Mastering Your Money: Debt Management Tips for Millennials

Effectively managing debt is crucial for millennials facing challenges like student loans and high living costs, and involves understanding your debt profile, creating a budget, and employing repayment strategies like the debt snowball or avalanche methods. Exploring options like refinancing and loan forgiveness, while building a support system and staying informed, can help alleviate financial stress and pave the way to financial freedom. By taking a proactive approach, millennials can master their finances and work towards a stable financial future.

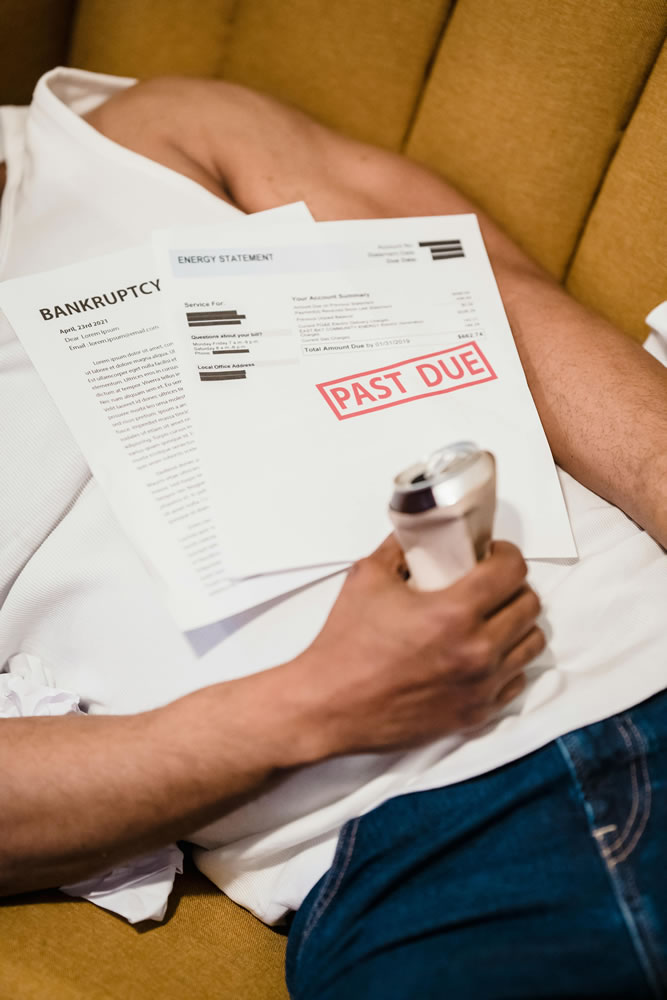

Managing debt can feel like trying to navigate a labyrinth blindfolded, especially for millennials who are grappling with unique financial pressures. Between hefty student loans and the ever-rising cost of living, it’s no wonder money matters can become overwhelming. But fear not! With a bit of guidance and a strategic approach, you can master your money and work toward financial stability.

The first step? Understanding that you're not alone and that these challenges are more common than you might think. According to a 2022 report by Experian, the average millennial carries about $28,317 in non-mortgage debt. This number underscores the importance of taking control and crafting a game plan that works for you. Let's dive into some practical strategies that could make a significant difference in your financial journey.

Understanding Your Debt Profile

Before you can tackle your debt, you need to fully understand what you're dealing with. This means taking stock of all your financial obligations—from student loans to credit card balances. Break down each type of debt by interest rate and total amount owed. This will give you a clear picture of where you stand and help you prioritize your payments.

It's crucial to differentiate between high-interest and low-interest debts. Credit cards typically carry the highest interest rates, often averaging around 16% to 24%, while federal student loans might be in the 4% to 7% range. Knowing these details can inform your strategy, especially if you’re considering the debt avalanche method, which targets high-interest debt first to save on interest payments over time.

