Tax Planning for Families: How to Optimize Your Savings

Effective tax planning is crucial for families aiming to optimize savings and minimize tax liabilities by strategically leveraging tax credits, deductions, and retirement contributions. By understanding the benefits of tools like Health Savings Accounts (HSAs) and 529 College Savings Plans, families can effectively manage healthcare and education costs while enjoying tax advantages. Year-end strategies, such as income-shifting and tax-loss harvesting, further ensure families can maximize savings and enhance their financial security.

When it comes to family finances, tax planning might not top the list of dinner table conversations, but it really should be a priority. Think of it as the unsung hero of financial planning—often overlooked, yet crucial for optimizing your savings and minimizing tax liabilities. With a bit of strategic foresight, families can leverage tax credits, deductions, and retirement contributions to keep more money in their pockets. Plus, there are smart ways to manage healthcare and education costs with tools like Health Savings Accounts (HSAs) and 529 College Savings Plans, all while reaping tax benefits.

Many families are surprised at how much they can save by making a few informed tweaks to their tax strategy. Whether you’re a new parent grappling with childcare expenses or a seasoned pro planning for college tuition, there’s something here for everyone. So, grab a cup of coffee and settle in as we explore the ins and outs of tax planning for families.

Leverage Tax Credits and Deductions

Tax credits and deductions are the bread and butter of family tax planning. They reduce the amount of tax you owe, sometimes significantly. The Child Tax Credit, for instance, offers up to $2,000 per qualifying child under the age of 17, as of 2023. This credit is partially refundable, which means it can increase your tax refund beyond what you’ve paid in. Another example is the Earned Income Tax Credit (EITC), designed to benefit low to moderate-income working families. It can offer a substantial boost, especially for families with three or more children.

Deductions, on the other hand, lower your taxable income. Consider the state and local tax (SALT) deduction or the mortgage interest deduction if you own a home. These can shave thousands off your taxable income. As financial journalist Robert Powell points out, "Maximizing deductions can be like finding extra income."

Keeping track of these credits and deductions can be daunting, but tax software and a good CPA can make the process manageable. It’s worth noting, though, that not all credits and deductions will apply to every family. A personalized approach is key, and this is where professional advice can be invaluable.

Maximize Retirement Contributions

Retirement savings accounts, such as 401(k)s and IRAs, offer significant tax advantages. Contributing to these accounts not only secures your future but also reduces your taxable income in the present. For example, contributions to a traditional 401(k) are made with pre-tax dollars, lowering your income for the year. As a result, you could pay less in taxes while bolstering your retirement savings.

Moreover, some employers offer matching contributions to 401(k)s, which is essentially free money. As financial advisor Jane Smith explains, "Not taking full advantage of employer matching is like leaving money on the table." And don’t overlook the benefits of a Roth IRA, which allows for tax-free withdrawals in retirement. This is particularly advantageous for families who anticipate being in a higher tax bracket in the future.

By setting up automatic contributions, families can ensure they’re consistently saving, which compounds over time. The earlier you start, the more you benefit from compound interest, setting your family up for a more secure financial future.

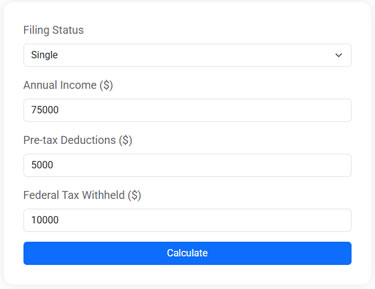

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Take Advantage of Health Savings Accounts (HSAs)

Health Savings Accounts are a triple tax-advantaged way to save for medical expenses. Contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses aren’t taxed either. According to CNBC, HSAs can be a powerful tool for families with high-deductible health plans, allowing them to save on healthcare costs while enjoying significant tax benefits.

Consider the case of a family with a $5,000 deductible health plan. By contributing to an HSA, they can not only cover out-of-pocket healthcare expenses but also reduce their taxable income by the amount contributed. Over time, unused HSA funds can be invested, growing tax-free and serving as a de facto retirement account for medical expenses.

Remember, though, that not all medical expenses qualify for HSA withdrawals, so familiarize yourself with eligible expenses to avoid unexpected taxes or penalties.

Utilize 529 College Savings Plans

529 plans are a fantastic way to save for your children’s education while enjoying tax advantages. Contributions grow tax-free, and withdrawals for qualified education expenses aren’t taxed. This can cover a wide range of educational costs, from tuition and fees to room and board.

Many states also offer tax deductions or credits for 529 contributions, which can further enhance savings. As Sally Herigstad, a CPA and personal finance author, notes, "The more you can save in a tax-advantaged way, the less you’ll worry about future college costs."

It’s important to start early with 529 contributions because even small, regular contributions can grow significantly over time. And if your child chooses not to attend college, the funds can be transferred to another family member, ensuring that the money remains a family asset.

Implement Year-End Strategies

As the year winds down, a few strategic moves can make a big difference in your tax bill. One effective strategy is income-shifting, which involves moving income from a high-income family member to one in a lower tax bracket. This can be particularly beneficial for families with teenagers or young adults who can earn income at a lower rate.

Tax-loss harvesting is another savvy move. This strategy involves selling investments at a loss to offset gains in other areas, thereby reducing taxable income. As investment advisor Tim Maurer puts it, "Tax-loss harvesting is like a silver lining in a down market."

Finally, consider making charitable contributions before year-end. Not only do they benefit a cause you care about, but they also offer potential tax deductions. Just be sure to keep thorough records of your donations, as the IRS may require documentation.

Optimizing your family’s tax strategy isn’t just about saving money today. It’s about building a foundation for future financial security. With thoughtful planning and strategic action, you can navigate the complexities of the tax code and come out ahead. So, whether you’re aiming to fund college, retire comfortably, or simply keep more of your hard-earned money, effective tax planning can help you achieve your goals.