Navigating Tax Season as a First-Time Homebuyer

Buying your first home brings exciting opportunities for tax savings, such as the mortgage interest and property tax deductions, which can significantly reduce your tax burden if you itemize deductions. Additionally, while federal first-time homebuyer credits are no longer available, exploring state or local programs for potential tax relief or credits is beneficial. Staying organized with documentation and consulting tax professionals can help you optimize these benefits and confidently manage your tax responsibilities as a new homeowner.

Buying your first home is a thrilling milestone—one that signifies both a new chapter in your life and a series of new financial responsibilities. As you settle into your new abode, it's also important to navigate the complexities of tax season, which can feel as daunting as moving all your furniture in one day. However, being a first-time homebuyer comes with several tax-saving opportunities that can ease your financial burden. While these opportunities can significantly reduce what you owe Uncle Sam, they require a bit of know-how and organization. Fear not; this guide will walk you through the essentials, from understanding key deductions to exploring potential credits.

Understanding Mortgage Interest and Property Tax Deductions

One of the biggest perks of homeownership is the ability to deduct mortgage interest and property taxes from your taxable income. These deductions can make a noticeable difference in your tax bill, but they require you to itemize deductions on your tax return. For many first-time homeowners, this is the first time itemizing becomes more beneficial than taking the standard deduction.

The mortgage interest deduction allows you to deduct interest paid on up to $750,000 of mortgage debt. This is particularly advantageous in the early years of your mortgage when the bulk of your payments go toward interest rather than principal. As financial advisor Jane Smith explains, "Leveraging mortgage interest deductions can significantly lower your taxable income, potentially saving you hundreds, if not thousands, in taxes each year."

Property tax deductions, meanwhile, let you deduct the state and local property taxes you've paid, up to a combined limit of $10,000. It's worth noting that this limit includes other state and local taxes, such as sales and income taxes. Keeping organized records of your payments is crucial to ensure you're claiming the full deduction you're entitled to.

Exploring State and Local Tax Credits

While the federal first-time homebuyer tax credit that many remember from the late 2000s is no longer available, don't despair. Several states and local governments offer their own versions of tax credits or relief programs aimed at first-time homebuyers. These programs can provide substantial financial benefits, especially in areas with high property taxes or housing costs.

For example, some states offer mortgage credit certificates (MCCs), which allow first-time homebuyers to claim a tax credit for a portion of the mortgage interest paid. This credit directly reduces your tax liability dollar-for-dollar, unlike deductions, which reduce your taxable income. According to a report by the National Council of State Housing Agencies, MCCs can save homeowners an average of $2,000 annually.

It's essential to research what’s available in your area, as these programs can vary widely. Local housing agencies or a knowledgeable real estate agent can often provide guidance tailored to your situation. Just be sure to check any income or purchase price restrictions that may apply.

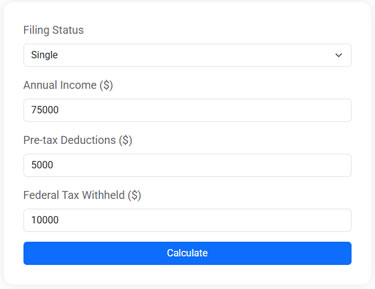

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Staying Organized with Documentation

Good record-keeping is the backbone of claiming deductions and credits. As a homeowner, you'll receive a Form 1098 from your mortgage lender, detailing the mortgage interest paid over the year. This form is crucial for claiming your mortgage interest deduction. Similarly, keep records of your property tax payments, which may come in handy not just for tax deductions but also when budgeting for future expenses.

Consider using digital tools to track and store your tax-related documents. Apps and cloud storage services can help you maintain easy access to your financial records, making tax time less of a scramble. As tax preparer Lisa Johnson notes, "Being organized can prevent headaches when filing and ensure you don’t miss out on any deductions or credits."

Additionally, maintaining records of any home improvements can be beneficial. While these aren't immediately deductible, they can impact your tax situation when you eventually sell your home. Improvements that increase your home's value can adjust your cost basis, potentially reducing capital gains taxes down the line.

Consulting with Tax Professionals

Given the intricacies of tax law and the unique circumstances of each taxpayer, consulting with a tax professional can be invaluable. These experts can provide personalized advice tailored to your financial situation and help you navigate the nuances of tax deductions and credits. They can also assist in determining whether itemizing deductions is truly beneficial for you, given the recent changes to the standard deduction amounts.

While it might seem like an added expense, the insight provided by a tax advisor can lead to significant savings and peace of mind. According to a survey by the National Association of Tax Professionals, clients who work with tax professionals often find deductions and credits they wouldn’t have otherwise considered.

Moreover, a tax professional can help you plan for the long term, advising on retirement contributions or other strategies that can optimize your tax situation year after year.

Navigating Changes in Tax Law

Tax laws are constantly evolving, and staying informed about changes is crucial for maximizing your benefits as a homeowner. For instance, recent tax reforms have altered the landscape of deductions and credits, impacting decisions about whether to itemize or take the standard deduction.

Keeping an eye on legislative changes can help you adapt your strategy and take advantage of new opportunities that arise. Subscribing to reputable financial newsletters or consulting with your tax advisor regularly can keep you informed about any new developments.

In conclusion, while tax season may seem daunting for first-time homebuyers, understanding the available deductions and credits can turn it into an opportunity for substantial savings. By staying organized, leveraging state and local programs, and seeking professional guidance, you can confidently navigate your tax responsibilities and enjoy the financial benefits of homeownership. Remember, the more you know, the more you save—not just in dollars, but in peace of mind.