Tax Tips for Small Business Owners to Boost Your Bottom Line

Managing taxes efficiently is crucial for small business success, as it can significantly impact your bottom line. Key strategies include keeping detailed records, maximizing deductions, choosing the right business structure, planning for estimated taxes, and leveraging tax credits. By understanding and implementing these tips, small business owners can optimize their financial health and reduce tax liabilities.

Managing taxes efficiently is not just a necessary task for small business owners—it's a strategic move that can significantly impact your bottom line. Taxes may seem like a maze of forms, numbers, and deadlines, but navigating this maze effectively can free up cash flow, reduce stress, and ultimately contribute to the success and longevity of your business. Whether you're a seasoned entrepreneur or just starting out, understanding and leveraging tax strategies can provide a critical edge.

While it might seem daunting, the good news is that with some thoughtful planning and organization, you can turn the complex world of taxes into an opportunity for growth. From keeping meticulous records to capitalizing on deductions and credits, there are several practical steps you can take to optimize your financial health and minimize your tax liabilities. Let's dive into some key strategies that can help you keep more of what you earn.

Keep Detailed Records

One of the most fundamental steps in managing your business taxes is maintaining thorough and accurate records. This might sound like common sense, but you'd be surprised at how many business owners overlook this crucial practice. Good record-keeping not only helps ensure compliance with tax laws but also provides a clear picture of your financial health.

When you keep detailed records of all your transactions, including receipts, invoices, and bank statements, you're better positioned to substantiate your income and expenses if ever audited. Moreover, these records can help you identify trends in your business, allowing you to make informed decisions. According to the IRS, having accurate records can even help you discover areas where you can cut costs or increase revenue.

Consider using accounting software like QuickBooks or FreshBooks, which can automate many of these tasks and provide a digital trail that's easy to access and organize. And remember, the more organized you are with your records, the more time you save, which can be redirected towards growing your business.

Maximize Deductions

Deductions are one of the most powerful tools business owners have to reduce their taxable income. Yet, many entrepreneurs miss out on valuable deductions simply because they're unaware of them or unsure how to claim them. It's essential to familiarize yourself with the deductions available to your business type and industry.

Common deductions include office expenses, travel costs, and even meals, but be sure to keep detailed records and receipts to support these claims. For instance, if you work from home, you might be eligible for the home office deduction, which allows you to deduct a portion of your rent or mortgage interest, utilities, and other related expenses.

As financial advisor Jane Smith explains, "Every dollar you can deduct from your taxable income is a dollar you don't have to pay taxes on, which can lead to significant savings." Regularly reviewing your expenses with a tax professional can help ensure you're not leaving money on the table.

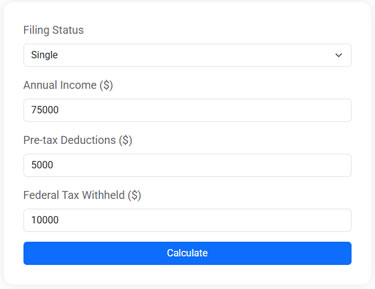

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Choose the Right Business Structure

The structure of your business—whether it's a sole proprietorship, partnership, LLC, or corporation—can have a profound impact on your tax obligations. Each structure has its own tax implications, so it's vital to choose the one that aligns with your business goals and financial situation.

For example, an LLC provides flexibility and potential tax advantages, such as pass-through taxation, which can help avoid the double taxation faced by C corporations. On the other hand, S corporations can offer benefits like self-employment tax savings.

Consulting with a tax advisor or attorney who understands the nuances of small business taxation can be invaluable when deciding on the best structure for your business. According to CNBC, re-evaluating your business structure periodically ensures it still serves your best interests as your business evolves.

Plan for Estimated Taxes

Unlike employees who have taxes withheld from their paychecks, small business owners are responsible for paying estimated taxes throughout the year. This can be a tricky area, as it requires you to predict your income and calculate your tax liability in advance.

The IRS requires estimated tax payments to be made quarterly, and failing to do so can result in penalties and interest. To avoid surprises, it's wise to set aside a portion of your income each month specifically for taxes. Many business owners find it helpful to open a separate bank account dedicated to tax savings.

Using past tax returns as a guide can help you estimate what you might owe, but keep in mind that your income—and therefore your tax liability—can fluctuate. A tax professional can assist in making more accurate projections and adjust your payments as needed.

Leverage Tax Credits

Tax credits are one of the most effective ways to reduce your tax bill because they provide a dollar-for-dollar reduction in your tax liability. Unlike deductions, which lower your taxable income, credits directly reduce the amount of tax you owe.

There are numerous tax credits available to small business owners, including credits for hiring employees, investing in renewable energy, and providing employee health insurance. For example, the Work Opportunity Tax Credit offers incentives for businesses that hire individuals from certain target groups who face significant barriers to employment.

Staying informed about available credits can be challenging, as they often change with new legislation. Keeping in touch with a tax professional or subscribing to updates from the IRS can help ensure you're taking full advantage of these opportunities.

Seek Professional Guidance

While DIY tax filing might be manageable for some small business owners, the complexities of tax law make professional guidance a worthwhile investment for many. A tax advisor can help you navigate the intricacies of tax codes, identify opportunities for savings, and ensure compliance with all filing requirements.

As your business grows, your tax situation may become more complex, and having a trusted advisor can provide peace of mind. According to a survey by the National Small Business Association, more than half of small business owners use a tax professional to prepare their taxes, highlighting the value of expert guidance.

In the end, managing your taxes effectively is about more than just staying out of trouble with the IRS—it's a strategic part of running a successful business. By implementing these tax tips, you can reduce your liabilities, improve your financial health, and ultimately boost your bottom line. Remember, taxes are just one piece of the financial puzzle. With careful planning and the right strategies, you can focus more on growing your business and less on worrying about tax season.