Tax-Saving Strategies Every Investor Should Know

The article emphasizes the importance of tax efficiency in investing, highlighting strategies such as maximizing contributions to tax-advantaged accounts, utilizing tax-loss harvesting, considering asset location, focusing on qualified dividends and long-term capital gains, and taking advantage of tax credits. These tactics can significantly reduce an investor's tax burden, allowing them to retain more of their returns. By employing these strategies, investors can enhance their financial health and investment outcomes.

As investors, we often focus on maximizing returns, analyzing market trends, and picking the right stocks or funds. But one crucial piece of the investment puzzle that sometimes gets overlooked is tax efficiency. Paying attention to tax-saving strategies can make a world of difference in the long run. It’s not just about how much you earn; it’s about how much you keep after Uncle Sam takes his share. By incorporating some smart tax-saving strategies, you can potentially boost your investment returns without any additional market risk.

Taxes are an inevitable part of investing, but they don't have to be the enemy. There are a variety of tactics available to help you minimize your tax liability and maximize your wealth. From leveraging tax-advantaged accounts to understanding the nuances of capital gains, these strategies can go a long way in enhancing your financial health. Let’s dive into some of the savviest tax-saving strategies every investor should know.

Maximize Contributions to Tax-Advantaged Accounts

One of the most straightforward ways to save on taxes is to make the most of tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs. Contributions to traditional 401(k)s and IRAs are typically tax-deductible, meaning they can lower your taxable income for the year. This is essentially a way to defer taxes and potentially grow your investments tax-free until you withdraw them in retirement.

For example, if you're in the 24% tax bracket and make a $5,000 contribution to your traditional IRA, you could save $1,200 in taxes that year. It’s a smart way to put more of your money to work for you now while planning for the future. According to the IRS, for 2023, the contribution limit for 401(k)s is $22,500, with an additional $7,500 catch-up contribution allowed for those aged 50 and over.

Roth IRAs, on the other hand, are funded with after-tax dollars, meaning you don’t get a tax break upfront. However, the advantage lies in the fact that withdrawals are tax-free in retirement. This can be particularly beneficial for those who expect to be in a higher tax bracket later in life. Balancing contributions between traditional and Roth accounts can be a strategic move depending on your current and projected future tax situations.

Utilize Tax-Loss Harvesting

Tax-loss harvesting is a technique savvy investors use to offset capital gains with capital losses. Essentially, it involves selling investments that have lost value to offset the taxes on gains from other investments. This strategy can help reduce your taxable income and keep more money in your pocket.

To illustrate, imagine you sold some stocks for a $10,000 gain earlier in the year. If you have another investment that has decreased in value by $10,000, you can sell it to offset the gain. As a result, your taxable gain is effectively zero. Of course, it’s important to be mindful of the IRS’s wash-sale rule, which prohibits you from buying back the same or substantially identical security within 30 days before or after the sale.

As financial advisor Jane Smith explains, "Tax-loss harvesting can be an especially useful tool in volatile markets when fluctuations in stock prices provide more opportunities to sell at a loss." By strategically realizing losses and gains, you can manage your tax bill more effectively throughout the year.

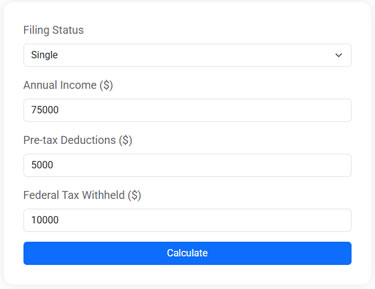

Federal Income Tax Estimator

Estimate your 2025 federal taxes with this free online tax calculator. Enter your income, deductions, and withholding to see your potential refund or taxes owed.

Consider Asset Location

Asset location refers to the strategic placement of investments within different types of accounts to maximize tax efficiency. Not all income is taxed equally, so where you hold your investments matters. Generally, it’s wise to hold tax-inefficient investments like bonds and real estate investment trusts (REITs) in tax-advantaged accounts, while placing tax-efficient investments like index funds and ETFs in taxable accounts.

For example, interest from bonds is typically taxed as ordinary income, which can be as high as 37% for the highest earners in 2023. By keeping bonds in a tax-deferred account like a 401(k) or IRA, you can defer these taxes until you withdraw the funds. Conversely, qualified dividends and long-term capital gains, which are taxed at a maximum rate of 20%, can be more tax-efficient when held in a taxable account.

According to CNBC’s financial expert, "Asset location can be a game-changer for high-net-worth individuals and anyone looking to minimize their tax footprint over the long haul." Thoughtful placement of your investments can optimize your portfolio’s tax efficiency and improve your overall returns.

Focus on Qualified Dividends and Long-Term Capital Gains

Another key to tax-efficient investing is understanding the difference between qualified dividends and ordinary dividends, as well as short-term versus long-term capital gains. Qualified dividends are taxed at the more favorable long-term capital gains rate, which can be significantly lower than ordinary income tax rates.

To qualify for this lower rate, dividends must meet specific criteria, such as being paid by a U.S. corporation or a qualified foreign corporation and meeting a required holding period. Similarly, long-term capital gains — profits from selling an asset held for more than a year — are also taxed at this lower rate. This makes holding onto appreciated investments for the long term a smart move for minimizing taxes.

For instance, if you’re in the 24% tax bracket and you sell a stock for a $10,000 gain after holding it for over a year, you’d pay just 15% in taxes, or $1,500, instead of $2,400 if taxed as ordinary income. By focusing on qualified dividends and long-term gains, you can reduce your tax liability and enhance your investment returns.

Take Advantage of Tax Credits

Tax credits are often more beneficial than deductions because they reduce your tax bill dollar for dollar. For investors, credits like the Retirement Savings Contributions Credit can be particularly valuable. This credit is designed to reward low- and moderate-income taxpayers who contribute to retirement accounts, potentially reducing taxes owed by up to $1,000 ($2,000 for married couples filing jointly).

Another opportunity is the American Opportunity Tax Credit, which offers a credit for eligible college expenses, making it possible to offset taxes while investing in education. While these credits may not directly relate to your investment portfolio, they can provide significant savings, allowing you to allocate more resources toward investing.

As CPA John Doe notes, "Tax credits can make a substantial difference come tax time, especially if you’re eligible for multiple credits. It’s like getting a double benefit for doing things that are already in your financial best interest." By exploring available credits and planning accordingly, you can keep more of your hard-earned money working for you.

Incorporating these tax-saving strategies into your investment plan can seem daunting, but the rewards are well worth the effort. By maximizing contributions to tax-advantaged accounts, utilizing tax-loss harvesting, considering asset location, focusing on qualified dividends, and taking advantage of tax credits, you can significantly reduce your tax burden. The result? More of your investment returns stay in your pocket, enhancing your financial health and investment outcomes. Remember, the goal is not just to earn more but to keep more of what you earn and grow your wealth in the most efficient way possible.