Debt-Free Living: How to Achieve Financial Freedom

Living debt-free is attainable by understanding your financial landscape, crafting a realistic budget, and choosing effective debt repayment strategies like the snowball or avalanche methods. Establishing an emergency fund provides a safety net against unexpected expenses, while embracing a debt-free lifestyle involves a mindset shift towards frugality and financial literacy. Achieving financial freedom requires dedication and discipline, but the benefits of peace of mind and the ability to make choices without financial constraints make it a worthwhile journey.

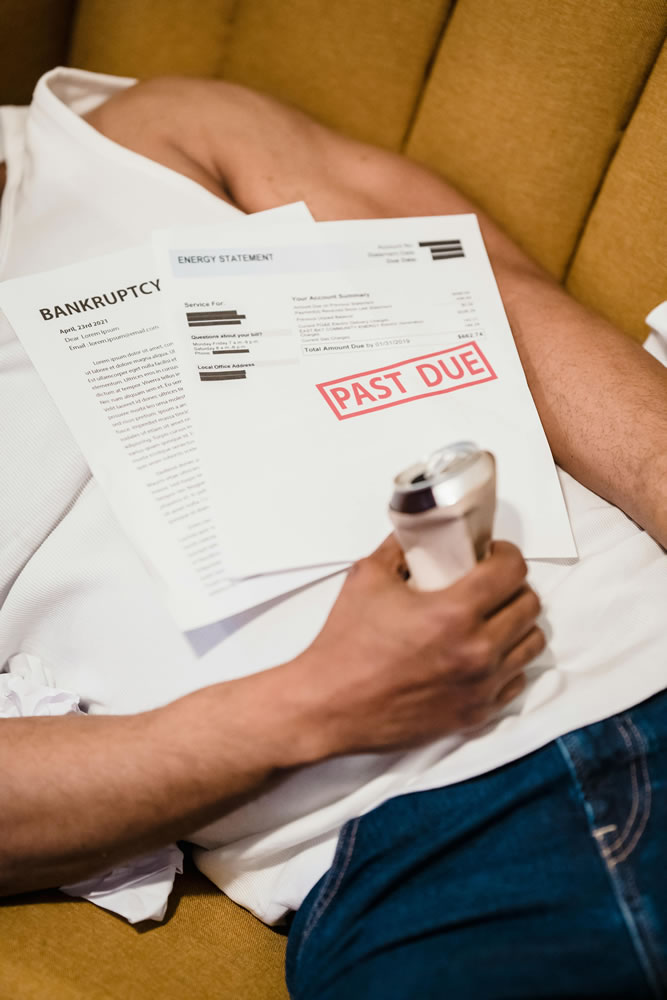

Living debt-free is a goal that resonates with many of us, yet it often feels like an elusive dream. The allure of financial freedom—the ability to make choices without the shackles of monthly debt payments—is undeniable. But how do we transform this dream into reality? It all begins with understanding your financial landscape, crafting a realistic budget, and choosing effective debt repayment strategies. Alongside these practical steps, a shift in mindset towards frugality and financial literacy can pave the way to a debt-free lifestyle. Let's embark on this journey together, exploring how dedication and discipline can lead to the profound peace of mind that financial freedom brings.

Debt can feel like a constant companion, whispering anxieties into your ear with each monthly statement or unexpected expense. However, by adopting a proactive approach and viewing debt as a challenge to be overcome rather than an insurmountable obstacle, you can begin to chip away at it. Just as with any journey, the first step is often the hardest, but it's also the most crucial.

Understanding Your Financial Landscape

Before any meaningful progress can be made, it's essential to take stock of your current financial situation. This involves a thorough review of all debts, including credit cards, student loans, car payments, and any outstanding bills. Gather your statements, list your debts in detail, and note the interest rates and minimum payments for each. This process can be eye-opening, but it’s necessary for creating a comprehensive debt repayment plan.

Next, assess your income sources and monthly expenses. This will give you a clearer picture of your cash flow and highlight areas where you might cut back. As financial advisor Jane Smith notes, "Awareness is the first step towards change. You can’t fix what you don’t acknowledge." Understanding where your money is going each month is foundational to crafting a budget that aligns with your financial goals.

Crafting a Realistic Budget

A well-planned budget is your roadmap to financial freedom. Start by categorizing your expenses into essentials and non-essentials. Essentials include rent or mortgage, utilities, groceries, and transportation, while non-essentials cover dining out, entertainment, and subscriptions. Allocate a portion of your income to each category, making sure to prioritize debt repayment and savings.

It's important to be realistic about your lifestyle and spending habits. A budget that’s too restrictive can backfire, leading to frustration and eventual abandonment. Instead, aim for a balanced approach that allows some room for enjoyment while keeping your financial goals in focus. According to CNBC, setting aside a small "fun fund" can help maintain morale without derailing your progress.

Debt Payoff Calculator

Plan your financial future by estimating how long it will take to pay off your debt based on your balance, annual percentage rate (APR), and monthly payment. After entering your figures, the calculator determines the number of months needed to fully repay the debt and calculates the total interest paid over time.

Choosing Effective Debt Repayment Strategies

When it comes to paying down debt, two popular methods have gained traction: the snowball method and the avalanche method. The snowball method involves paying off the smallest debts first, giving you a psychological boost with each cleared balance. Financial expert Dave Ramsey advocates for this approach, emphasizing the momentum it creates.

On the other hand, the avalanche method focuses on tackling debts with the highest interest rates first, potentially saving more money in the long run. This method requires patience and discipline, as it might take longer to see the first debt disappear. Both strategies have their merits, and the choice depends on your personal preference and financial situation. The key is consistency and commitment, regardless of the path you choose.

Establishing an Emergency Fund

An emergency fund serves as a financial cushion against unexpected expenses, such as medical emergencies or car repairs. Without it, you might find yourself resorting to credit cards or loans, perpetuating the cycle of debt. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

Building an emergency fund requires patience, but the peace of mind it offers is invaluable. Start small if necessary, setting aside a manageable amount each month. Over time, these contributions will add up, providing a safety net that shields you from financial setbacks. As personal finance blogger Emma Johnson says, "An emergency fund turns a crisis into an inconvenience."

Embracing a Debt-Free Lifestyle

Living debt-free involves more than just paying off balances; it requires a fundamental shift in mindset. Embrace frugality by finding joy in simpler pleasures and focusing on what truly matters. This might mean cooking more meals at home, enjoying free community events, or engaging in hobbies that don’t break the bank.

Moreover, prioritize financial literacy by continually educating yourself about money management. Books, podcasts, and courses can deepen your understanding and provide new strategies for maintaining financial health. As you become more informed, you’ll feel empowered to make decisions that align with your long-term goals.

The Benefits of Financial Freedom

Achieving financial freedom is no small feat, but the rewards are well worth the effort. With debts paid off, you’ll have the flexibility to pursue opportunities that align with your passions, rather than those dictated by financial necessity. Whether it’s traveling, starting a business, or simply enjoying more time with family, the choices become yours to make.

Furthermore, the stress and anxiety associated with debt diminish significantly, leading to improved mental health and overall well-being. As you gain control over your finances, you’ll likely notice a greater sense of peace and a renewed outlook on life.

In conclusion, living debt-free is a journey that requires dedication, discipline, and a willingness to change. By understanding your financial landscape, creating a realistic budget, and embracing effective debt repayment strategies, you can pave the way to financial freedom. Establishing an emergency fund and adopting a debt-free mindset further bolster your efforts. The path may be challenging, but the benefits of financial freedom—a life of choice, peace, and empowerment—make it a journey worth undertaking.