is a fixed dollar amount that reduces your taxable income, while itemizing allows you to deduct specific expenses, such as medical bills, state and local taxes, and charitable donations.

The choice hinges on which option yields a greater deduction. For many taxpayers, the standard deduction is the easier and more beneficial route, especially since the Tax Cuts and Jobs Act of 2017 nearly doubled the standard deduction. However, if your itemized deductions exceed the standard deduction, taking the time to itemize could be worth it. According to H&R Block, running the numbers both ways is a prudent strategy to ensure you’re not leaving money on the table.

Consider Professional Help If Needed

Even with a detailed checklist, tax filing can become complex, particularly if you have a complicated financial situation. In such cases, enlisting the help of a tax professional can be a wise investment. A certified public accountant (CPA) or an enrolled agent can provide personalized advice, ensure compliance with the latest tax laws, and potentially save you money by identifying deductions and credits you might have missed.

For those who prefer to do it themselves but still want some guidance, tax software like TurboTax or H&R Block’s online offerings can be invaluable. These programs guide you through the filing process with a series of questions, ensuring you don’t overlook any critical details. As the saying goes, sometimes the best way to save money is to spend a little upfront for expertise.

Double-Check Before Filing

Before hitting submit, it’s crucial to double-check all your information. Ensure that Social Security numbers, addresses, and bank account numbers are correct to avoid delays or issues with the IRS. Review your entries for typos or transposed numbers, as these small errors can lead to big headaches.

Make sure you’ve included all necessary forms and documentation, and if you’re e-filing, don’t forget to print or save a copy of your return for your records. According to the IRS, keeping a copy of your tax return for at least three years is recommended, as it can be useful for future filings or if any discrepancies arise.

By approaching tax season with a calm, organized mindset and a thorough checklist in hand, you can take control of the process and make the most of your financial situation. With the right preparation, tax filing can be a time to reflect on your financial goals and planning for the future, rather than just a chore to check off your to-do list. So, take a deep breath, start early, and remember, you’ve got this.