Navigating Tax Season: Essential Tips for Smooth Sailing

As tax season approaches, preparing in advance by organizing financial documents, understanding deductions and credits, and using tax software can help reduce stress and improve financial outcomes. Consider professional assistance for complex situations and plan proactively throughout the year to streamline future tax seasons. By implementing these strategies, you can transform tax season from a daunting task into an opportunity for financial clarity and growth.

Navigating tax season can feel like steering through a storm without a compass. The good news? With a bit of foresight and organization, you can transform this often-dreaded time of year into an opportunity for financial clarity and growth. Whether you're a seasoned taxpayer or this is your first time filing, taking steps to prepare in advance can make all the difference. From understanding deductions and credits to leveraging technology and professional help, let's explore some essential tips to help you chart a course toward a stress-free tax season.

Tax season doesn't have to be synonymous with stress. By approaching it as a chance to review your financial health and make strategic decisions, you can actually benefit from this annual ritual. Just as a sailor prepares their vessel before hitting the open sea, organizing your financial documents and understanding your tax situation can make the journey much smoother. So grab a coffee, settle in, and let's dive into some actionable advice that can make your tax season not only manageable but maybe even a bit empowering.

Organize Your Financial Documents

The first step to a smooth tax season is getting your financial documents in order. Think of it as gathering your ship's supplies before setting sail. Having everything you need at your fingertips not only saves time but also reduces the likelihood of errors. Start by collecting all necessary forms, such as W-2s, 1099s, and any other income-related documents. Don't forget to include investment statements, mortgage interest statements, and any receipts related to deductible expenses.

Creating a centralized location for these documents, whether it's a physical folder or a digital one, can make a world of difference. Consider using apps like Evernote or Google Drive to scan and store documents as they come in. As Forbes points out, digital organization minimizes clutter and ensures you can access your documents anytime, anywhere. And remember, tax season is an excellent time to review these documents for accuracy and report any discrepancies to the relevant parties.

Understand Deductions and Credits

Deductions and credits can be the wind in your sails, significantly lowering your tax bill if used correctly. But they can also be the rocks you crash against if misunderstood. The key difference? Deductions reduce your taxable income, while credits reduce your tax bill directly. Common deductions include mortgage interest, student loan interest, and charitable contributions. Meanwhile, credits like the Earned Income Tax Credit or the Child Tax Credit can be particularly beneficial.

Educating yourself on what you qualify for is crucial. Websites like the IRS's official site offer comprehensive lists and tools to help you determine eligibility. Additionally, life changes such as marriage, having a child, or going back to school can open up new opportunities for deductions and credits. As financial advisor Jane Smith advises, "Keep an eye on changes in your life, as they often bring changes to your tax situation."

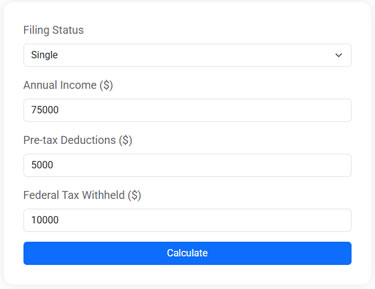

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Leverage Tax Software

In today's digital age, tax software can be your best ally. Programs like TurboTax and H&R Block offer user-friendly interfaces and step-by-step guidance that can simplify the filing process significantly. These tools are designed to help you maximize deductions and credits while minimizing errors, and they often provide real-time updates on changes to tax laws.

Many of these programs also offer audit protection and support, giving you peace of mind. As CNBC notes, using tax software can be particularly advantageous for those with straightforward tax situations. However, if your circumstances are more complex, like owning a business or having multiple income streams, you might consider pairing software with professional advice. The combination of technology and expertise can ensure you're not leaving money on the table.

Consider Professional Assistance

For some, the complexities of their financial situation may warrant professional assistance. Hiring a certified public accountant (CPA) or enrolled agent can be a wise investment, especially if your tax situation involves multiple incomes, significant investments, or business ownership. These professionals are trained to navigate the intricacies of tax law and can provide personalized advice tailored to your circumstances.

According to a study by the National Association of Tax Professionals, working with a tax professional can lead to more accurate returns and potentially higher refunds. They can also help you plan for future tax seasons, offering strategies to minimize taxes and optimize financial outcomes. If you're considering this route, start your search early, as tax professionals tend to book up quickly as the deadline approaches.

Plan Proactively for Future Tax Seasons

One of the best ways to ensure smooth sailing during tax season is to plan ahead. This means thinking beyond the current year and considering how your financial decisions will impact your taxes down the line. Setting up a system for tracking expenses, keeping up with tax law changes, and reviewing your tax situation periodically can be incredibly beneficial.

Consider scheduling a mid-year check-in with your tax professional to adjust your withholdings or estimated payments based on your current financial situation. This proactive approach not only helps avoid surprises at tax time but also aligns your tax strategy with your long-term financial goals. Remember, a little planning now can lead to significant benefits later.

Transform Tax Season into an Opportunity

Ultimately, tax season is what you make of it. By viewing it as an opportunity to gain insight into your financial life, you can use this time to make informed decisions that benefit your future. Whether it's adjusting your budget, planning for retirement, or setting new financial goals, the clarity gained during tax season can be a powerful tool.

So, while the idea of tackling taxes might never become your favorite pastime, embracing the process and implementing these strategies can turn it into a meaningful and productive activity. Here's to a successful, stress-free tax season—and the financial growth that comes with it.