Budgeting for Millennials: Setting Yourself Up for Success

Millennials face unique financial challenges, but they can build a resilient financial future by understanding their financial landscape, crafting realistic budgets, and leveraging technology for financial management. Establishing an emergency fund and planning for long-term goals like investing and retirement are also crucial steps. By implementing these strategies, millennials can navigate financial hurdles and set themselves up for lasting success.

Millennials, often labeled as the generation caught between student debt and the gig economy, face a unique set of financial challenges. From the skyrocketing costs of education and healthcare to the pressure of saving for a home in an unpredictable market, navigating the financial landscape can feel like a daunting task. Yet, with the right strategies in place, setting oneself up for financial success is entirely achievable. The key lies in understanding the financial landscape, crafting budgets that reflect real life, and leveraging the power of technology. Let's dive into how millennials can conquer these challenges and build a robust financial future.

Understanding the Millennial Financial Landscape

Before diving into the nuts and bolts of budgeting, it's crucial to understand the economic environment millennials are operating in. This generation is particularly burdened by student loan debt, with the average student loan balance sitting at around $33,000, according to data from the Federal Reserve. Furthermore, many millennials entered the workforce during or shortly after the Great Recession, which led to stagnant wages and a competitive job market. As financial advisor Jane Smith points out, "The economic playing field has shifted. Millennials need to be more strategic and informed about their financial decisions than previous generations."

Moreover, the rise of the gig economy has offered flexibility but often lacks the financial stability of traditional employment, including benefits like health insurance and retirement plans. This adds another layer of complexity to financial planning. By acknowledging these challenges, millennials can better tailor their budgeting strategies to fit their unique needs.

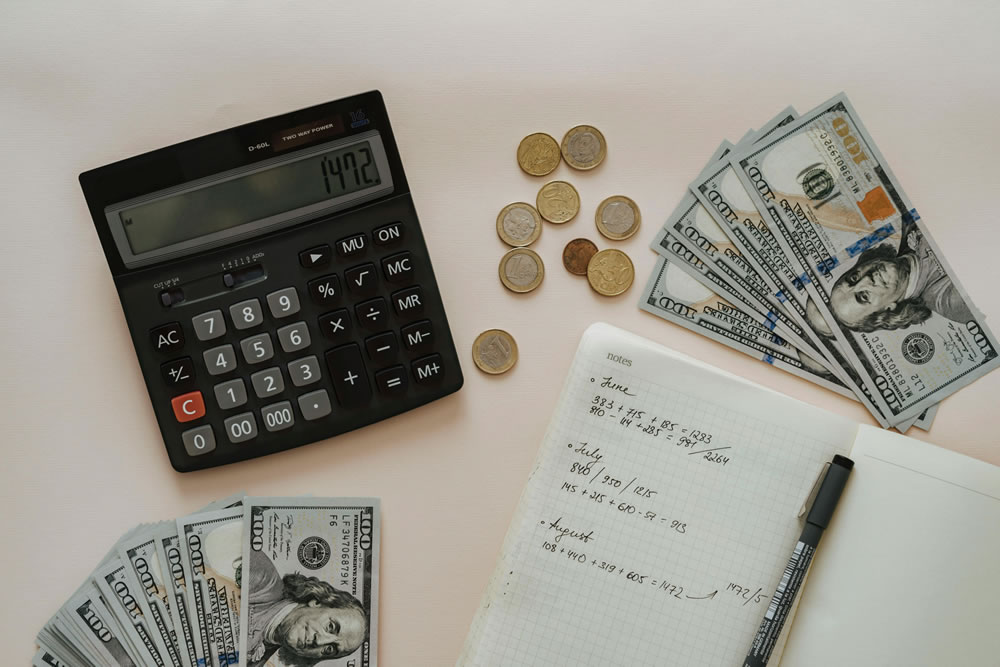

Crafting a Realistic Budget

Creating a budget that genuinely reflects one's lifestyle and financial obligations is a cornerstone of financial success. Start by listing all sources of income, including side gigs, and then outline all expenses, both fixed (like rent and utilities) and variable (such as dining out and entertainment). It's important to be honest about spending habits—underestimating expenses is a common pitfall.

A popular method is the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. However, this is not a one-size-fits-all solution. For instance, if student loans are a significant burden, it might make sense to adjust these percentages to allocate more towards debt repayment. Financial expert David Ramsey emphasizes, "The best budget is the one that works for your specific situation, not the one that looks perfect on paper."

Emergency Fund Calculator

Wondering how much you should set aside for life's unexpected moments? Our Emergency Fund Calculator helps you quickly figure out how much you need to save to cover your expenses for 3, 6, or even 12 months. Whether you're building a financial safety net or planning for job loss, medical bills, or other emergencies, this tool gives you a clear savings goal to aim for — fast and easy.

Leveraging Technology for Financial Management

Technology has revolutionized the way we manage money, offering tools that make budgeting more accessible and less intimidating. Apps like Mint and YNAB (You Need A Budget) allow users to track spending, set savings goals, and receive alerts when they're nearing budget limits. These tools can provide a clear picture of where the money is going, which is essential for making informed financial decisions.

Additionally, robo-advisors like Betterment and Wealthfront can assist with investing by offering automated, low-cost investment management, making it easier to start building wealth even with modest amounts of money. According to a report from CNBC, millennials are embracing these digital tools, with 54% using mobile apps to manage their finances. This trend suggests a growing comfort with technology as a means to achieve financial stability.

Establishing an Emergency Fund

An emergency fund acts as a financial safety net, providing peace of mind and security in the face of unexpected expenses such as medical bills or car repairs. Financial experts typically recommend saving three to six months’ worth of living expenses. While this might seem daunting, starting small is key. Even setting aside $10 a week can gradually build a substantial fund over time.

Consider keeping this fund in a high-yield savings account to earn interest while maintaining easy access to the money when needed. Personal finance blogger Sarah Johnson suggests, "Automating your savings can be a game-changer. Set it and forget it, and watch your fund grow without the temptation to spend."

Planning for Long-term Goals: Investing and Retirement

While day-to-day budgeting is essential, planning for the future is equally crucial. Despite the common stereotype of millennials as poor savers, many are investing and saving for retirement. The key is to start early, even if contributions are small. Compound interest is a powerful ally; the earlier one starts, the more time investments have to grow.

Contribute to retirement accounts like a 401(k) if your employer offers one, especially if there's a matching contribution. For those without access to employer-sponsored plans, opening a Roth IRA is a great alternative. As financial planner Mark Green advises, "Don't get caught up in trying to time the market. Consistency is what builds wealth over time."

Conclusion: Navigating Financial Hurdles

For millennials, the path to financial success is fraught with challenges but also ripe with opportunities. By understanding their unique financial landscape, crafting realistic budgets, leveraging technology, and planning for both short-term and long-term goals, they can navigate these hurdles with confidence. Remember, financial success is not about perfection; it's about making informed decisions that align with personal values and goals. With persistence and a strategic approach, millennials can indeed set themselves up for lasting financial success.