Avoiding Tax Scams: How to Protect Yourself from Fraud

In the digital era, tax scams have become more sophisticated, complicating the already stressful tax season. To protect against these threats, it's crucial to be aware of common scams, secure personal information, understand IRS communication methods, report suspicious activities, and stay informed about the latest fraud prevention strategies. By remaining vigilant and proactive, individuals can safeguard their personal and financial information effectively.

In recent years, the world of tax scams has evolved into a sophisticated web of deception, preying particularly on unsuspecting individuals during the already stressful tax season. As we navigate this digital era, it's more important than ever to be on high alert for these scams that seem to multiply each year. From phishing emails to phone calls from so-called IRS agents, the tactics used by fraudsters are becoming increasingly cunning and convincing. But fear not—by equipping ourselves with the right knowledge and strategies, we can shield our personal and financial information from these modern-day pirates.

Diving into the depths of tax scams might feel overwhelming, but understanding their mechanics is the first step towards protection. So, grab a cup of coffee, and let's chat about how you can stay one step ahead of the scammers this tax season.

Recognizing Common Tax Scams

The first line of defense against tax fraud is awareness. Scammers are always on the lookout for new angles to exploit, but many fraud schemes revolve around similar themes. One of the most prevalent scams involves phishing emails, where fraudsters impersonate the IRS or other tax authorities to steal your personal information. These emails often contain urgent messages, prompting you to click on malicious links or download harmful attachments. If you receive such an email, remember: the IRS will never initiate contact via email to request personal or financial information.

Phone scams are another common tactic. You might receive a call from someone claiming to be an IRS agent, threatening arrest if you don't pay a supposed tax bill immediately. These calls can be terrifying, especially when they come with a sense of urgency. However, the IRS usually communicates via mail and will never demand immediate payment over the phone using prepaid debit cards or wire transfers.

Securing Your Personal Information

Protecting your personal information is a crucial step in safeguarding against tax scams. Start with the basics: ensure that your devices are equipped with up-to-date antivirus software. This can help shield you from malware that could steal your personal information. Be cautious about sharing your Social Security number, and treat it like gold—only provide it when absolutely necessary.

When filing taxes online, use secure and trusted websites. Look for "https://" in the URL and a padlock icon in the browser's address bar to confirm the site's security. Additionally, utilizing strong, unique passwords for your accounts can add an extra layer of protection. Consider using a password manager if keeping track of complex passwords is challenging.

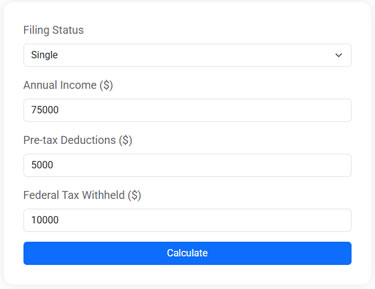

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Understanding IRS Communication Methods

Knowing how the IRS communicates is key to identifying potential scams. Generally, the IRS initiates contact with taxpayers through the mail. If there are any issues with your tax return, they will send a notice or letter. If you receive a phone call, email, or text message claiming to be from the IRS, it’s likely a scam.

If you’re uncertain about the legitimacy of a communication, you can verify it by calling the IRS directly at their official number. As a former IRS agent once advised in a Forbes article, "When in doubt, hang up and call the IRS using a number you know is legitimate."

Reporting Suspicious Activities

If you encounter a suspicious email, phone call, or any other potential scam, it’s important to report it. This not only helps protect you but also aids the authorities in tracking down these scammers. The IRS encourages individuals to forward phishing emails to phishing@irs.gov. If you receive a suspicious phone call, you can report it to the Treasury Inspector General for Tax Administration (TIGTA) using their online form or by calling their hotline.

Additionally, if you've fallen victim to a tax scam, take immediate action. File a report with the Federal Trade Commission (FTC) at IdentityTheft.gov and consider placing a fraud alert on your credit reports.

Staying Informed About Fraud Prevention Strategies

Staying informed is one of the most powerful tools in your anti-scam arsenal. Regularly check the IRS website for alerts on the latest tax scams and fraud prevention tips. The IRS often updates its "Dirty Dozen" list, which highlights the most common tax scams each year.

Financial advisors, like Jane Smith, often recommend attending workshops or webinars on fraud prevention, many of which are offered by community organizations or credit unions. These sessions can provide valuable insights and practical advice on protecting yourself from scams.

Moreover, consider following reputable financial news outlets or subscribing to newsletters that focus on cybersecurity and fraud prevention. As the landscape of scams evolves, keeping up-to-date with the latest information ensures you're always prepared and never caught off guard.

In a world where tax scams are a constant threat, staying vigilant and proactive is essential. By educating ourselves about common scams, securing our personal information, understanding how legitimate tax authorities communicate, and staying informed about the latest fraud prevention strategies, we can effectively navigate the treacherous waters of tax season. Remember, while scammers may be clever, with the right knowledge and tools, you can be one step ahead, protecting your hard-earned assets from falling into the wrong hands.