Budgeting on a Low Income: Tips and Tricks to Make it Work

Managing a budget on a tight income can be challenging, but by tracking expenses, prioritizing spending, cutting unnecessary costs, boosting income, and building an emergency fund, you can gain control over your finances. These strategies help you make the most of your money, paving the way for long-term financial stability and reducing stress. Remember, progress over perfection is key to a brighter financial future.

Managing a budget on a tight income can feel like trying to solve a puzzle with missing pieces. You know the picture on the box—financial stability, less stress—but getting there seems daunting. The truth is, while it might be challenging, it's far from impossible. With a few strategic moves, you can stretch your dollars further than you'd expect. This isn't about making drastic sacrifices or living on the bare essentials; it's about smart planning and understanding where your money goes. Remember, the goal here is progress, not perfection.

When you're working with a limited income, every penny counts. Whether you're a single parent, a recent graduate, or simply someone finding it hard to make ends meet, there are practical steps you can take to regain control over your finances. Let's dive into some tried-and-true strategies that can help you navigate budgeting on a low income with confidence.

Tracking Your Expenses: The Foundation of a Solid Budget

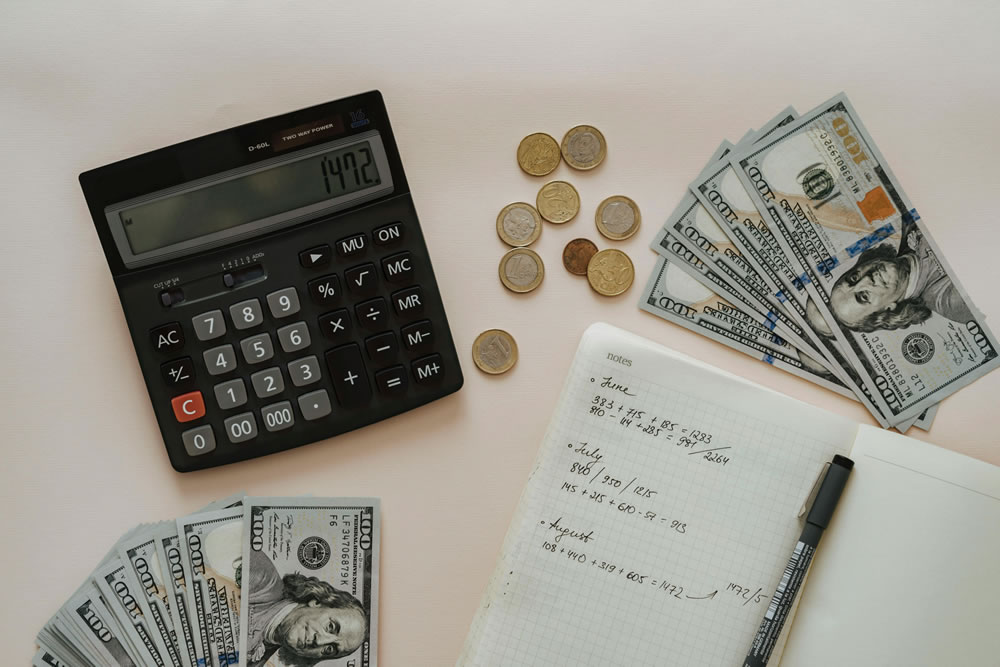

Before you can effectively manage your money, you need to know where it's going. This might sound basic, but tracking your expenses is crucial. Start by noting down every purchase you make for a month. Use a notebook, a spreadsheet, or an app like Mint or YNAB (You Need A Budget) to help you keep track. The key is consistency; without it, you won't get an accurate picture.

Once you've gathered enough data, categorize your spending. This will help you identify areas where you might be overspending. For instance, you may find you're spending more on dining out than you realized. As financial expert Dave Ramsey says, "A budget is telling your money where to go instead of wondering where it went." By understanding your current spending habits, you can begin to make informed decisions about where to cut back.

Prioritizing Your Spending: Needs vs. Wants

When money is tight, distinguishing between needs and wants is essential. Needs are the essentials—think housing, utilities, groceries, and transportation. Wants are those things that are nice to have but not necessary for survival, like that Netflix subscription or the occasional takeout meal.

Create a prioritized list of your expenses. Allocate funds to your needs first, ensuring you're covering the basics. Once your necessities are taken care of, see what's left for the wants. This doesn't mean you can't enjoy any luxuries, but it helps ensure you're not compromising on essentials. Consider the 50/30/20 rule as a guideline: 50% for needs, 30% for wants, and 20% for savings or debt repayment. It's adaptable, so tweak it to suit your situation.

Emergency Fund Calculator

Wondering how much you should set aside for life's unexpected moments? Our Emergency Fund Calculator helps you quickly figure out how much you need to save to cover your expenses for 3, 6, or even 12 months. Whether you're building a financial safety net or planning for job loss, medical bills, or other emergencies, this tool gives you a clear savings goal to aim for — fast and easy.

Cutting Unnecessary Costs: Little Changes, Big Impact

Even minor expenses can add up quickly, and reducing them can have a significant impact over time. Look at your recurring monthly bills. Are there any subscriptions or memberships you can do without? Cancel or pause those that aren't essential. Review your utility bills and consider ways to reduce them, such as using energy-efficient appliances or adjusting your thermostat.

Grocery shopping is another area ripe for savings. Plan meals ahead of time and make a list before heading to the store to prevent impulse buys. Buying in bulk, using coupons, and opting for store brands can also lead to substantial savings. As personal finance blogger Paula Pant puts it, "You can afford anything, but not everything." Small cuts can lead to more breathing room in your budget.

Boosting Your Income: Finding Opportunities

While cutting costs is crucial, increasing your income can provide extra financial cushion. Explore side hustles or freelance work that aligns with your skills. Websites like Upwork or Fiverr offer opportunities for various talents, from graphic design to writing.

If time permits, consider a part-time job or gig work through platforms like Uber or DoorDash. While these jobs are not guaranteed to provide a steady income, they can help bridge the gap during tight months. Additionally, don't hesitate to ask for a raise at your current job if you believe it’s warranted. Prepare your case, highlighting your contributions and market research to support your request.

Building an Emergency Fund: Preparing for the Unexpected

An emergency fund acts as a financial safety net, helping you avoid debt when unexpected expenses arise. While saving may seem impossible on a low income, start small. Aim for a starter fund of $500 to $1,000. This can cover minor emergencies, like car repairs or medical bills, without disrupting your budget.

Set up automatic transfers to a separate savings account, even if it's just a few dollars each week. Over time, these small contributions add up. As Suze Orman, a personal finance author, advises, "The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, and so broadens the mind." Prioritizing an emergency fund can significantly reduce financial stress.

Embracing Progress Over Perfection

Budgeting on a low income isn't about getting it perfect every time. It's about making gradual improvements and learning from any setbacks. Celebrate small victories, like sticking to your budget for a month or saving a little more than usual. These achievements build momentum and motivation.

Remember, everyone's financial journey is unique, and comparing yourself to others can be discouraging. Focus on your goals and the steps you're taking to reach them. Progress, not perfection, is the key to a brighter financial future. As you implement these strategies, you'll find yourself gaining more control over your finances, paving the way for long-term stability and less stress.