The Dos and Don’ts of Tax Filing: A Comprehensive Guide

Filing taxes doesn't have to be overwhelming if you follow some key practices: organize your financial documents early, avoid procrastination, and take full advantage of tax deductions and credits. Staying informed about changes in tax laws is essential to ensure accurate filing, and consider seeking professional help if your financial situation is complex. By adopting these strategies, you can navigate tax season with confidence and potentially reduce your tax bill.

Filing taxes can often feel like a daunting task. The mere thought of gathering piles of paperwork and navigating the intricate web of tax forms is enough to unsettle even the most financially savvy among us. Yet, what if I told you that with a bit of organization and some strategic planning, tax season could transform from a dreaded chore into a manageable, even empowering, process? By adopting a few smart practices and staying informed, you can tackle your taxes with confidence and possibly even ease your tax burden.

When it comes to tax filing, knowledge truly is power. With every year bringing potential changes to tax laws and regulations, staying up-to-date is crucial. It’s not just about avoiding mistakes; it's about making the most of the opportunities available to you. Whether you're a tax newbie or a seasoned filer, understanding the dos and don’ts of tax filing is essential. Let’s break it down.

Do Organize Your Financial Documents Early

One of the best ways to set yourself up for success during tax season is to start organizing your financial documents early. This means gathering all relevant paperwork such as W-2s, 1099s, receipts for deductible expenses, and records of any other income or investments as they come in. By keeping a dedicated folder or digital file for these documents, you’ll save yourself from the last-minute scramble to find everything when it’s time to file.

Consider using a digital tool or app to help you track expenses throughout the year. Apps like Expensify or Mint can be invaluable for logging and categorizing expenses as they occur, making it easier to identify deductible expenses when the time comes. As financial planner Mark Wilson notes, "Being proactive rather than reactive can significantly reduce the stress of tax season and help ensure nothing important gets overlooked."

Don’t Procrastinate

Procrastination is the nemesis of effective tax filing. Waiting until the last minute increases the chances of errors, omissions, and unnecessary stress. Aim to start your tax preparation well ahead of the deadline. This gives you ample time to gather missing documents, clarify any uncertainties, and seek advice if needed.

In fact, starting early can also provide financial benefits. For example, if you discover you're due a refund, filing early means you'll get your money sooner. Conversely, if you owe money, you'll have more time to save up for the payment. As CPA and tax expert Laura Adams advises, "The earlier you start, the more control you have over the process."

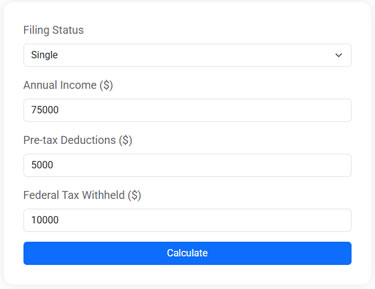

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Do Take Advantage of Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax bill, but they’re only beneficial if you know about them. Deductions lower your taxable income, while credits reduce your tax bill dollar-for-dollar. Common deductions include student loan interest, mortgage interest, and contributions to retirement accounts. On the credit side, you might qualify for the Earned Income Tax Credit, Child Tax Credit, or credits for education expenses.

It’s essential to research which deductions and credits apply to your unique situation. For instance, did you know that if you worked from home, you might qualify for a home office deduction? Or, if you made energy-efficient improvements to your home, you could be eligible for certain energy credits? According to the IRS, many taxpayers leave money on the table each year simply because they aren't aware of all the deductions and credits available to them.

Don’t Overlook Changes in Tax Laws

Tax laws are not static; they evolve over time. Significant changes can occur due to new legislation or IRS updates. For instance, the Tax Cuts and Jobs Act of 2017 brought sweeping changes that affected everything from standard deductions to personal exemptions. Staying informed about such changes is vital for accurate filing.

A great way to stay updated is by subscribing to newsletters from reputable financial news outlets or following the IRS's official updates. Both can provide insights into any new regulations or changes that might impact your tax filing. As tax attorney Sarah Johnson explains, "Understanding the current tax landscape can prevent costly mistakes and ensure you're leveraging every possible advantage."

Do Consider Professional Help for Complex Situations

If your financial situation is complex—think owning a business, having multiple income streams, or dealing with international investments—it might be wise to seek professional help. A certified public accountant (CPA) or a tax advisor can offer valuable insights that you might miss on your own.

They can help identify tax-saving opportunities, ensure compliance with the latest tax laws, and provide peace of mind that your taxes are filed correctly. As financial expert Dave Ramsey often points out, "Investing in professional advice can often save you more money than you spend on the service itself."

Don’t Forget to Double-Check Your Filing

Even with the best preparation, mistakes can happen. Double-checking your tax return before submitting it is a crucial step. Look for common errors such as incorrect Social Security numbers, math errors, or missed signatures.

Using tax software can help catch some of these mistakes, but it’s no substitute for a thorough personal review. If you’re working with a tax professional, review the return with them to ensure everything is accurate. Remember, the responsibility for the return rests with you, even if someone else prepares it.

Do Keep a Copy of Your Tax Return

Once your taxes are filed, keep a copy of your return and all supporting documents. This is important not only for your records but also in case you need to reference them for future tax filings or if the IRS has any questions.

The IRS recommends keeping records for at least three years, but some situations may require longer retention. For example, if you file a claim for a loss from worthless securities, you should keep records for seven years. Having a well-organized archive of past returns can simplify future filings and provide valuable information for financial planning.

By following these dos and don’ts, you can approach tax season with a sense of preparedness and confidence. Remember, the key to successful tax filing is understanding your financial situation, staying informed, and taking proactive steps to maximize your benefits while minimizing errors. Whether you're filing on your own or with professional help, these practices can help you navigate the complexities of taxes with greater ease.