Understanding the New Tax Laws: What You Need to Know

The new tax laws have introduced significant changes, including adjustments to tax brackets, standard deductions, and personal exemptions, which can impact individuals' and businesses' tax liabilities. Enhancements to tax credits, such as the increased child tax credit and new incentives for clean energy investments, offer potential savings opportunities. Additionally, alterations in business taxation and retirement savings rules require careful review and planning to optimize financial outcomes and ensure compliance.

The world of taxes has always been a bit of a labyrinth, but recent legislative changes have added a few twists and turns that we all need to navigate. Whether you're an individual taxpayer trying to figure out how these changes affect your annual return, or a business owner looking to optimize your financial strategy, understanding the new tax laws is crucial. It's a bit like learning a new dance—at first, it might seem daunting, but with a little bit of practice and the right guidance, you'll be moving with confidence in no time.

At the heart of these new laws are adjustments to tax brackets, standard deductions, and personal exemptions, all of which have the potential to significantly impact your tax liability. But it's not just about paying more or less; it's about understanding how these changes interact with your financial situation. Beyond the basics, there are also enhanced tax credits that could offer savings opportunities, if you know where to look. So, grab your favorite coffee mug, settle in, and let's dive into what these changes mean for you.

Adjustments to Tax Brackets and Standard Deductions

One of the most noticeable changes in the new tax laws is the adjustment of the tax brackets. While the number of brackets remains the same, the income ranges for each have shifted slightly. This means that even if your income hasn't changed, the portion of it that falls into each bracket might. For example, if you were previously at the top edge of one bracket, you might find yourself in a lower bracket this year, potentially reducing your tax bill.

The standard deduction has also seen an increase, which is generally positive news for taxpayers. By raising the standard deduction, the government essentially reduces the amount of income that is subject to tax, thereby lowering your overall tax burden. For many, this change simplifies tax filing since it reduces the need to itemize deductions. According to the IRS, the standard deduction for single filers has increased to $13,850, up from $12,950, while for married couples filing jointly, it's now $27,700, up from $25,900.

However, personal exemptions have been eliminated in this new tax landscape. While this might initially sound like a loss, the increased standard deduction and modified child tax credits are designed to offset this change. As financial advisor Jane Smith notes, "For most families, especially those with children, the net effect of these changes is a wash, or even a slight benefit."

Enhanced Tax Credits and Incentives

Tax credits have always been the golden tickets in the tax code because they reduce your tax bill dollar for dollar. The new laws have expanded and enhanced several credits that could lead to substantial savings. One of the most talked-about changes is the increase in the child tax credit. For qualifying children, the credit has been increased to $3,600 for children under six, up from $2,000, and $3,000 for children ages six to seventeen.

In addition to the child tax credit, new incentives for clean energy investments have been introduced. These incentives aim to encourage both individuals and businesses to invest in sustainable practices. For instance, there's a sizable credit available for those who install solar panels or invest in energy-efficient home improvements. As the Department of Energy highlights, these incentives not only reduce your tax bill but can also lower your energy costs in the long run.

These changes are not just about saving money; they're about fostering a shift towards more sustainable living. By aligning financial incentives with environmental goals, the government is encouraging a win-win situation for both taxpayers and the planet.

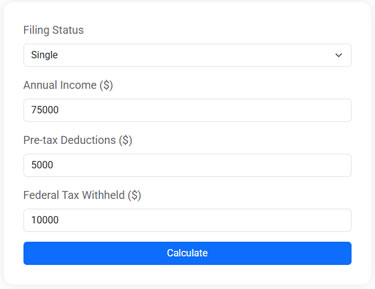

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Changes in Business Taxation

Businesses, both large and small, are also feeling the effects of the new tax laws. Corporate tax rates have been adjusted, and deductions that were previously available might have been altered or eliminated. For instance, the deduction for business interest expenses has been restricted, which could impact companies with high levels of debt.

However, it's not all about tightening the belt. There are new benefits, such as enhanced credits for research and development activities, which are intended to spur innovation and growth. These credits can be particularly beneficial for tech startups or companies investing heavily in innovation.

Navigating these changes requires careful planning and, often, consultation with a tax professional. As tax advisor Mark Johnson puts it, "Businesses need to be proactive in understanding these changes to optimize their tax strategies and ensure compliance."

Retirement Savings Rules and Their Impact

The new tax laws have also introduced changes to retirement savings rules, which could affect how you plan for your golden years. One noteworthy change is the adjustment to contribution limits for retirement accounts like 401(k)s and IRAs. These limits have been increased, allowing you to save more pre-tax income for retirement.

Moreover, there are new provisions related to the age at which you must start taking required minimum distributions (RMDs) from your retirement accounts. The age has been pushed back, giving your savings more time to grow tax-deferred. This change can be beneficial, especially if you plan to work longer or have other sources of income in retirement.

It's important to revisit your retirement strategy in light of these changes. Speak with a financial planner to understand how these new rules align with your long-term goals. As retirement specialist Linda Green advises, "A little bit of planning now can lead to significant benefits down the road."

Navigating the New Tax Landscape

Understanding the new tax laws is not just about reading the fine print; it's about recognizing how these changes impact your overall financial picture. Whether you're an individual or a business, these changes present both challenges and opportunities. By staying informed and seeking professional advice when needed, you can optimize your financial outcomes and ensure compliance with the new regulations.

Remember, taxes are a part of life, but they don't have to be a burden. With the right approach and an eye on the bigger picture, you can navigate these new waters with confidence. So, take a deep breath, grab your calculator, and start planning. After all, the best time to prepare is now.