How to Leverage Tax Credits to Lower Your Tax Burden

As tax season approaches, understanding and leveraging tax credits can significantly reduce your tax bill since they directly lower your tax liability, unlike deductions, which only reduce taxable income. Key personal credits include the Earned Income Tax Credit, Child Tax Credit, and education-related credits, while businesses can benefit from the Research and Development Tax Credit, Work Opportunity Tax Credit, and others. To maximize savings, stay informed about changes in tax credits, maintain organized documentation, and consider consulting a tax professional or using tax software for guidance.

Tax season is a time of year that seems to sneak up on us, despite its predictable annual recurrence. For many, it’s a period filled with stress and confusion, particularly when it comes to understanding how to best manage one’s tax burden. Fortunately, there's a bright spot in the tax code that can offer significant savings: tax credits. Unlike deductions, which merely reduce your taxable income, tax credits offer a dollar-for-dollar reduction of your tax liability. That means more money stays in your pocket. Whether you're filing as an individual or representing a business, knowing how to leverage tax credits can be a game-changer.

But how can you effectively tap into these savings? It starts with understanding the various types of credits available and applying them to your situation. From personal credits that benefit families and individuals to specialized credits designed to foster business innovation and employment, there’s a lot to explore. Let’s dive into the world of tax credits and see how they can work for you.

Understanding Personal Tax Credits

Personal tax credits are designed to ease the financial burden on households, particularly those with moderate to low incomes. One of the most well-known is the Earned Income Tax Credit (EITC), which benefits working individuals and families with low to moderate income. The EITC not only boosts take-home pay but can also lead to a hefty refund if the credit amount exceeds your tax liability. According to the IRS, in 2022, over 25 million taxpayers received more than $60 billion in EITC funds, with an average credit of about $2,411.

Another valuable credit for families is the Child Tax Credit (CTC). This credit provides financial support for parents raising children under 17. The American Rescue Plan temporarily expanded the CTC in 2021, increasing the maximum credit amount and allowing it to be fully refundable. While the expansion has since rolled back, it's crucial to stay informed about any legislative changes that could affect your eligibility or the credit amount.

Education-related credits, such as the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC), are designed to lessen the financial burden of higher education. The AOTC offers a credit of up to $2,500 per eligible student for tuition, fees, and course materials, while the LLC provides a credit of up to $2,000 per return for qualified education expenses. To maximize these credits, ensure you keep detailed records of all education expenses.

Maximizing Business Tax Credits

Businesses have their own set of tax credits that can significantly reduce operating costs and encourage growth. The Research and Development Tax Credit, for example, is designed to reward companies investing in innovation and technological advancements. This credit can apply to a wide range of industries, from software development to manufacturing, as long as the activities meet certain criteria established by the IRS.

The Work Opportunity Tax Credit (WOTC) is another valuable incentive for businesses. It encourages employers to hire individuals from specific target groups, such as veterans, ex-felons, and long-term unemployed persons. By doing so, businesses not only gain access to a diverse workforce but also receive a credit that can be worth up to $9,600 per eligible employee hired.

Another noteworthy credit is the Small Business Health Care Tax Credit, which assists small businesses in providing health insurance to their employees. To qualify, businesses must have fewer than 25 full-time equivalent employees with average wages below a certain threshold. This credit can cover up to 50% of premiums paid for employee health insurance, significantly reducing overall costs.

