Expert Advice on Maximizing Your Tax Savings This Year

Maximizing tax savings involves contributing to retirement accounts, itemizing deductions, taking advantage of tax credits, and strategically managing capital gains and losses. Staying informed about changing tax laws and seeking professional advice can help you navigate these strategies effectively, ultimately optimizing your tax situation and keeping more money in your pocket.

Maximizing your tax savings each year can feel like navigating a maze, but with a few well-placed strategies, you can uncover some serious savings. The trick isn't just about sifting through endless forms or memorizing tax codes, but about understanding and implementing smart financial moves that align with your overall money goals. Whether you’re a seasoned taxpayer or just starting to tackle your financial future, the right approach can make a significant difference in your take-home pay. So, let's dive into some expert-backed strategies that can help you keep more of your hard-earned money.

Tax laws can be complex and ever-changing, which makes it crucial to stay informed. The landscape can often seem daunting, but by breaking down the various components—like retirement accounts, deductions, credits, and investment strategies—you can demystify the process and potentially save a substantial amount. Plus, knowing when to seek professional advice can further enhance your tax-saving journey.

Contribute to Retirement Accounts

One of the most straightforward strategies to maximize tax savings is by contributing to retirement accounts. Not only does this help secure your future, but it also offers immediate tax benefits. For instance, contributions to traditional IRAs or 401(k) plans are often tax-deductible, reducing your taxable income for the year. As noted by the IRS, the annual contribution limit for a 401(k) is $22,500 for 2023, with an additional catch-up contribution of $7,500 if you’re 50 or older.

Consider this: if you're in the 24% tax bracket and manage to contribute the maximum amount to your 401(k), you could potentially save over $5,000 in taxes. Additionally, Roth IRAs, while not offering upfront tax deductions, allow for tax-free withdrawals in retirement, making them an attractive option for many.

Moreover, if your employer offers a matching contribution, you’re effectively getting free money added to your retirement savings. Financial planner John Davis advises, "Always contribute at least enough to get the full employer match. It's one of the few instances in life where you truly get something for nothing."

Itemize Your Deductions

While the standard deduction is a convenient option, itemizing your deductions can lead to greater tax savings if your eligible expenses exceed this amount. This approach involves listing out specific expenses, such as mortgage interest, medical expenses, and charitable donations. For many, especially homeowners, itemizing can be the better choice.

For example, if you have significant medical expenses—those exceeding 7.5% of your adjusted gross income (AGI)—you can deduct these costs. Similarly, charitable contributions can be deducted, providing an additional incentive to support your favorite causes. As financial expert Suze Orman suggests, it’s worth keeping meticulous records of these expenses throughout the year to streamline the process come tax season.

Understanding the thresholds and limits for each deduction category is crucial. For instance, the Tax Cuts and Jobs Act has capped the deduction for state and local taxes at $10,000, which can significantly affect taxpayers in high-tax states. Always consult the latest IRS guidelines or a tax professional to determine if itemizing is the right move for you.

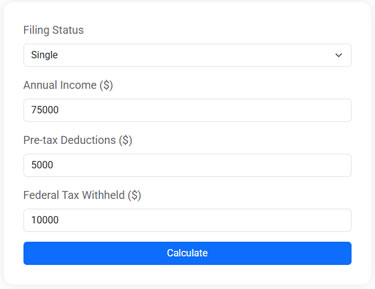

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Take Advantage of Tax Credits

Tax credits are a powerful tool in reducing your tax liability because they directly decrease the amount of tax you owe, dollar for dollar. For instance, the Child Tax Credit offers significant savings for parents, providing up to $2,000 per qualifying child under age 17. Unlike deductions, which reduce taxable income, credits reduce the tax itself, making them particularly valuable.

Educational expenses can also provide tax credit opportunities. The American Opportunity Tax Credit, for instance, offers up to $2,500 annually for qualified education expenses. This credit is partially refundable, meaning if it reduces your tax bill to zero, you can get up to $1,000 back as a refund.

It's important to understand the eligibility criteria for each credit, as they often have income limits or other requirements. For example, the Earned Income Tax Credit (EITC) is designed to benefit low to moderate-income working individuals and families. Always check the IRS website or consult with a tax advisor to ensure you're maximizing these opportunities.

Strategically Manage Capital Gains and Losses

Investment income can be a double-edged sword when it comes to taxes. However, by strategically managing your capital gains and losses, you can minimize the tax impact. For starters, holding investments for more than a year qualifies them for long-term capital gains rates, which are generally lower than ordinary income tax rates.

Moreover, if you have investments that have lost value, consider selling them to offset gains from other investments. This practice, known as tax-loss harvesting, can reduce your taxable income. As investment advisor Michael Chen explains, "It's about balancing your portfolio. Selling at a loss isn't inherently bad if it helps reduce your overall tax bill."

Remember, you can deduct up to $3,000 of capital losses against ordinary income each year, with any excess losses carried forward to future years. This strategy requires careful planning and timing, so it may be beneficial to work with a financial advisor to optimize your approach.

Stay Informed and Seek Professional Advice

The tax landscape is constantly evolving with new laws and regulations. Staying informed about these changes is critical to maximizing your tax savings. For instance, recent updates in tax law may affect deductions, credits, and income thresholds, altering what you can claim.

Furthermore, a tax professional can offer personalized advice tailored to your unique financial situation. They can help you navigate complex tax issues, file accurately, and uncover additional saving opportunities you might overlook. As CPA Laura Mitchell puts it, "Investing in professional advice can pay dividends in the form of tax savings and peace of mind."

While it's entirely possible to manage your taxes on your own, the complexity of the tax code often warrants the expertise of a professional, especially if you have substantial assets or complex financial circumstances. Consider this an investment in your financial future, one that could potentially save you more than it costs.

By incorporating these strategies into your tax planning, you can effectively reduce your tax liability and keep more money where it belongs—in your pocket. Remember, the key is to stay informed, be proactive, and don't hesitate to seek help when needed. With the right approach, tax season can become a time of opportunity instead of stress.