Remember, the goal is not just to pay off your debt but to do it in the most efficient way possible. Understanding your debt profile is the first step in devising a plan that minimizes financial strain and maximizes your peace of mind.

Creating a Realistic Budget

Crafting a budget is like drawing a roadmap to your financial goals. Start by listing your monthly income and expenses. Don’t forget to account for essentials like rent, utilities, groceries, and minimum debt payments. Once you have a clear picture of your cash flow, identify areas where you can cut back. Maybe it’s the daily coffee run or those subscription services you rarely use.

Budgeting isn’t about deprivation—it’s about making conscious choices that align with your priorities. Consider the 50/30/20 rule as a guideline: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This not only helps you manage debt but also ensures you're building a safety net for future expenses.

A budget is a living document. Revisit it regularly to adjust for life changes, like a new job or an unexpected car repair. Flexibility is key, and staying engaged with your budget can empower you to make informed financial decisions.

Debt Payoff Calculator

Plan your financial future by estimating how long it will take to pay off your debt based on your balance, annual percentage rate (APR), and monthly payment. After entering your figures, the calculator determines the number of months needed to fully repay the debt and calculates the total interest paid over time.

Choosing a Debt Repayment Strategy

Two popular strategies for tackling debt are the snowball and avalanche methods. The debt snowball method involves paying off your smallest debts first, which can provide quick wins and build momentum. It’s a psychological boost that can keep you motivated as you tackle larger debts.

On the other hand, the debt avalanche method focuses on paying off the highest interest debts first. While it might take longer to see tangible results, this approach can save you more money in interest over time. Choosing between these methods depends on your personal financial situation and what will keep you motivated.

For instance, if seeing immediate progress keeps you on track, the snowball method might be your best bet. If you’re more concerned with minimizing the total interest paid, then the avalanche approach is likely more suitable. Both methods have their merits, so consider your financial habits and emotional triggers when deciding.

Exploring Refinancing and Loan Forgiveness Options

Refinancing can be a powerful tool in your debt management toolkit, especially if you have high-interest loans. By securing a lower interest rate, you can reduce your monthly payments or shorten your repayment term. Just be sure to weigh the pros and cons, as refinancing federal student loans, for example, could mean losing access to flexible repayment plans or loan forgiveness options.

Speaking of loan forgiveness, it’s worth exploring if you qualify for any federal programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. These programs can offer significant relief for those working in specific fields or sectors. As CNBC noted, understanding the eligibility requirements and application process is essential to take full advantage of these opportunities.

Taking the time to research and understand these options can lead to significant savings and potentially expedite your journey to becoming debt-free.

Building a Support System

Debt can feel isolating, but you don’t have to face it alone. Consider enlisting the help of a financial advisor or joining a support group. Sharing experiences with others in similar situations can provide emotional support and practical advice. As financial advisor Jane Smith often suggests, discussing your financial goals with a trusted friend or family member can help keep you accountable.

Online communities and forums can also be a treasure trove of tips and encouragement. Platforms like Reddit’s personal finance subreddit offer a space to ask questions and share victories. Remember, seeking support is a strength, not a weakness.

Building a support system can make the journey less daunting and more collaborative. It’s about finding people who understand your struggles and celebrate your successes.

Staying Informed and Proactive

The financial landscape is always evolving, and staying informed is key to navigating it successfully. Subscribe to personal finance blogs, listen to podcasts, or even take online courses to enhance your financial literacy. The more you know, the better equipped you’ll be to make smart financial decisions.

Being proactive also means regularly reviewing your credit report. This not only helps you track your progress but also catch any errors that could affect your credit score. A healthy credit score can open doors to better interest rates and financial opportunities.

Ultimately, mastering your money is about taking control and making informed choices. By staying educated and proactive, you can transform financial stress into financial empowerment.

Managing debt is a journey, not a sprint. With the right tools and mindset, millennials can turn financial challenges into stepping stones toward a brighter, more secure future.