The Ultimate Guide to Tax Deductions You Didn’t Know About

Tax season offers opportunities to reduce your liability through lesser-known deductions beyond the standard ones. You can potentially save money by deducting overlooked expenses like medical costs exceeding 7.5% of your adjusted gross income, education-related expenses such as the Lifetime Learning Credit, and job search expenses, if applicable. Additionally, charitable contributions, home office, and business expenses offer more avenues for deductions, making it worthwhile to consult a tax professional for personalized advice and compliance.

As the tax season rolls around, many of us dutifully shuffle through our financial documents, hoping to uncover any deductions that might ease our tax burden. While most people are familiar with standard deductions, there's a treasure trove of lesser-known deductions that can significantly reduce your taxable income. These hidden gems can make a substantial difference, yet they often fly under the radar. So, grab a cup of coffee, and let’s dive into some of the tax deductions you might not know about but could be saving you money.

Navigating the world of taxes can feel like wandering through a maze, but with a little guidance, you can find your way to savings. It's important to note that while this guide offers insights into potential deductions, consulting with a tax professional is always a smart move. They can provide personalized advice and ensure compliance with the latest tax laws. Now, let's explore these opportunities.

Medical Expenses That Exceed 7.5% of Your Adjusted Gross Income

Medical expenses can be a significant financial burden, especially when they start piling up. If your medical and dental expenses exceed 7.5% of your adjusted gross income (AGI), you might qualify for a tax deduction. This includes not only the big expenses like surgeries or hospital stays but also out-of-pocket costs for things like prescription medications, insurance premiums, and even travel expenses related to medical care.

To illustrate, imagine you've had a particularly challenging year health-wise, and your annual AGI is $50,000. If your medical expenses total $5,000, you can deduct the amount that exceeds $3,750 (which is 7.5% of your AGI), thereby reducing your taxable income. It’s a deduction that’s often overlooked because it requires itemizing rather than taking the standard deduction, but it can be worth the effort if your medical expenses are significant.

According to the IRS, eligible expenses can also include payments for preventive care, surgeries, treatments, dental and vision care, and mental health services. So, keep those receipts handy and track your expenses meticulously throughout the year.

Education-Related Expenses: The Lifetime Learning Credit

Continuing education can be both a personal and professional boon, but it often comes with a hefty price tag. Thankfully, the Lifetime Learning Credit (LLC) can help mitigate these costs. This credit allows you to claim 20% of the first $10,000 you spend on qualified education expenses, up to a maximum credit of $2,000 per tax return.

This credit isn't just for traditional college students; it’s available to anyone pursuing post-secondary education or job skills courses. For example, if you're taking a coding bootcamp or professional development course to boost your career, the costs might qualify for the LLC. One catch, though: this credit is phased out at higher income levels, so it’s important to check the current IRS income thresholds.

Financial advisor Jane Smith notes, "Many people think education credits are just for full-time students, but the Lifetime Learning Credit can be a great resource for anyone looking to expand their skills, as long as they meet the income criteria."

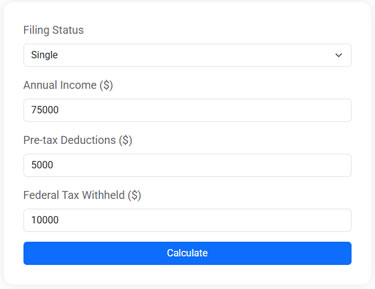

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Job Search Expenses

If you’re on the hunt for a new job, you might be able to deduct certain job search expenses. This deduction is available even if you don't land the job, as long as you're searching within your current occupation. Eligible expenses might include travel to interviews, resume preparation, and employment agency fees.

For instance, if you’re a marketing professional seeking a new position in the same field, the cost of hiring a professional resume writer or traveling for an interview could be deductible. However, it’s worth noting that this deduction has seen some changes due to recent tax law reforms, so it’s essential to verify current eligibility.

The key is to keep detailed records of your job search expenses and consult with a tax professional to understand how these can be applied to your specific situation.

Charitable Contributions

Giving back to the community not only feels good but can also provide you with tax benefits. The IRS allows you to deduct charitable contributions made to qualified organizations. This includes not just cash donations, but also the fair market value of donated goods, such as clothing or household items.

Consider the case of donating gently used items to a local thrift store. As long as the organization is recognized by the IRS as tax-exempt, you can deduct the value of the items. Remember to get a receipt and keep a detailed list of what you’ve donated.

Moreover, as Kiplinger points out, if you volunteer, you can deduct certain out-of-pocket expenses incurred while volunteering, such as mileage driven for charity work. However, your time or the value of your service itself isn’t deductible.

Home Office Deduction

With the rise of remote work, the home office deduction has become increasingly relevant. If you use part of your home exclusively and regularly for business purposes, you might qualify for this deduction. This could include a portion of your rent or mortgage, utilities, and other home-related expenses.

For example, if you’re a freelance graphic designer using a dedicated room in your house solely for your business, you could deduct a percentage of your household expenses proportional to the size of your office space. The IRS offers two methods for this deduction: the simplified option, which is calculated at $5 per square foot up to 300 square feet, and the regular method, which involves more detailed calculations of actual expenses.

Tax expert David Green advises, "The key to the home office deduction is ensuring that the space is used exclusively for business. Mixing personal and business use can complicate things. Keep clear boundaries and records."

Business Expenses

For small business owners and self-employed individuals, business expenses can be a goldmine of deductions. These can range from office supplies and business travel to software subscriptions and marketing costs. The goal is to deduct expenses that are ordinary and necessary for running your business.

Take, for example, a freelance writer who subscribes to industry publications and attends writing conferences. Both the subscription and conference-related expenses could be deductible, provided they are directly related to the business.

It’s important to keep meticulous records and receipts for all business-related expenses. As the IRS frequently updates guidelines, staying informed and consulting with a tax advisor can help ensure you’re claiming all eligible deductions and staying compliant.

In the end, while taxes may never be fun, they don't have to be painful either. By exploring these lesser-known deductions, you could potentially lower your tax bill and keep more money in your pocket. Remember, the tax code is complex, and what works for one person might not work for another. Always consider seeking personalized advice to optimize your tax situation. Happy filing!