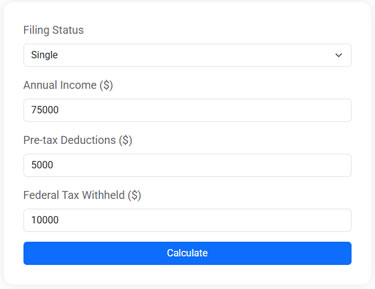

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

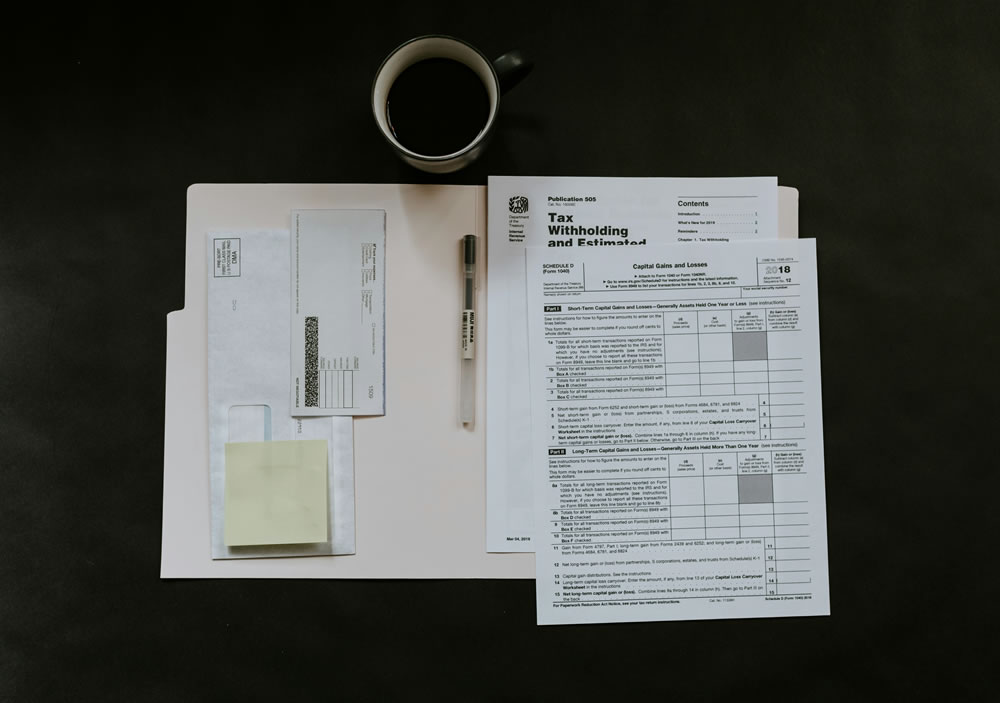

Staying Informed About Tax Credit Changes

Tax credits, much like other areas of tax law, are subject to change. Staying informed about these changes is essential to maximizing your savings. Legislative shifts can alter credit amounts, eligibility criteria, and other important details. For instance, the temporary enhancements to the Child Tax Credit in 2021 demonstrated how quickly tax credits can evolve in response to economic conditions.

Keeping an eye on updates from trusted sources, such as the IRS website, can help you stay ahead. Additionally, subscribing to newsletters from reputable financial publications or following tax professionals on social media can provide timely insights. Consider setting aside a few hours each tax season to review any changes and adjust your filing strategy accordingly.

Organizing Documentation for Tax Credits

Proper documentation is crucial when claiming tax credits. The IRS requires proof of eligibility, and missing paperwork can lead to disallowed credits or delayed refunds. Organize your documents throughout the year to make tax season less stressful. This might include saving receipts, keeping track of income statements, and maintaining a record of expenses related to the credits you're eligible for.

Digital tools can be incredibly helpful in this endeavor. Apps that scan and categorize receipts, cloud storage for important documents, and spreadsheets for tracking expenses can streamline the process. The effort you put into staying organized will pay off when it’s time to file your taxes, ensuring you don’t miss out on valuable credits.

Seeking Professional Guidance

While some taxpayers feel comfortable navigating tax credits on their own, others benefit from professional guidance. A certified tax professional can offer personalized advice tailored to your unique financial situation. They’re equipped to handle complex tax scenarios and can help identify credits you might have overlooked.

Another option is using tax software, which often includes features that automatically check for eligible credits. These platforms guide you through the filing process step-by-step, offering an easy and cost-effective way to ensure you’re not leaving money on the table. According to a survey by the National Society of Accountants, taxpayers who used professional help or tax software reported higher satisfaction with their tax filing experience.

In summary, leveraging tax credits is a savvy strategy to reduce your tax burden. By understanding the various credits available and taking steps to maximize them, you can keep more of your hard-earned money while navigating the often complex tax landscape with confidence. Whether you’re an individual or a business, staying informed, organized, and open to professional help can make all the difference. So as tax season approaches, take the time to explore the credits available to you and ensure you’re making the most of them. After all, in the world of taxes, knowledge truly is power.